Embarking on the Journey of Global Stock Investing

Are you an American investor looking to expand your portfolio beyond the domestic market? Buying stocks online outside the US can open up a world of opportunities. This comprehensive guide will walk you through the process, highlighting key considerations, top platforms, and real-life examples.

Understanding the Basics

1. Diversification

Investing in stocks outside the US is a powerful way to diversify your portfolio. By allocating your investments across different regions and sectors, you can mitigate risks associated with market volatility and currency fluctuations.

2. Market Access

Investing in foreign stocks allows you to tap into emerging markets, access unique sectors, and benefit from different economic cycles. For example, investing in technology stocks in China or healthcare companies in Europe can provide valuable exposure to global growth trends.

3. Currency Fluctuations

When investing in foreign stocks, currency fluctuations can impact your returns. Understanding the exchange rate dynamics is crucial to making informed investment decisions.

Top Platforms for Buying Stocks Outside the US

1. E*TRADE

E*TRADE is a popular platform among American investors seeking international stock exposure. It offers a wide range of global stock exchanges, including the London Stock Exchange, Hong Kong Stock Exchange, and Tokyo Stock Exchange.

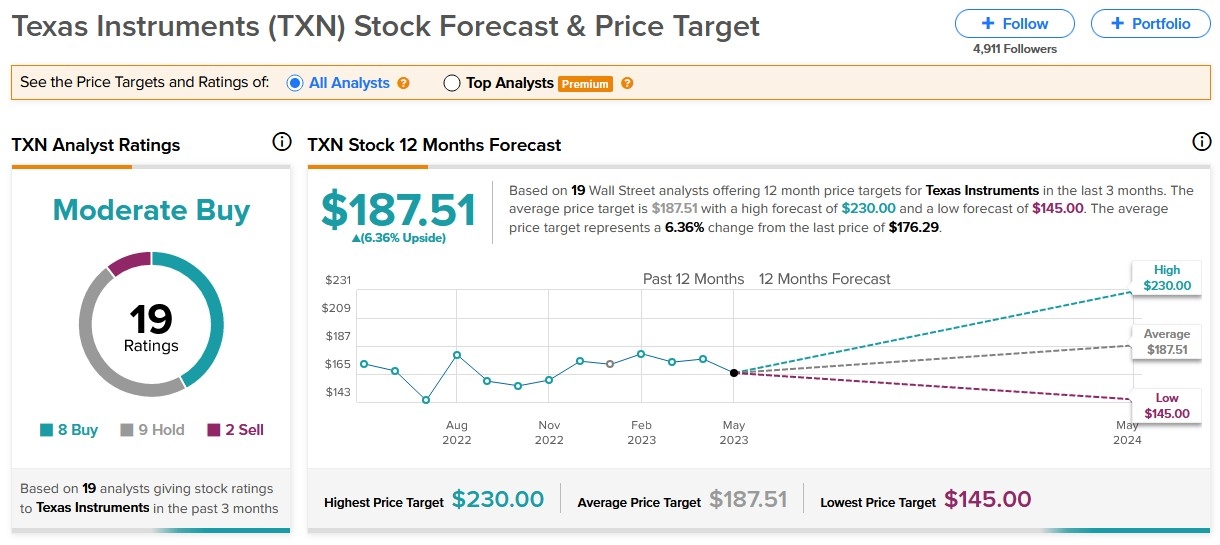

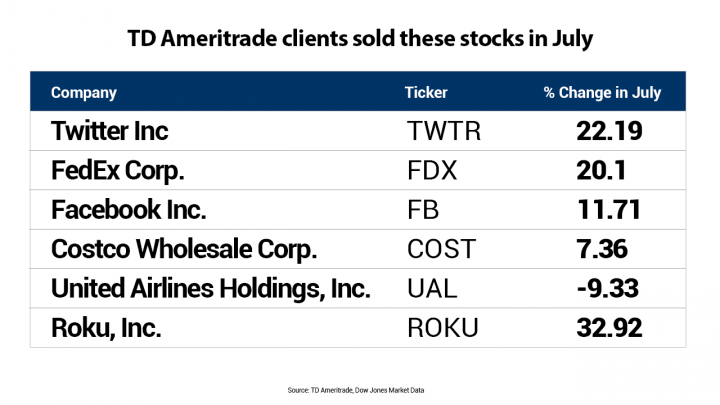

2. TD Ameritrade

TD Ameritrade provides access to over 90 stock exchanges worldwide, making it an excellent choice for investors looking to diversify their portfolio globally. The platform offers comprehensive research tools and educational resources to help you make informed decisions.

3. Charles Schwab

Charles Schwab offers a wide range of international stock options, including American depositary receipts (ADRs) and direct foreign stock purchases. The platform provides a user-friendly interface and access to a wide array of research tools.

Key Considerations When Buying Stocks Outside the US

1. Research and Due Diligence

Before investing in foreign stocks, it's crucial to conduct thorough research and due diligence. This includes analyzing the company's financial statements, business model, management team, and industry trends.

2. Tax Implications

Investing in foreign stocks may have tax implications, depending on your jurisdiction. It's important to consult with a tax professional to understand the potential tax liabilities and ensure compliance with applicable regulations.

3. Regulatory Compliance

When buying stocks outside the US, you must comply with the regulations of the foreign market. This includes understanding the reporting requirements, corporate governance standards, and disclosure practices.

Real-Life Example: Investing in Chinese Technology Stocks

One popular approach for American investors is to invest in Chinese technology stocks, such as Alibaba Group Holding Ltd. and Tencent Holdings Ltd. These companies offer exposure to the rapidly growing Chinese tech market and have a significant presence in sectors like e-commerce, cloud computing, and fintech.

By utilizing platforms like E*TRADE or TD Ameritrade, investors can easily purchase these stocks and benefit from the global growth trends in the technology sector.

Conclusion

Buying stocks online outside the US can be a valuable strategy for diversifying your portfolio and accessing global growth opportunities. By understanding the basics, utilizing top platforms, and conducting thorough research, you can make informed investment decisions and potentially enhance your returns. Remember to consult with a financial advisor or tax professional to ensure compliance with applicable regulations and optimize your investment strategy.