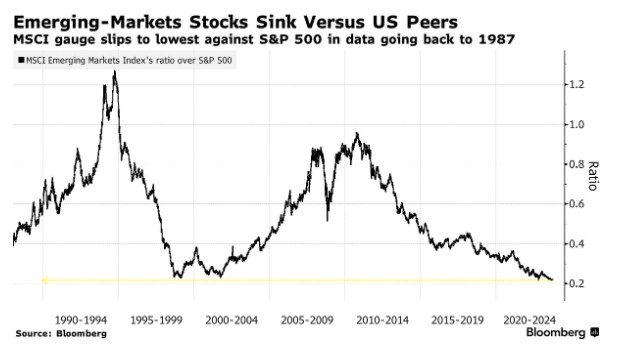

In recent weeks, Asian stock markets have experienced a significant downturn, primarily driven by concerns over rising US inflation and the ongoing economic challenges in China. This article delves into the factors contributing to this decline and examines the potential implications for investors and the global economy.

Rising US Inflation

One of the key reasons behind the decline in Asian stocks is the increasing inflation rates in the United States. The Consumer Price Index (CPI) in the US has reached a 40-year high, prompting concerns about the potential for higher interest rates by the Federal Reserve. This has led to a sell-off in stock markets worldwide, including Asia.

China's Economic Challenges

The economic challenges faced by China have also played a significant role in the decline of Asian stocks. The country's property market, which has been a major driver of its economic growth, is currently experiencing a downturn. This has led to concerns about the potential for a broader economic slowdown in China, which could have a ripple effect on the region.

Impact on Asian Stocks

The combination of rising US inflation and China's economic challenges has had a profound impact on Asian stock markets. Many Asian companies are heavily reliant on exports to the US and China, and the uncertainty surrounding these markets has led to a decline in investor confidence.

Case Study: Samsung Electronics

A prime example of the impact of these factors on Asian stocks is the case of Samsung Electronics. The company, which is one of the largest exporters to the US and China, has seen its stock price decline significantly in recent months. This decline can be attributed to concerns about the potential for lower demand in these markets due to rising inflation and economic challenges.

Conclusion

In conclusion, the recent decline in Asian stocks can be attributed to rising US inflation and the ongoing economic challenges in China. While these factors are concerning, it is important for investors to remain vigilant and stay informed about the latest developments in these markets. By doing so, they can make more informed investment decisions and navigate the evolving landscape of the global economy.