Are you looking to invest in Canadian stocks but don't know how to get started? Many Americans are interested in investing in Canadian stocks, as the Canadian market offers a wide range of opportunities. In this article, we will guide you through the process of buying stocks from Canada in the US online, step by step.

Understanding the Process

Before diving into the details, it's important to understand that buying stocks from Canada in the US involves a few key steps. You'll need to open a brokerage account, research Canadian stocks, and execute your trades. Here's a breakdown of the process:

Open a Brokerage Account: The first step is to open a brokerage account that allows you to trade stocks from Canada. Many US-based brokers offer access to Canadian stocks, so you have plenty of options to choose from.

Research Canadian Stocks: Once you have your brokerage account, it's time to research Canadian stocks. Look for companies that align with your investment strategy and have a strong track record.

Execute Your Trades: After selecting your Canadian stocks, you can execute your trades through your brokerage account. This can be done online, via phone, or through a mobile app.

Choosing the Right Brokerage Account

When choosing a brokerage account, it's important to consider factors such as fees, available Canadian stocks, and customer service. Here are a few popular brokerage accounts that offer access to Canadian stocks:

Charles Schwab: Schwab offers a wide range of Canadian stocks and has a user-friendly platform. They also offer competitive fees and excellent customer service.

Fidelity: Fidelity is another great option for trading Canadian stocks. They offer a variety of investment options and have a strong reputation for customer satisfaction.

TD Ameritrade: TD Ameritrade offers access to Canadian stocks and has a robust trading platform. They also offer educational resources and research tools to help you make informed investment decisions.

Researching Canadian Stocks

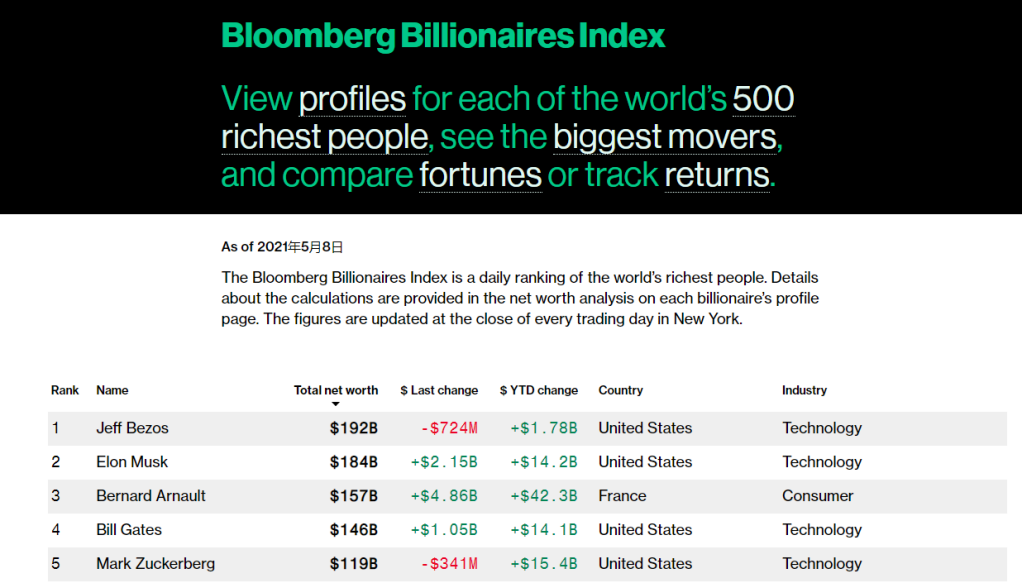

Researching Canadian stocks is similar to researching US stocks. Look for companies with strong fundamentals, such as a high return on equity, low debt-to-equity ratio, and a solid dividend yield. Here are a few tips for researching Canadian stocks:

Use Online Research Tools: Many brokerage platforms offer free research tools that can help you analyze Canadian stocks. These tools can provide valuable insights into a company's financial health and performance.

Read Company Reports: Company reports, such as annual reports and quarterly earnings reports, can provide valuable information about a company's operations and financial performance.

Stay Informed: Keep up with news and events that may impact Canadian stocks. This includes economic indicators, political events, and industry-specific news.

Executing Your Trades

Once you've selected your Canadian stocks, it's time to execute your trades. Here's how to do it:

Log in to Your Brokerage Account: Access your brokerage account online, via phone, or through a mobile app.

Enter Your Trade Details: Enter the stock symbol, the number of shares you want to buy, and the price you're willing to pay.

Review and Confirm Your Trade: Review your trade details and confirm the transaction.

Case Study: Investing in Canadian Stocks

Let's say you're interested in investing in a Canadian energy company, such as Suncor Energy. After researching the company and analyzing its financials, you decide to buy 100 shares at $40 per share. You log in to your brokerage account, enter the trade details, and confirm the transaction. A few days later, your shares are purchased, and you become a shareholder in Suncor Energy.

By following these steps, you can easily buy stocks from Canada in the US online. Remember to do your research, choose the right brokerage account, and stay informed about the market. With a bit of effort, you can add Canadian stocks to your investment portfolio and potentially benefit from the growth of the Canadian market.