In the dynamic world of financial markets, the Dow Jones and NASDAQ are two of the most influential indices. Understanding the differences and similarities between these two giants can provide investors with valuable insights into the market trends. This article delves into the key aspects of both the Dow Jones and NASDAQ, offering a comprehensive guide for investors looking to gain a better understanding of the US stock market.

What is the Dow Jones?

The Dow Jones Industrial Average (DJIA), commonly known as the Dow, is one of the oldest and most recognized stock market indices in the world. It consists of 30 large, publicly-owned companies across various industries, such as technology, finance, healthcare, and consumer goods. The Dow is widely considered a benchmark for the overall health of the US economy.

Key Features of the Dow Jones:

- Industry Representation: The Dow represents a diverse range of industries, making it a good indicator of the broader market.

- Market Cap: The companies included in the Dow are large-cap, meaning they have a high market capitalization.

- Historical Significance: The Dow has been around since 1896, making it a reliable indicator of long-term market trends.

What is the NASDAQ?

The NASDAQ Stock Market, or simply NASDAQ, is the second-largest stock exchange in the world by market capitalization. It lists a wide range of companies, including technology giants like Apple, Microsoft, and Google. The NASDAQ is known for its strong focus on technology and innovation.

Key Features of the NASDAQ:

- Industry Focus: The NASDAQ has a significant concentration of technology and biotechnology companies.

- Market Cap: Similar to the Dow, the companies listed on the NASDAQ are generally large-cap.

- Innovation: The NASDAQ is considered a hotbed for innovation and cutting-edge technologies.

Comparison: Dow Jones vs. NASDAQ

Industry Representation:

- The Dow Jones represents a broader range of industries, while the NASDAQ focuses on technology and biotechnology.

- The Dow's industry diversification makes it a more conservative indicator of the overall market.

Market Capitalization:

- Both the Dow Jones and NASDAQ list large-cap companies, which means they have significant market value and are considered stable investments.

Historical Performance:

- Over the years, both indices have shown significant growth, but the NASDAQ has generally outperformed the Dow due to its strong technology sector.

Case Study: Apple (AAPL)

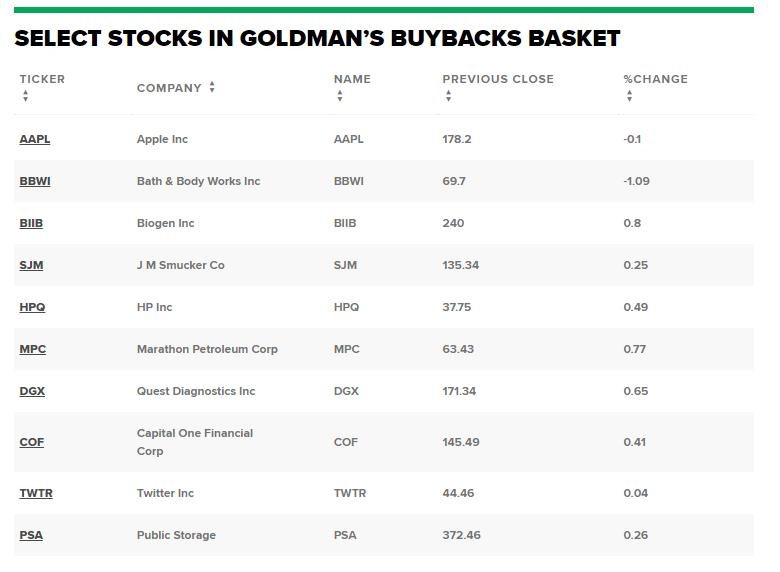

Apple is a prime example of how the Dow Jones and NASDAQ can differ in their representation. As one of the most valuable companies in the world, Apple is included in both indices. However, its inclusion in the NASDAQ highlights the index's focus on technology, while its presence in the Dow Jones demonstrates its stability and historical significance.

In conclusion, both the Dow Jones and NASDAQ offer valuable insights into the US stock market. While the Dow represents a broad range of industries and is a more conservative indicator, the NASDAQ focuses on technology and innovation. Investors should consider their investment goals and risk tolerance when choosing between these two indices.