The US stock market has experienced some of the most significant drops in its history. These declines have often been accompanied by widespread economic turmoil and uncertainty. In this article, we delve into the largest US stock market drops, examining the causes, impacts, and lessons learned from these pivotal moments.

The Dot-Com Bubble Burst (2000-2002)

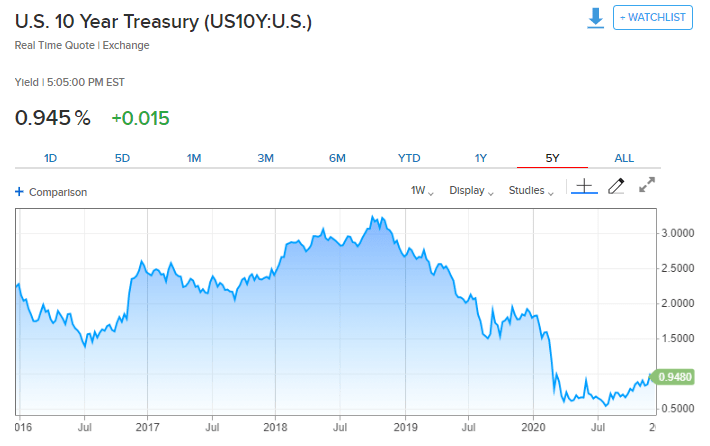

One of the most notable stock market drops in US history was the bursting of the dot-com bubble. This period, which began in the late 1990s, saw a rapid rise in the value of technology stocks. However, by 2000, the bubble burst, leading to a massive decline in the stock market. The NASDAQ Composite Index, which was heavily weighted with technology stocks, fell by over 78% from its peak in March 2000 to its trough in October 2002.

The Financial Crisis of 2008

The financial crisis of 2008 is often considered the largest stock market drop in the US. Triggered by the collapse of the housing market and the subsequent failure of several major financial institutions, the stock market plummeted. The S&P 500 Index fell by over 57% from its peak in October 2007 to its trough in March 2009.

Causes of Stock Market Drops

Several factors contribute to stock market drops, including:

- Economic Downturns: Economic recessions can lead to a decrease in consumer spending and business investment, which in turn can cause stock prices to fall.

- Market Speculation: Excessive speculation in certain sectors can lead to irrational price increases, which are eventually corrected when the bubble bursts.

- Political and Geopolitical Events: Events such as elections, political instability, and international conflicts can cause uncertainty and volatility in the stock market.

- Financial System Failures: The collapse of financial institutions can lead to a loss of confidence in the market and widespread panic selling.

Impacts of Stock Market Drops

The impacts of stock market drops can be far-reaching, affecting individuals, businesses, and the economy as a whole. Some of the key impacts include:

- Loss of Wealth: Investors who hold stocks in the market can experience significant losses in their wealth.

- Reduced Consumer Spending: As individuals lose confidence in the market, they may reduce their spending, leading to a decrease in economic activity.

- Increased Unemployment: Businesses may be forced to lay off employees due to reduced revenue and increased costs.

- Economic Recession: Stock market drops can lead to broader economic downturns, with increased unemployment, falling wages, and reduced economic growth.

Lessons Learned

Several lessons can be learned from the largest US stock market drops:

- Diversification: Diversifying investments can help reduce the risk of significant losses during market downturns.

- Risk Management: It is crucial to assess and manage risks when investing in the stock market.

- Long-Term Perspective: Investing for the long term can help mitigate the impact of short-term market volatility.

- Regulatory Oversight: Strong regulatory oversight can help prevent excessive speculation and financial system failures.

Case Study: The Tech Wreck of 2000

The dot-com bubble burst in 2000, leading to a significant decline in the stock market. One of the most notable companies affected was Amazon.com. At its peak in December 1999, Amazon's market capitalization was over

In conclusion, the largest US stock market drops have had a profound impact on the economy and individuals. Understanding the causes, impacts, and lessons learned from these events can help investors navigate the stock market and mitigate risks.