Introduction:

In the dynamic world of finance, the words of analysts often hold significant sway. Today, a notable upgrade in US stocks has been announced, stirring up excitement among investors and market watchers. This article delves into the reasons behind this upgrade, the potential implications for the market, and how it could impact investors' portfolios.

The Analyst Upgrade: A Comprehensive Look

Today's upgrade from a respected analyst has marked a turning point in the market's outlook for US stocks. The analyst's reasoning is multifaceted, encompassing factors like economic indicators, corporate earnings, and technological advancements.

Economic Indicators

One of the key factors cited by the analyst is the strong economic indicators. The US economy has been growing steadily, with low unemployment rates and robust consumer spending. This economic momentum has bolstered the analyst's confidence in the market, leading to the upgrade.

Corporate Earnings

Corporate earnings have also played a pivotal role in the upgrade. Many companies have reported impressive earnings, driven by factors such as cost-cutting measures, improved productivity, and increased demand for their products and services. This has been a positive signal for the market and has contributed to the upgrade.

Technological Advancements

Another factor highlighted by the analyst is the rapid pace of technological advancements. These advancements have opened up new opportunities for companies to innovate and grow, further bolstering their earnings potential. This has been a key driver behind the upgrade in US stocks.

Implications for the Market

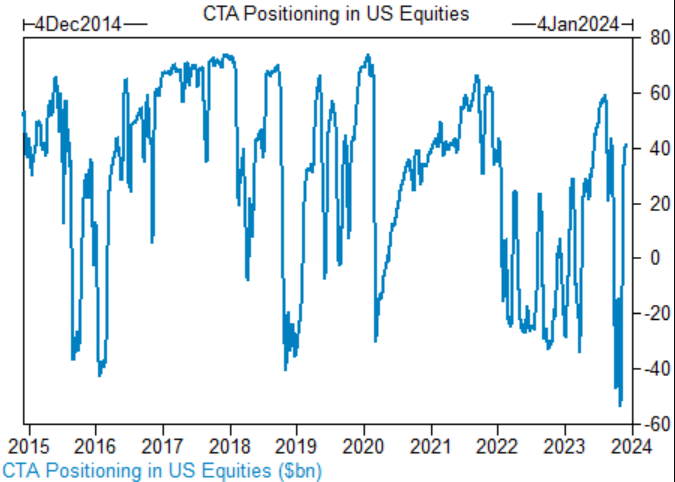

The analyst upgrade has significant implications for the market. It could lead to increased investor confidence, resulting in higher stock prices. This, in turn, could attract more capital into the market, leading to further growth.

Impact on Investors' Portfolios

For investors, this upgrade presents a golden opportunity. Those with a long-term perspective may consider adding US stocks to their portfolios, particularly in sectors that have been positively impacted by the upgrade. However, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

Case Studies:

To illustrate the potential impact of this upgrade, let's consider two case studies.

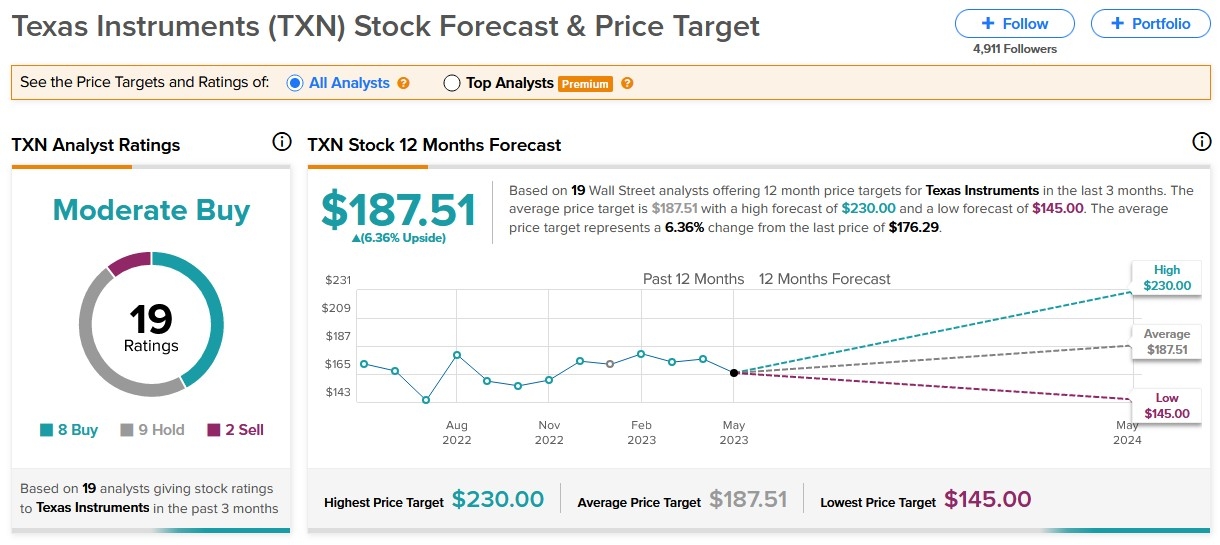

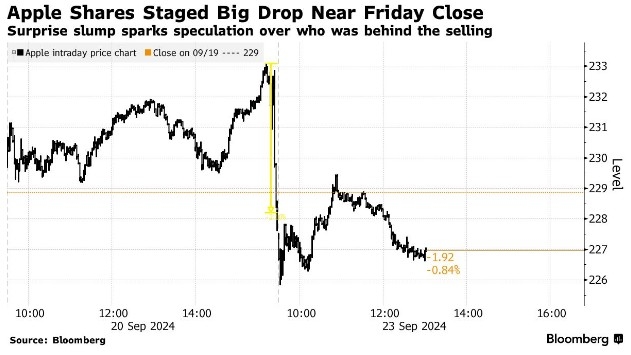

Technology Sector: The technology sector has been one of the most significant beneficiaries of the upgrade. Companies like Apple and Microsoft, known for their innovative products and robust financials, could see their stock prices rise further, providing investors with potential growth opportunities.

Healthcare Sector: The healthcare sector has also been positively impacted by the upgrade. Companies that have been investing in research and development to combat diseases and improve patient care could see their stocks rise, making them attractive investment options.

Conclusion:

Today's analyst upgrade of US stocks is a positive sign for the market and investors. It highlights the strength of the US economy, the robustness of corporate earnings, and the potential of technological advancements. As always, investors should conduct thorough research and seek professional advice before making investment decisions.