Are you a non-US citizen interested in trading stocks but unsure if you're eligible? The good news is that, in many cases, non-US citizens can indeed trade stocks. However, there are certain regulations and procedures to consider. This article will provide you with a comprehensive guide to help you understand the process and what you need to do to start trading stocks as a non-US citizen.

Understanding the Basics

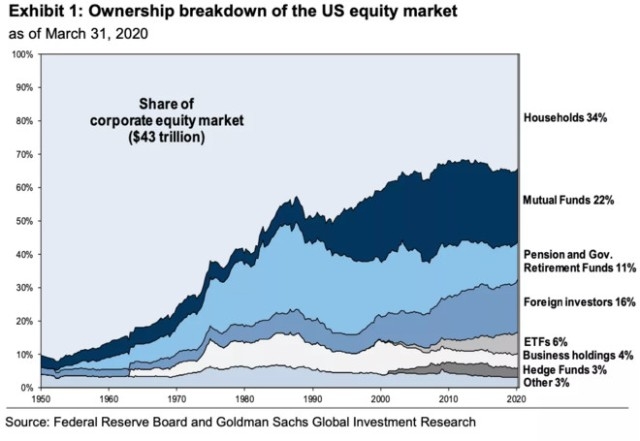

First, it's important to understand that trading stocks involves buying and selling shares of publicly-traded companies. These shares are typically bought and sold on stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ.

Eligibility for Non-US Citizens

As a non-US citizen, you can trade stocks in the US if you meet certain criteria:

- Legal Residence: You must have legal residence in the US, such as a Green Card or a visa that allows you to work or study here.

- Bank Account: You'll need a US bank account to facilitate transactions and receive dividends.

- Trading Account: You'll also need a trading account with a brokerage firm that allows non-US citizens to trade.

Opening a Trading Account

To start trading stocks, you'll need to open a trading account with a brokerage firm. There are several options available, including full-service brokers and discount brokers.

Full-Service Brokers:

- Offer personalized advice and support.

- Charge higher fees than discount brokers.

- Suitable for investors with a high net worth or those who prefer hands-on assistance.

Discount Brokers:

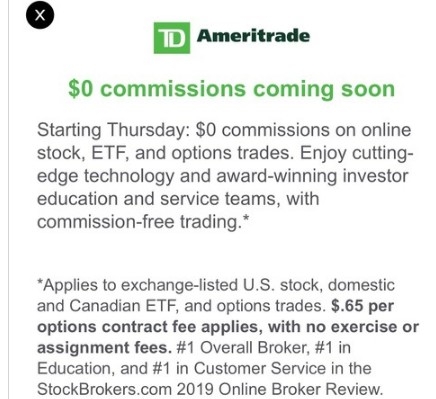

- Focus on executing trades efficiently at a lower cost.

- Ideal for self-directed investors who prefer to make their own trading decisions.

- Examples include TD Ameritrade, E*TRADE, and Charles Schwab.

Regulations and Tax Implications

When trading stocks, it's important to be aware of the regulations and tax implications, especially if you're a non-US citizen:

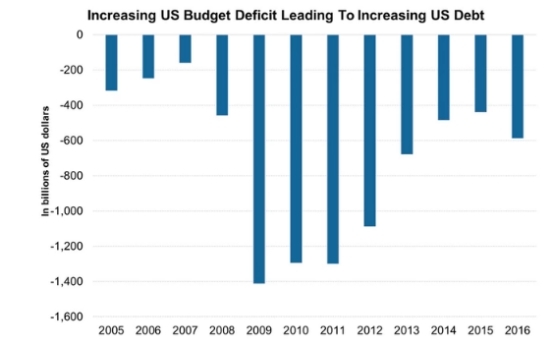

- Regulations: Non-US citizens must comply with the same regulations as US citizens when trading stocks. This includes reporting all income and capital gains to the IRS.

- Tax Implications: Non-US citizens are subject to the same tax rates on capital gains as US citizens. However, there may be additional reporting requirements and taxes on foreign income.

Case Study: John, a Non-US Citizen

John, a citizen of Germany, wants to invest in US stocks. He has a Green Card and opens a trading account with a discount broker. John carefully researches companies and uses a diversified portfolio to manage risk. He follows the regulations and reports all income to the IRS.

Conclusion

In conclusion, non-US citizens can trade stocks in the US, but they must meet certain criteria and comply with regulations. By understanding the process and taking appropriate steps, you can start trading stocks and potentially grow your investments. Always consult with a financial advisor to ensure you're making informed decisions.