Are you a Pakistani investor looking to diversify your portfolio by investing in US stocks? With the global financial market becoming increasingly accessible, buying US stocks from Pakistan is now easier than ever. This article will guide you through the process, helping you make informed decisions and navigate the complexities of international stock trading.

Understanding the Basics

Before diving into the details, it's essential to understand the basics of buying US stocks from Pakistan. The United States has one of the most robust and liquid stock markets in the world, with numerous companies offering diverse investment opportunities. However, investing in US stocks requires a few prerequisites, including a reliable internet connection, a foreign currency account, and a brokerage account.

Opening a Foreign Currency Account

To buy US stocks, you'll need a foreign currency account to facilitate transactions. Most Pakistani banks offer multi-currency accounts, allowing you to hold USD, EUR, GBP, and other major currencies. This account will be used to deposit funds for purchasing stocks.

Choosing a Brokerage Account

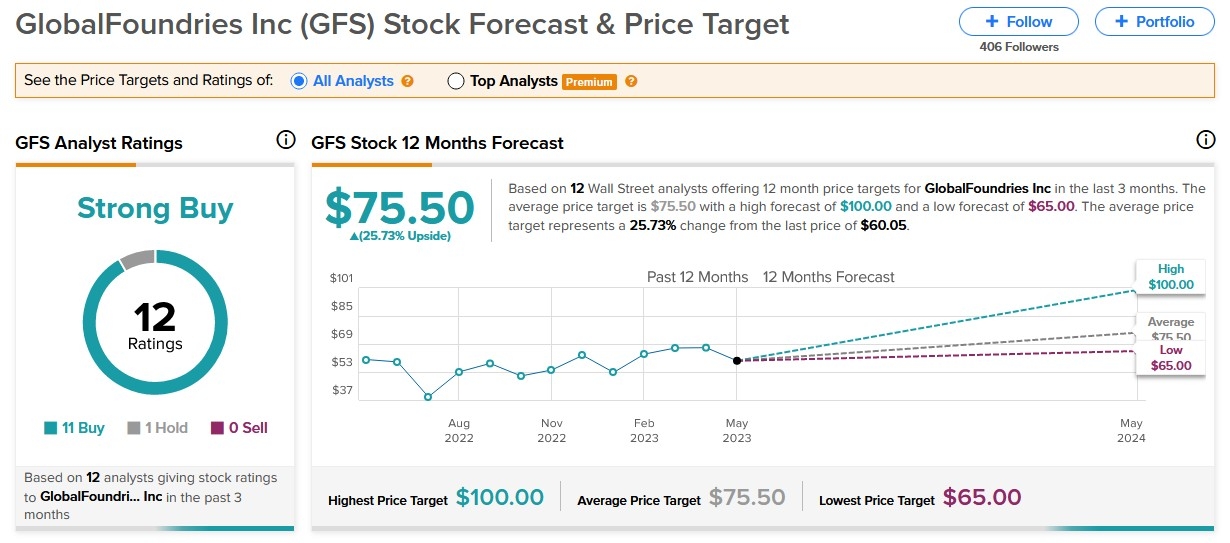

The next step is to open a brokerage account with a reputable online brokerage firm. Several international brokers offer services to Pakistani investors, including TD Ameritrade, E*TRADE, and Charles Schwab. When choosing a broker, consider factors such as fees, customer service, and the range of investment options available.

Understanding the Process

Once you have a brokerage account, the process of buying US stocks is straightforward:

Research and Analyze: Conduct thorough research on the companies you're interested in. Analyze their financial statements, market trends, and industry outlook. This step is crucial to ensure you're investing in a company with strong fundamentals.

Place an Order: Log in to your brokerage account and place an order to buy shares of the desired company. You can choose between market orders (buying at the current market price) and limit orders (buying at a specific price).

Fund Your Account: Transfer funds from your foreign currency account to your brokerage account. This process may take a few days, depending on your bank and the brokerage firm.

Monitor Your Investment: Once your order is executed, monitor your investment regularly. Keep an eye on the company's performance, market trends, and any news that may impact its stock price.

Case Study: Investing in Apple Inc.

Let's consider a hypothetical scenario where you want to invest in Apple Inc. (AAPL). After conducting thorough research, you believe that Apple's strong product lineup and global market presence make it a solid investment. You decide to buy 100 shares of Apple at $150 per share.

Open a Brokerage Account: You open a brokerage account with a reputable firm and fund it with USD.

Place an Order: Log in to your account and place a market order to buy 100 shares of Apple at $150 per share.

Fund Your Account: Transfer funds from your foreign currency account to your brokerage account.

Monitor Your Investment: After the order is executed, you become a shareholder in Apple Inc. Monitor the company's performance and market trends to make informed decisions about your investment.

Conclusion

Buying US stocks from Pakistan is a feasible and potentially profitable investment strategy. By understanding the basics, opening the necessary accounts, and conducting thorough research, you can successfully diversify your portfolio and take advantage of the opportunities offered by the US stock market.