The US stock market has experienced another dramatic day of trading, with significant movements across various sectors. Here’s a comprehensive summary of the key developments on August 22, 2025.

Market Overview

The S&P 500 closed slightly down on the day, while the NASDAQ Composite and the Dow Jones Industrial Average ended higher. The market's performance was influenced by a mix of economic data, corporate earnings reports, and geopolitical events.

Key Developments

1. Economic Data

The Labor Department reported that initial jobless claims rose to 235,000 last week, slightly higher than the expected 230,000. This data raised concerns about the labor market's strength, despite the recent decline in unemployment.

In addition, the Commerce Department announced that the GDP grew at an annualized rate of 2.3% in the second quarter, below the expected 2.5%. This slower growth rate may prompt the Federal Reserve to reconsider its monetary policy stance.

2. Corporate Earnings

Several major companies reported their second-quarter earnings, with mixed results. Apple Inc. (AAPL) reported stronger-than-expected earnings, driven by robust sales of its iPhone and Mac products. The company's strong performance helped lift the tech sector.

On the other hand, Tesla Inc. (TSLA) reported a loss, missing Wall Street estimates. The company's struggles with production and supply chain issues have raised concerns about its long-term prospects.

3. Geopolitical Events

The ongoing tensions between the US and China continued to weigh on investor sentiment. The White House announced new trade restrictions on Chinese companies, further complicating the relationship between the two countries.

Sector Performance

1. Technology

The technology sector was one of the best performers on the day, with Apple Inc. (AAPL) leading the pack. The strong earnings report from the tech giant helped lift the sector's overall performance.

2. Energy

The energy sector was another major gainer, with crude oil prices rising on the day. The surge in oil prices was attributed to the geopolitical tensions and supply concerns.

3. Financials

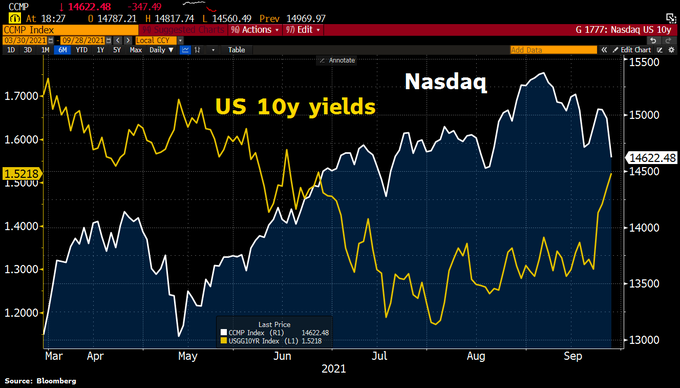

The financial sector ended lower, as investors remained cautious about the economic outlook and the potential impact of rising interest rates.

Stock Movements

1. Apple Inc. (AAPL)

Apple Inc. (AAPL) reported stronger-than-expected earnings, driven by robust sales of its iPhone and Mac products. The company's shares closed up 2.5%, outperforming the broader market.

2. Tesla Inc. (TSLA)

Tesla Inc. (TSLA) reported a loss, missing Wall Street estimates. The company's shares closed down 5%, underperforming the broader market.

3. Exxon Mobil Corp. (XOM)

Exxon Mobil Corp. (XOM) reported better-than-expected earnings, driven by higher oil prices. The company's shares closed up 1.5%, outperforming the broader market.

Conclusion

The US stock market ended the day with mixed results, influenced by economic data, corporate earnings, and geopolitical events. Investors remain cautious about the economic outlook and the potential impact of rising interest rates. As the market continues to navigate through these uncertainties, it will be important to closely monitor key economic indicators and corporate earnings reports.