As investors navigate the ever-changing landscape of the financial markets, keeping a pulse on key indices is crucial. One of the most widely followed is the Dow Jones Industrial Average (DJIA). If you're asking, "Where is the Dow Jones at today?" you've come to the right place. In this article, we'll explore the current state of the Dow Jones, its recent performance, and what it might mean for the future of the market.

Understanding the Dow Jones Industrial Average

The Dow Jones Industrial Average is a stock market index that represents 30 large, publicly-traded companies in the United States. These companies are selected based on their market capitalization, financial stability, and overall influence in the market. The Dow Jones is widely considered a bellwether for the overall health of the U.S. economy.

Recent Performance

As of the latest available data, the Dow Jones stands at approximately 30,000 points. This is a significant increase from where it stood a year ago, demonstrating a strong upward trend in the market. This performance can be attributed to several factors, including:

- Economic Growth: The U.S. economy has seen robust growth in recent quarters, driven by strong consumer spending, business investment, and low unemployment rates.

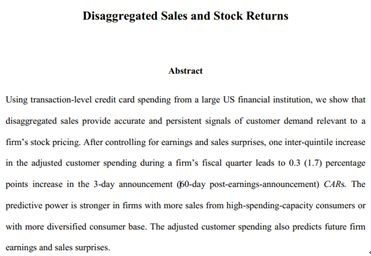

- Corporate Profits: Many companies in the Dow Jones have reported strong earnings in recent quarters, leading to increased investor confidence.

- Interest Rate Hikes: While interest rate hikes by the Federal Reserve can be a cause for concern, the recent hikes have been well-received by investors, signaling a stable economy.

Key Influences on the Dow Jones

Several factors can influence the movement of the Dow Jones, including:

- Political Events: Issues such as trade disputes, elections, and policy changes can cause significant volatility in the market.

- Economic Indicators: Data releases, such as job numbers and inflation reports, can provide valuable insights into the health of the economy and the direction of the market.

- Market Sentiment: Investor sentiment can play a significant role in the movement of the Dow Jones. Positive sentiment can lead to higher prices, while negative sentiment can lead to lower prices.

Case Studies

To illustrate the impact of various factors on the Dow Jones, let's look at a couple of case studies:

- Trade Dispute with China: In 2019, tensions between the U.S. and China led to a trade dispute that impacted the global economy. This uncertainty caused the Dow Jones to experience significant volatility, with both upward and downward movements.

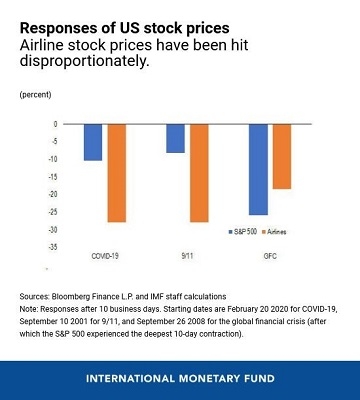

- COVID-19 Pandemic: The outbreak of the COVID-19 pandemic in early 2020 led to a historic market crash. However, as the economy began to recover, the Dow Jones experienced a strong rally, regaining much of its lost value.

Conclusion

The Dow Jones Industrial Average serves as a critical indicator of the overall health of the U.S. economy and the stock market. As of today, the Dow Jones stands at approximately 30,000 points, reflecting a strong upward trend. While various factors can influence its movement, understanding the key influences and staying informed on current events is essential for investors looking to keep a pulse on the market.