The Stock Market: A Roadmap to the Future

As we approach the year 2025, the U.S. stock market remains a topic of keen interest for investors, financial analysts, and economists alike. The market has been characterized by its resilience, innovation, and adaptability over the years, and it continues to be a bellwether for the broader economic landscape. In this article, we delve into the 2025 U.S. stock market forecast, offering insights and analysis to help readers understand what the future might hold.

Economic Growth and Market Performance

Economic growth is a critical factor in the performance of the stock market. With the U.S. economy projected to grow at a moderate pace over the next few years, the stock market is expected to follow suit. Key economic indicators, such as GDP, unemployment rates, and consumer spending, are all expected to show positive trends in 2025.

Sector Performance: Technology, Energy, and Healthcare

Technology companies have been the backbone of the U.S. stock market for years, and this trend is expected to continue in 2025. Companies like Apple, Google, and Amazon are likely to see strong performance as they continue to innovate and expand their product lines. The energy sector, particularly in renewable energy, is also poised for significant growth as the world moves towards more sustainable practices.

Healthcare companies, especially those involved in biotechnology and pharmaceuticals, are expected to benefit from increasing research and development investments. With an aging population and advancements in medical technology, the healthcare sector is likely to remain a strong performer in the U.S. stock market.

Emerging Trends: Artificial Intelligence and Blockchain

Emerging technologies such as artificial intelligence (AI) and blockchain are expected to have a significant impact on the stock market in 2025. Companies that are at the forefront of these technologies are likely to see substantial growth, as they drive innovation and efficiency across various industries.

Risk Factors: Trade Wars and Geopolitical Tensions

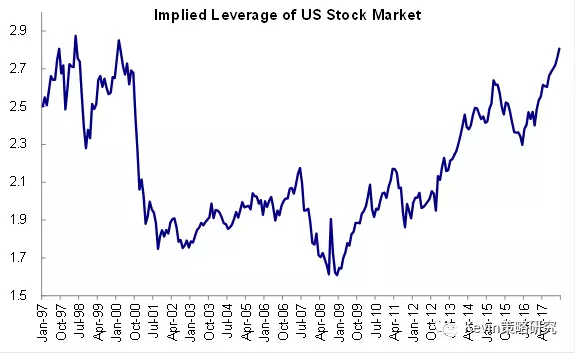

While the outlook for the U.S. stock market in 2025 is generally positive, there are several risk factors that investors should be aware of. Trade wars, geopolitical tensions, and regulatory changes can all impact market performance. It is crucial for investors to stay informed and be prepared for potential market volatility.

Case Study: Tesla and the Electric Vehicle Revolution

One compelling case study is Tesla, a company that has revolutionized the automotive industry with its electric vehicles (EVs). Tesla's stock has seen significant growth over the years, driven by its innovative technology and strong market position. As the world moves towards a more sustainable future, companies like Tesla are likely to see continued growth in the stock market.

Conclusion

The 2025 U.S. stock market forecast outlook suggests a positive future for investors, with economic growth, technological innovation, and emerging trends driving market performance. However, it is crucial to stay informed and be prepared for potential risks. As always, diversification and a well-thought-out investment strategy are key to achieving long-term success in the stock market.