Gazprom, one of the world's largest energy companies, has long been a subject of interest for investors worldwide. Its operations span across multiple continents, and its influence is felt far and wide. This article delves into Gazprom's stock performance in the United States and its relationship with the Russian Ruble, providing insights into the investment implications for both domestic and international investors.

Gazprom's Stock Performance in the US

Gazprom's stock has been listed on the New York Stock Exchange (NYSE) since 1998, making it one of the first Russian companies to do so. Over the years, the stock has experienced its fair share of volatility, reflecting the broader economic and political changes in Russia and the global energy market.

Investment Implications

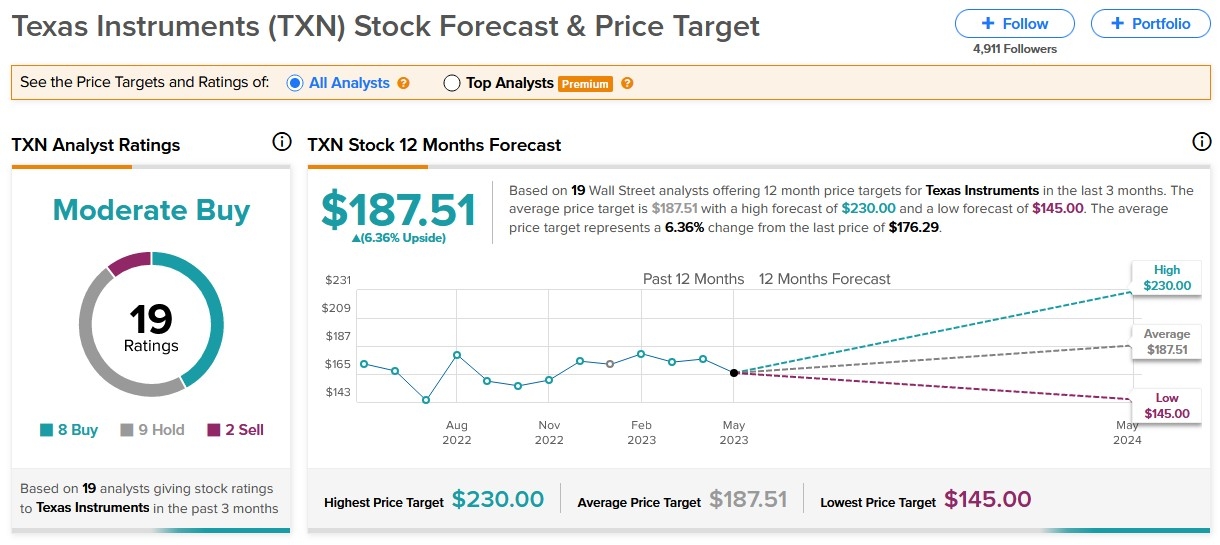

Political Risks: Gazprom's operations are heavily influenced by Russian politics. Sanctions imposed on Russia in response to geopolitical events have had a significant impact on Gazprom's stock performance. Investors need to be aware of these risks and consider their political stance before investing.

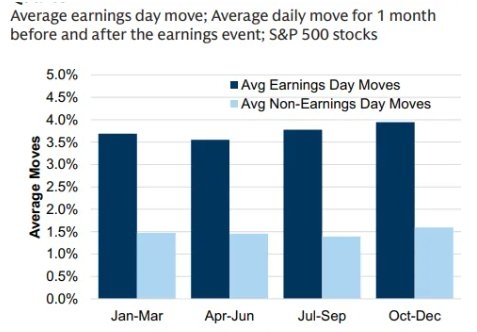

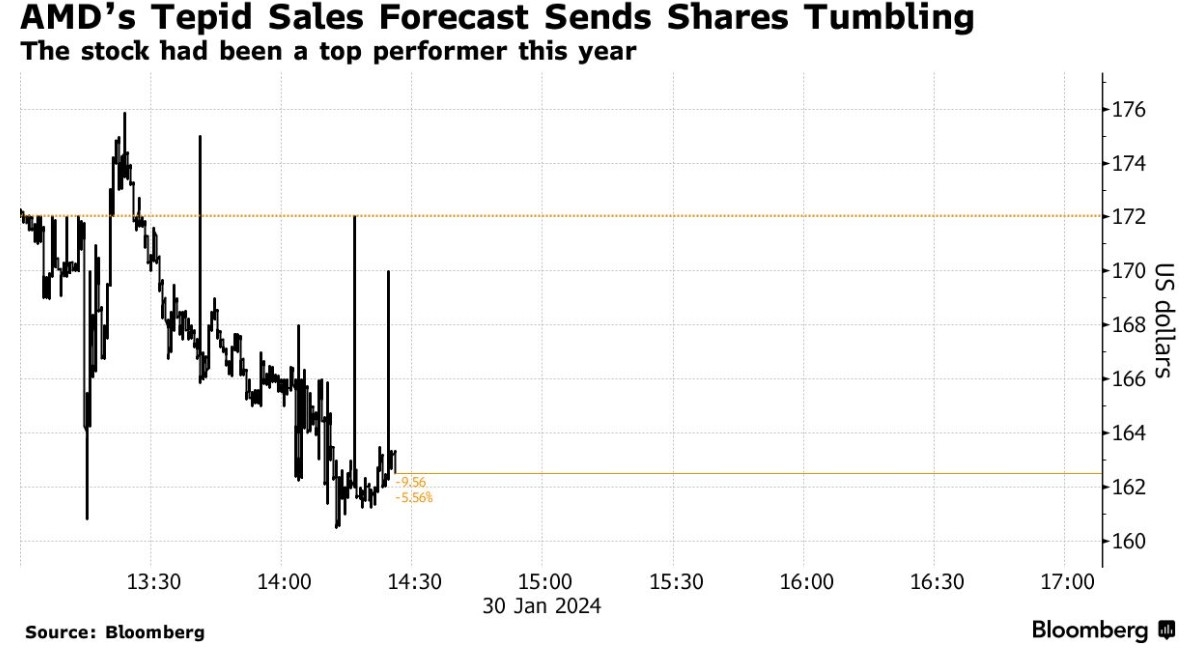

Energy Market Dynamics: As a major player in the global energy market, Gazprom's stock is highly sensitive to fluctuations in energy prices. Energy prices can be volatile, and a decrease in prices can negatively impact Gazprom's profitability and stock value.

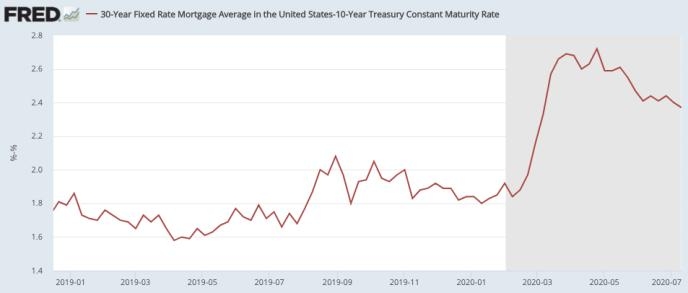

Currency Fluctuations: Gazprom's stock is listed in US dollars, but its revenue is primarily generated in Rubles. Currency fluctuations between the Ruble and the US Dollar can affect the company's financial performance and stock price.

Gazprom and the Russian Ruble

The relationship between Gazprom and the Russian Ruble is complex. As a major player in the Russian economy, Gazprom's performance has a significant impact on the Ruble's value. Here are some key points to consider:

Revenue in Rubles: Gazprom generates the majority of its revenue in Rubles, making it less susceptible to fluctuations in the US Dollar. However, the Ruble's value can still affect the company's profitability and stock price.

Investment in Ruble: Investors who invest in Gazprom's US-listed stock indirectly invest in Rubles. As the Ruble strengthens, Gazprom's stock price may increase, and vice versa.

Sanctions and the Ruble: Sanctions imposed on Russia have weakened the Ruble, making it a more attractive currency for investors. However, this has also led to increased volatility in the Ruble, which can impact Gazprom's stock performance.

Case Study: Gazprom's Stock Performance in 2020

In 2020, the global energy market faced unprecedented challenges due to the COVID-19 pandemic. Energy prices plummeted, and Gazprom's stock performance was significantly impacted. However, the company's strong financial position and diversified operations helped mitigate the losses.

Conclusion

Investing in Gazprom's stock involves a complex interplay of political, economic, and currency risks. Understanding the relationship between Gazprom, the US stock market, and the Russian Ruble is crucial for investors looking to invest in this energy giant. While the risks are substantial, the potential rewards can be significant for those who conduct thorough research and consider the broader economic and political landscape.