Investing in the United States stock market can be a lucrative endeavor, but it requires a well-thought-out strategy and a keen eye for potential investments. This article delves into the art of CI US stock selection, offering insights and tips for smart investors looking to capitalize on the vast opportunities available in the American financial landscape.

Understanding CI US Stock Selection

CI US stock selection refers to the process of identifying and analyzing stocks that have the potential to deliver strong returns. This involves examining various factors, such as financial performance, market trends, and company fundamentals. By understanding these elements, investors can make informed decisions and increase their chances of success.

Key Factors to Consider in CI US Stock Selection

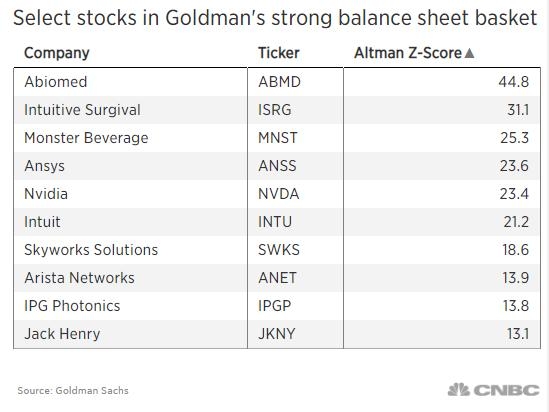

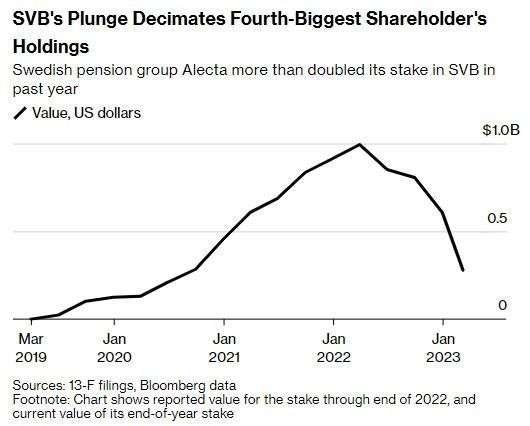

Financial Performance: A company's financial performance is a crucial indicator of its health and potential for growth. Investors should look for companies with strong revenue growth, solid profit margins, and a healthy balance sheet. Key financial metrics to consider include earnings per share (EPS), return on equity (ROE), and price-to-earnings (P/E) ratio.

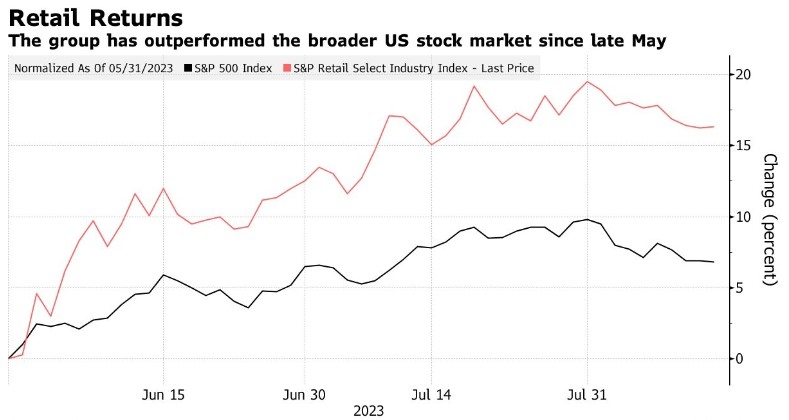

Market Trends: Keeping abreast of market trends is essential for CI US stock selection. This involves analyzing economic indicators, industry reports, and geopolitical events that could impact the market. By understanding the broader economic landscape, investors can identify sectors and companies that are poised to benefit from emerging trends.

Company Fundamentals: Beyond financial performance, investors should also examine a company's fundamentals. This includes assessing its management team, competitive position, and growth prospects. Companies with strong management, a competitive advantage, and a clear growth strategy are often more likely to succeed in the long term.

Dividends: Dividends can be a valuable source of income for investors. Companies that consistently pay dividends are often seen as stable and well-managed. When considering CI US stock selection, investors should look for companies with a history of paying dividends and a strong track record of increasing their dividend payments over time.

Strategies for Successful CI US Stock Selection

Diversification: Diversifying your portfolio is crucial to managing risk and maximizing returns. By investing in a variety of stocks across different sectors and industries, you can reduce the impact of any single stock's performance on your overall portfolio.

Long-Term Perspective: Investing in the stock market requires patience and a long-term perspective. Avoid the temptation to chase short-term gains and focus on companies with strong fundamentals and long-term growth potential.

Continuous Learning: The stock market is constantly evolving, so it's essential to stay informed and continue learning. Keep up with industry news, financial reports, and market trends to make informed decisions.

Case Study: Apple Inc.

One prime example of successful CI US stock selection is Apple Inc. Over the years, Apple has demonstrated strong financial performance, innovation, and a loyal customer base. By consistently investing in research and development, Apple has been able to launch groundbreaking products and maintain its competitive edge in the technology industry. This has translated into strong returns for investors who took a long-term approach to their investments in Apple stock.

In conclusion, CI US stock selection requires a comprehensive understanding of financial performance, market trends, and company fundamentals. By adopting a strategic approach and remaining informed, investors can identify and invest in stocks with strong potential for growth. Remember to diversify your portfolio, maintain a long-term perspective, and continue learning to maximize your chances of success in the US stock market.