In the ever-changing world of the stock market, staying informed about the latest trends and movements is crucial. One company that has been under the radar of many investors is Bayer AG. Specifically, the Bayer US stock price has been a topic of interest for those looking to invest in the pharmaceutical and agricultural giant. In this article, we'll delve into the factors influencing the Bayer US stock price and what investors should consider before making any decisions.

Understanding the Bayer Stock

Bayer AG, a German multinational corporation, is a leading player in the pharmaceutical and agricultural sectors. The company's U.S. operations, known as Bayer Crop Science and Bayer HealthCare, have been instrumental in its global success. The Bayer US stock price is listed on the New York Stock Exchange under the ticker symbol BAYRY.

Factors Influencing the Bayer US Stock Price

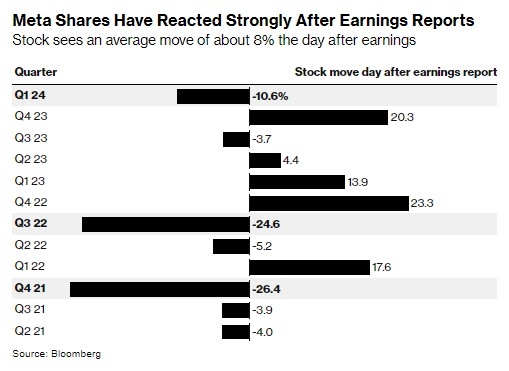

Earnings Reports: One of the primary factors that affect the Bayer US stock price is the company's earnings reports. Investors closely monitor these reports to gauge the company's financial health and future prospects.

Regulatory Decisions: The pharmaceutical industry is heavily regulated, and any decisions made by regulatory bodies, such as the U.S. Food and Drug Administration (FDA), can significantly impact the Bayer US stock price.

Product Launches: The introduction of new products or the success of existing ones can drive the Bayer US stock price higher. Conversely, setbacks in product development can lead to a decline in the stock price.

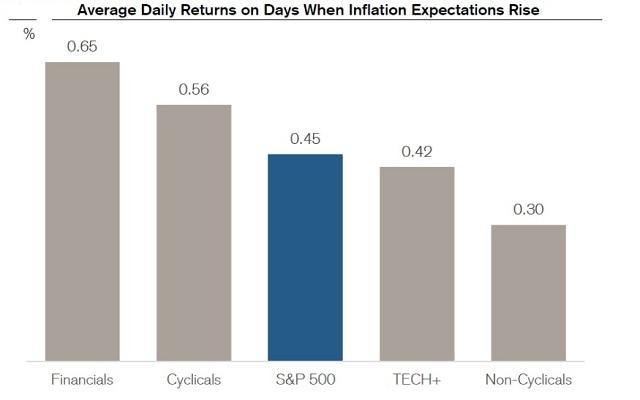

Global Economic Conditions: The global economic climate, including factors such as inflation, interest rates, and currency fluctuations, can also influence the Bayer US stock price.

Market Sentiment: Investor sentiment and market trends can have a significant impact on the Bayer US stock price. This sentiment can be influenced by various factors, including political events, industry news, and economic indicators.

Recent Developments and Stock Price Movements

In recent years, the Bayer US stock price has experienced volatility due to various factors. One notable event was the company's acquisition of Monsanto in 2018, which led to increased scrutiny from regulators and investors. The Bayer US stock price took a hit following the acquisition, but it has since stabilized.

Another significant factor affecting the Bayer US stock price was the settlement of a lawsuit involving the company's Roundup herbicide. In 2018, a jury awarded $2 billion to a California man who claimed that Roundup caused his cancer. This lawsuit, along with others, has put pressure on the Bayer US stock price.

Despite these challenges, the Bayer US stock price has shown resilience. In fact, the stock has experienced a steady increase over the past few years, driven by strong financial performance and positive developments in the pharmaceutical and agricultural sectors.

Investment Opportunities and Risks

Investing in the Bayer US stock can be a good opportunity for those looking to diversify their portfolios. However, it's important to consider the risks involved, including regulatory challenges, legal disputes, and market volatility.

Conclusion

Understanding the factors influencing the Bayer US stock price is crucial for investors looking to make informed decisions. By staying informed about the company's financial performance, regulatory decisions, and market trends, investors can better navigate the complexities of the stock market and potentially benefit from investing in Bayer AG.