Are you looking to expand your investment portfolio and consider trading US stocks from India? Intraday trading can be a lucrative way to capitalize on short-term market movements. However, navigating the complexities of international stock markets can be challenging. In this article, we will guide you through the process of intraday trading in US stocks from India, ensuring you are well-equipped to make informed decisions.

Understanding Intraday Trading

Intraday trading involves buying and selling stocks within the same trading day. This strategy requires quick decision-making and a thorough understanding of market trends. The goal is to profit from price fluctuations, often within minutes or hours.

Step 1: Choose a Reliable Broker

The first step in intraday trading is to select a reliable broker. Look for a broker that offers access to US stock exchanges and provides competitive fees. Some popular brokers for Indian traders include Zerodha, Upstox, and Angel Broking.

Step 2: Open a Trading Account

Once you have chosen a broker, open a trading account. This process typically involves filling out an application form, providing identification documents, and linking your bank account for fund transfers.

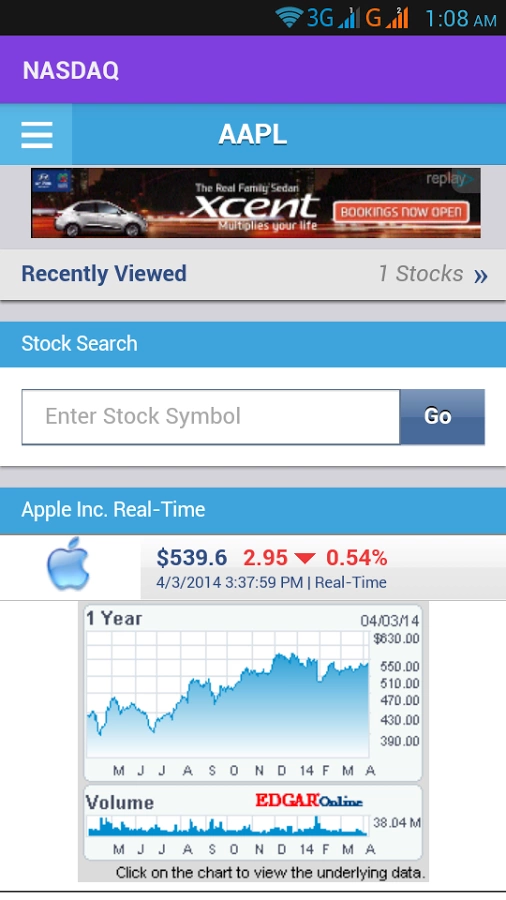

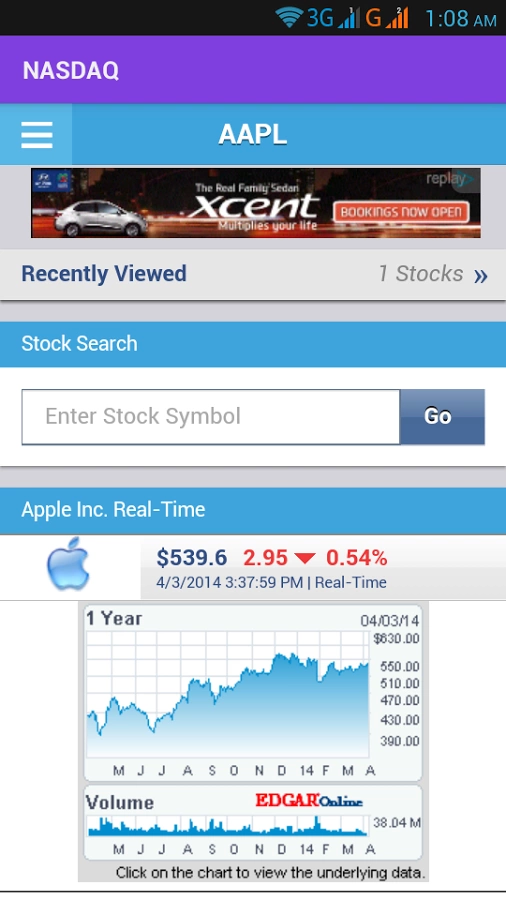

Step 3: Understand the US Stock Market

Before diving into intraday trading, it's crucial to understand the US stock market. Familiarize yourself with the major exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. Additionally, learn about the trading hours, which are typically from 9:30 AM to 4:00 PM Eastern Time.

Step 4: Analyze the Market

To succeed in intraday trading, you need to analyze the market. This involves studying various indicators, such as moving averages, volume, and price patterns. Some popular tools for technical analysis include MetaTrader, NinjaTrader, and TradingView.

Step 5: Develop a Trading Strategy

A well-defined trading strategy is essential for success in intraday trading. This strategy should include entry and exit points, risk management, and profit targets. Some common intraday trading strategies include scalping, momentum trading, and range trading.

Step 6: Monitor Your Trades

Once you have placed a trade, it's crucial to monitor it closely. This involves keeping an eye on market trends and news that could impact the stock's price. Be prepared to exit the trade quickly if the market moves against you.

Case Study: Intraday Trading Success Story

Let's consider a hypothetical scenario where an Indian trader, John, decides to trade US stocks using an intraday trading strategy. John thoroughly researches the market, identifies a potential opportunity in a technology stock, and decides to enter a long position. Using technical analysis, he sets a profit target and a stop-loss order. Within a few hours, the stock reaches his profit target, and John exits the trade with a profit.

Conclusion

Intraday trading in US stocks from India can be a rewarding investment strategy. By following these steps and developing a well-defined trading plan, you can increase your chances of success. Remember to stay disciplined, manage your risk, and continuously learn from your experiences. Happy trading!