In the dynamic world of US stocks, understanding the bid ask spread is crucial for investors looking to make informed decisions. The bid ask spread is the difference between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). This spread is a key indicator of market liquidity and can provide valuable insights into a stock's potential.

Understanding the Bid Ask Spread

The bid ask spread is typically measured in cents or pips, depending on the stock's price. A smaller spread indicates higher liquidity, as there are more buyers and sellers interested in the stock. Conversely, a larger spread suggests lower liquidity, which can be a red flag for potential investors.

Where to Watch the Bid Ask Spread

Stock Market Websites: Websites like Yahoo Finance, Google Finance, and CNBC provide real-time bid ask spreads for US stocks. These platforms are user-friendly and offer comprehensive information, including historical data and analysis.

Brokerage Platforms: Most online brokers offer detailed market data, including bid ask spreads. Platforms like TD Ameritrade, E*TRADE, and Charles Schwab provide access to real-time quotes and historical data, making them excellent resources for monitoring bid ask spreads.

Financial News Outlets: Financial news outlets like Bloomberg, Reuters, and The Wall Street Journal provide in-depth analysis and updates on bid ask spreads. These outlets often offer insights from market experts and can help investors make informed decisions.

Mobile Apps: Mobile apps like StockTwits, TD Ameritrade Mobile, and E*TRADE Mobile offer real-time bid ask spreads and market data. These apps are convenient for investors who are always on the go.

Key Factors Influencing the Bid Ask Spread

Several factors can influence the bid ask spread:

Market Liquidity: Higher liquidity typically results in a smaller spread, as there are more buyers and sellers interested in the stock.

Trading Volume: Stocks with higher trading volumes tend to have smaller spreads, as there is more activity in the market.

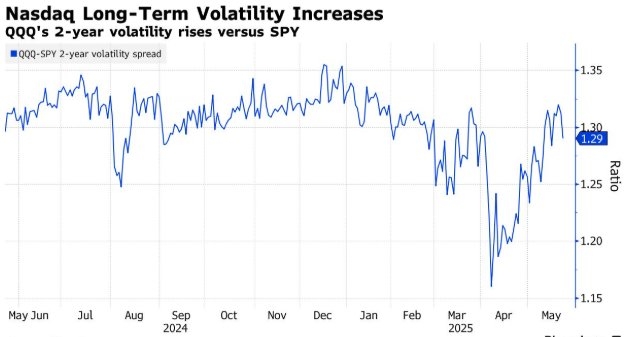

Market Conditions: During periods of high volatility, bid ask spreads may widen due to increased uncertainty and reduced liquidity.

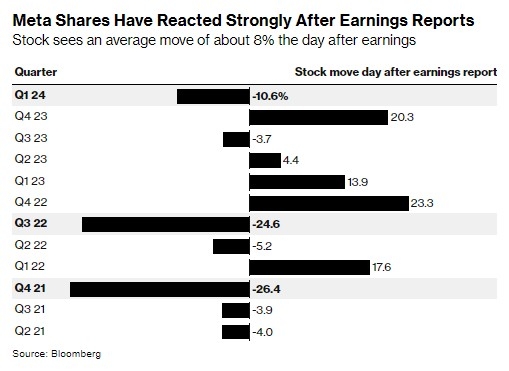

Stock Specific Factors: Factors like company news, earnings reports, and industry trends can also impact the bid ask spread.

Case Study: Apple Inc. (AAPL)

Let's consider Apple Inc. (AAPL) as an example. As of the latest data, the bid ask spread for AAPL is

Conclusion

Monitoring the bid ask spread is essential for investors looking to gain insights into market liquidity and potential trading opportunities. By utilizing various resources and understanding the key factors influencing the spread, investors can make informed decisions and potentially improve their investment returns.