The Dow Jones Industrial Average, a widely followed stock market index, has experienced several drops over the years. Understanding the reasons behind these declines is crucial for investors and traders alike. In this article, we delve into the factors that contribute to the Dow Jones drop, including economic indicators, geopolitical events, and market sentiment.

Economic Indicators

One of the primary reasons for the Dow Jones drop is economic indicators. These indicators, such as GDP growth, unemployment rates, and inflation, provide insights into the overall health of the economy. When these indicators show signs of weakness, it can lead to a drop in the stock market.

For instance, if the GDP growth rate slows down, it may indicate that the economy is not performing as well as expected. This can lead to investors selling off their stocks, causing the Dow Jones to drop. Similarly, if the unemployment rate rises or inflation accelerates, it can also contribute to a decline in the stock market.

Geopolitical Events

Geopolitical events, such as political instability, trade wars, and conflicts, can also cause the Dow Jones to drop. These events create uncertainty in the market, leading investors to sell off their stocks in anticipation of potential negative outcomes.

For example, the trade tensions between the United States and China in 2019 led to a significant drop in the Dow Jones. The uncertainty surrounding the outcome of these trade negotiations caused investors to become cautious, leading to a sell-off in the stock market.

Market Sentiment

Market sentiment plays a crucial role in the Dow Jones drop. When investors are optimistic about the future of the market, they tend to buy more stocks, driving up the prices. Conversely, when investors are pessimistic, they sell off their stocks, leading to a decline in the market.

Several factors can influence market sentiment, including economic news, corporate earnings reports, and political events. For instance, if a major company reports lower-than-expected earnings, it can lead to a sell-off in the stock market, causing the Dow Jones to drop.

Case Studies

To illustrate these points, let's look at a few case studies:

- 2008 Financial Crisis: The 2008 financial crisis was a significant event that caused the Dow Jones to drop dramatically. The crisis was triggered by the collapse of the housing market, leading to a credit crunch and a global financial crisis. The Dow Jones dropped by over 50% during this period.

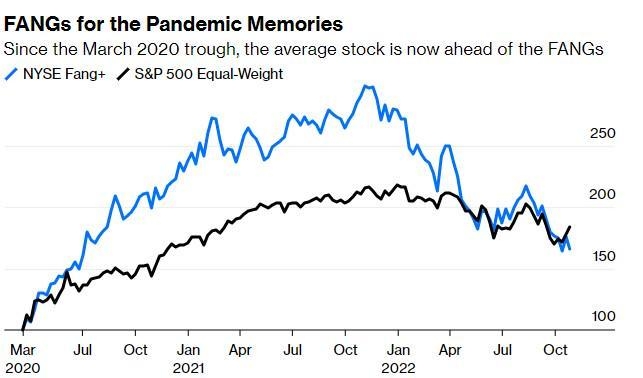

- COVID-19 Pandemic: The COVID-19 pandemic caused another significant drop in the Dow Jones. The pandemic led to widespread lockdowns and economic downturns, causing investors to become cautious and sell off their stocks. The Dow Jones dropped by over 30% between February and March 2020.

Conclusion

Understanding the factors behind the Dow Jones drop is essential for investors and traders. Economic indicators, geopolitical events, and market sentiment all play a role in the stock market's performance. By staying informed and being aware of these factors, investors can make more informed decisions and mitigate potential risks.