The stock market is a dynamic entity, constantly shifting and evolving based on a multitude of factors. One of the most pressing questions on the minds of investors and market watchers alike is whether the US stock market has bottomed out. This article delves into this question, analyzing the current market conditions, historical trends, and expert opinions to provide a comprehensive understanding of where we stand.

Understanding the Market Bottom

The term "bottom" in the context of the stock market refers to the lowest point in a market cycle, where prices have reached a level that is unlikely to fall further. This is often a critical moment for investors, as it represents an opportunity to buy stocks at potentially low prices.

Current Market Conditions

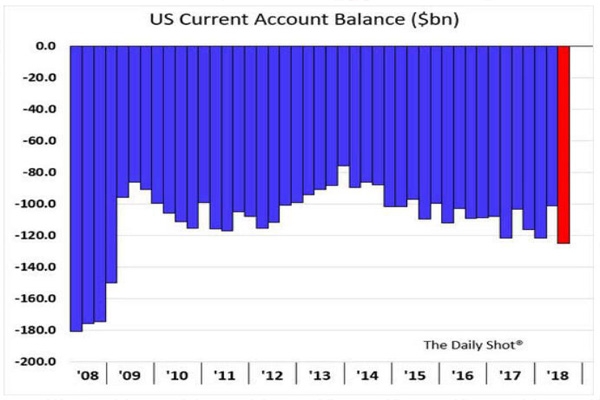

As of the time of writing, the US stock market has experienced significant volatility in recent years. The COVID-19 pandemic, geopolitical tensions, and economic uncertainties have all contributed to this volatility. However, some experts believe that the market has reached a bottom.

Historical Trends

Looking at historical data, we can see that the stock market has experienced numerous corrections and bear markets over the years. However, these periods have ultimately been followed by strong recoveries. For instance, the dot-com bubble burst in 2000, leading to a bear market that lasted until 2003. Similarly, the financial crisis of 2008 resulted in a severe bear market that lasted until 2009. In both cases, the market eventually bottomed out and recovered.

Expert Opinions

Several experts have weighed in on whether the US stock market has bottomed out. David Rosenberg, chief economist and strategist at Gluskin Sheff + Associates, believes that the market has bottomed out and is poised for a strong recovery. John Stumpf, chief investment officer at U.S. Bank Wealth Management, also shares a similar view, stating that the market has reached a level that is attractive for long-term investors.

Case Studies

To further illustrate the potential for a market bottom, let's look at a few case studies. During the dot-com bubble, investors who held onto their stocks eventually saw significant gains. Similarly, those who invested during the financial crisis of 2008 saw their investments recover over time.

Conclusion

While it is impossible to predict the future with certainty, the current market conditions, historical trends, and expert opinions suggest that the US stock market may have bottomed out. Investors who are willing to take on risk may find attractive opportunities in the current market environment. As always, it is important to conduct thorough research and consult with a financial advisor before making any investment decisions.