In the fast-paced world of the stock market, staying informed about the latest trends and movements is crucial. One such stock that has been capturing the attention of investors is MRO. In this article, we will delve into the MRO stock price, its factors, and what it means for potential investors.

Understanding MRO Stock

MRO, which stands for Maintenance, Repair, and Operations, is a company that specializes in providing essential services to various industries. These services include maintenance, repair, and operations support for equipment, machinery, and facilities. The company's stock price reflects its market performance and potential for growth.

Factors Influencing MRO Stock Price

Several factors can influence the MRO stock price. Here are some of the key factors to consider:

Economic Conditions: The overall economic climate plays a significant role in the stock price. A strong economy often leads to increased demand for MRO services, while a weak economy can have the opposite effect.

Industry Trends: The specific industry trends within which MRO operates can also impact its stock price. For example, an increase in manufacturing activity can lead to higher demand for MRO services.

Company Performance: The financial performance of MRO, including revenue growth, profit margins, and earnings per share, can significantly influence its stock price.

Market Sentiment: Investor sentiment towards the stock can also affect its price. Positive news or strong earnings reports can boost the stock price, while negative news or poor performance can lead to a decline.

Competition: The level of competition within the MRO industry can also impact the stock price. A company with a competitive advantage may see its stock price rise, while increased competition could lead to a decline.

Recent Trends in MRO Stock Price

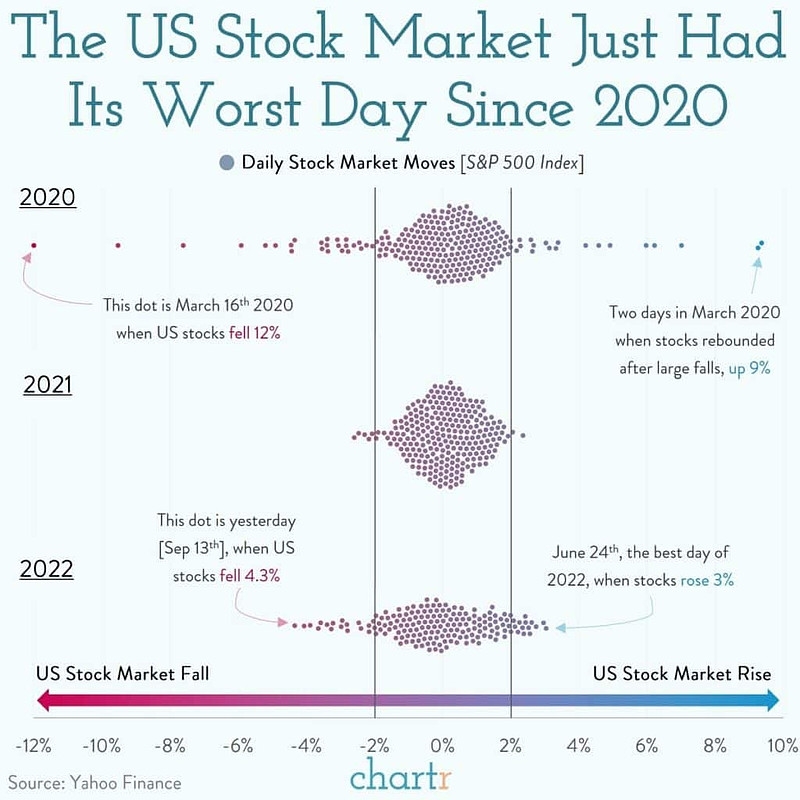

Over the past few years, the MRO stock price has shown significant volatility. Here are some recent trends:

Growth in Demand: The demand for MRO services has been growing, driven by factors such as increased industrial activity and aging infrastructure.

Strong Financial Performance: MRO has been reporting strong financial results, with consistent revenue growth and improved profit margins.

Market Sentiment: The stock has seen periods of strong investor interest, driven by positive news and strong performance.

Case Study: MRO's Response to the Pandemic

One notable example of MRO's resilience is its response to the COVID-19 pandemic. Despite the economic downturn, MRO continued to provide essential services and adapt to the changing market conditions. This adaptability and commitment to customer service have been well-received by investors, contributing to the stock's overall performance.

Conclusion

Understanding the MRO stock price requires a comprehensive analysis of various factors. By considering economic conditions, industry trends, company performance, market sentiment, and competition, investors can make informed decisions about their investments. As the MRO industry continues to grow, staying informed about the stock price and its underlying factors is crucial for potential investors.