In the ever-evolving world of financial markets, investors often find themselves pondering the question: Are US stocks up or down? This query is crucial for those looking to make informed investment decisions. In this article, we'll delve into the current state of the US stock market, analyze its trends, and discuss the factors that might influence its direction.

Understanding the Current State of the US Stock Market

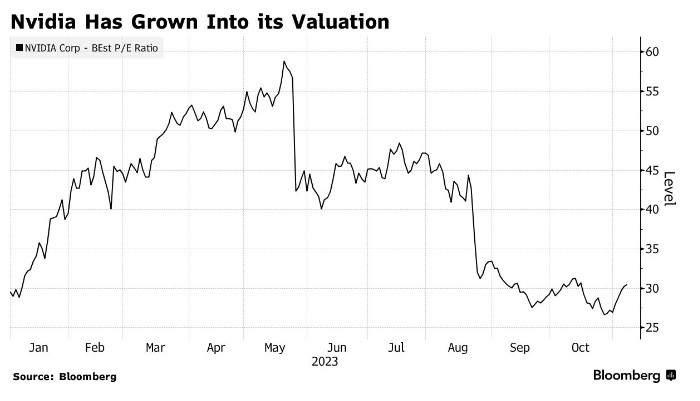

As of early 2023, the US stock market has experienced a mix of ups and downs. Major indices like the S&P 500, Dow Jones, and NASDAQ have seen both significant gains and losses over the past year. Several factors have contributed to this volatility, including economic data, geopolitical tensions, and corporate earnings reports.

Factors Influencing Stock Market Trends

Economic Data: Economic indicators, such as GDP growth, unemployment rates, and inflation, play a crucial role in determining the direction of the stock market. Positive economic data tends to boost investor confidence and drive stock prices higher, while negative data can lead to declines.

Geopolitical Tensions: International conflicts and trade disputes can significantly impact the stock market. For instance, the ongoing tensions between the US and China have caused concerns about global trade and supply chains, leading to volatility in the market.

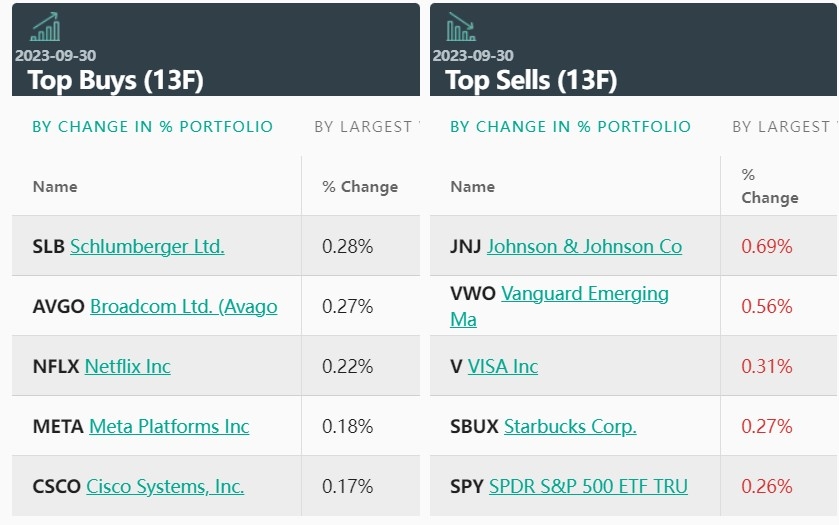

Corporate Earnings: The financial performance of companies directly influences stock prices. Strong earnings reports can drive stock prices higher, while weak earnings can lead to declines.

Interest Rates: The Federal Reserve's monetary policy, particularly interest rate decisions, has a profound impact on the stock market. Higher interest rates can lead to increased borrowing costs for companies, potentially dampening their earnings and stock prices.

Market Sentiment: Investor sentiment can also play a significant role in driving stock market trends. Positive sentiment can lead to a rally in the market, while negative sentiment can lead to declines.

Recent Trends and Predictions

In recent months, the US stock market has experienced a mix of volatility. While some sectors, such as technology and healthcare, have seen strong gains, others, such as energy and financials, have underperformed.

Analysts predict that the US stock market will likely continue to experience volatility in the coming months. They cite several factors, including the ongoing economic recovery, geopolitical tensions, and potential changes in corporate earnings.

Case Studies

To illustrate the impact of various factors on the US stock market, let's look at two recent case studies:

Geopolitical Tensions: In early 2021, tensions between the US and China escalated, leading to concerns about global trade and supply chains. This caused the stock market to experience significant volatility, with some sectors, such as technology, performing better than others.

Corporate Earnings: In late 2021, several major companies, including Apple and Microsoft, reported strong earnings. This led to a rally in the stock market, with the S&P 500 hitting record highs.

Conclusion

The question of whether US stocks are up or down is complex and depends on a variety of factors. By understanding these factors and analyzing the current state of the market, investors can make more informed decisions. As always, it's crucial to consult with a financial advisor before making any investment decisions.