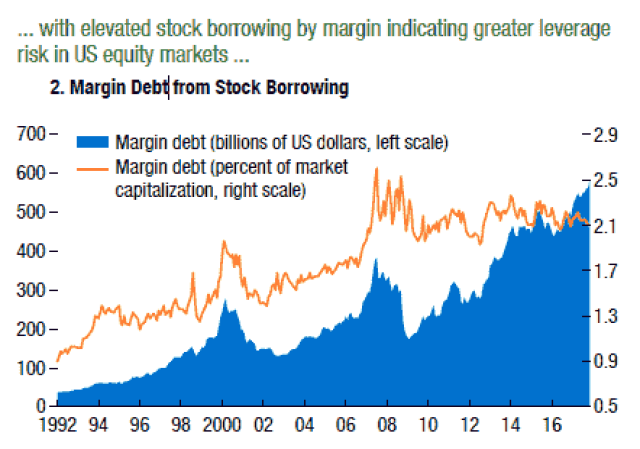

In the fast-paced world of stock trading, leverage can be a powerful tool for investors looking to amplify their returns. High leverage stock brokers in the US offer this capability, allowing traders to control larger positions with a smaller amount of capital. This guide will delve into what high leverage means, the benefits and risks, and how to choose the right broker for your needs.

Understanding High Leverage

High leverage refers to the ability to borrow money from a broker to trade stocks. For example, if a broker offers 50:1 leverage, you can control

Benefits of High Leverage Stock Brokers

- Amplified Returns: The most obvious benefit of high leverage is the potential for higher returns. By controlling larger positions, you can earn more from successful trades.

- Increased Trading Power: High leverage allows you to trade more than you would be able to with your own capital, giving you more flexibility and the ability to take advantage of market opportunities.

- Cost-Effective: Since you only need a small amount of capital to control larger positions, high leverage can be a cost-effective way to trade.

Risks of High Leverage Stock Brokers

- Increased Risk of Loss: As mentioned earlier, high leverage can amplify your losses as well as your gains. If the market moves against you, you could lose more than your initial investment.

- Margin Calls: If the value of your position falls below a certain level, your broker may require you to deposit additional capital to maintain your position. This can be a significant financial burden.

- Market Volatility: High leverage can be particularly risky in volatile markets, as even small price movements can have a significant impact on your position.

Choosing the Right High Leverage Stock Broker

When choosing a high leverage stock broker, it's important to consider several factors:

- Regulatory Compliance: Ensure that the broker is regulated by a reputable financial authority, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

- Leverage Offerings: Different brokers offer different levels of leverage. Choose a broker that offers the leverage ratio that best suits your trading style and risk tolerance.

- Fees and Commissions: High leverage brokers may have higher fees and commissions. Be sure to compare the costs of different brokers to find the most cost-effective option.

- Customer Service: Good customer service can be crucial, especially if you encounter issues with your account or need assistance with trading.

Case Study: High Leverage Trading Success

One of the most famous examples of high leverage trading success is George Soros, who famously broke the Bank of England in 1992 using high leverage. Soros used leverage to control a position worth

Conclusion

High leverage stock brokers in the US can be a powerful tool for investors looking to amplify their returns. However, it's important to understand the risks and choose the right broker for your needs. By doing so, you can take advantage of the benefits of high leverage while minimizing the potential drawbacks.