The Stock Market's Decline: What's Behind the Numbers?

In the world of finance, the stock market can be a rollercoaster ride. Today, investors are scratching their heads, trying to understand why stocks are down. This article delves into the factors contributing to the current market downturn and offers insights into what may lie ahead.

Economic Indicators and Global Events

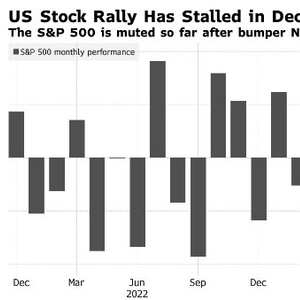

One of the primary reasons for the stock market's decline is the release of economic indicators that suggest a slowing economy. For instance, the Federal Reserve's decision to raise interest rates can lead to higher borrowing costs for companies, potentially affecting their profitability. Additionally, global events, such as political tensions or trade disputes, can create uncertainty and lead to a sell-off in the stock market.

Correlation with Bond Yields

Another factor contributing to the stock market's decline is the correlation with bond yields. When bond yields rise, it can make stocks less attractive to investors, as they may prefer the higher returns offered by bonds. This shift in investor sentiment can lead to a decrease in stock prices.

Sector-Specific Issues

It's important to note that the stock market's decline is not uniform across all sectors. Some sectors, such as technology and consumer discretionary, have been particularly hard hit. This can be attributed to various factors, including increased competition, regulatory concerns, or a shift in consumer preferences.

Technological Sector's Struggles

The technology sector has been a significant driver of the stock market's growth over the past few years. However, recent developments, such as increased regulatory scrutiny and concerns about overvaluation, have led to a downturn in this sector. Companies like Apple and Microsoft, which have been major contributors to the stock market's rise, have seen their shares decline as a result.

Consumer Discretionary Sector's Challenges

The consumer discretionary sector, which includes companies in the retail, automotive, and leisure industries, has also been affected by the market downturn. Factors such as rising inflation and consumer uncertainty have led to a decrease in spending, impacting the profitability of these companies.

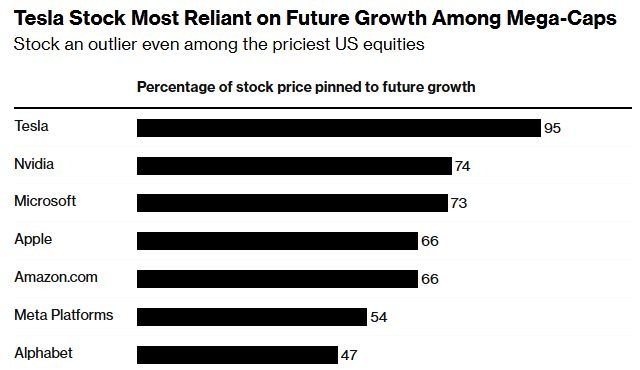

Case Study: Tesla's Stock Price Decline

A prime example of how sector-specific issues can impact the stock market is Tesla's recent stock price decline. Despite being one of the most innovative companies in the automotive industry, Tesla's shares have been hit hard by concerns about its growth prospects and increased competition.

Conclusion: Navigating the Market Downturn

Understanding the reasons behind the stock market's decline is crucial for investors looking to navigate the current market conditions. By analyzing economic indicators, global events, and sector-specific issues, investors can make informed decisions and potentially capitalize on the market downturn. While the future remains uncertain, staying informed and adaptable is key to success in the stock market.