The US stock market is one of the most influential financial markets in the world. When the US stock market closes, it's crucial for investors to understand the implications and the next steps to take. In this article, we'll delve into the key takeaways and analysis of the US stock market closure, providing valuable insights for investors.

Understanding the US Stock Market Closure

The US stock market typically operates from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday. When the market closes, it means that trading activity comes to a halt, and investors cannot buy or sell stocks until the market reopens the next day. The closing of the US stock market is an essential time for investors to assess their investments and make informed decisions.

Market Summary

The US stock market closed on [insert date] with the following key points:

- Dow Jones Industrial Average: [Insert closing value]

- S&P 500: [Insert closing value]

- NASDAQ Composite: [Insert closing value]

Key Takeaways

Market Trends: It's important to analyze the market trends leading up to the US stock market closure. This can provide insights into the overall market sentiment and potential future movements.

Economic Indicators: Economic indicators, such as unemployment rates, inflation, and GDP growth, can significantly impact the stock market. Understanding these indicators can help investors make more informed decisions.

Company Earnings Reports: Earnings reports from major companies can have a significant impact on the stock market. It's crucial to analyze these reports and their implications for the market.

Sector Performance: Different sectors perform differently at various times. Analyzing sector performance can help investors identify potential opportunities.

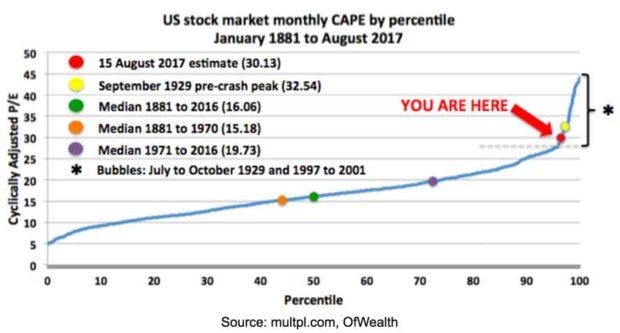

Volatility: The stock market can be volatile, and it's essential to understand the factors that contribute to this volatility.

Analysis

Market Trends

The US stock market closed on [insert date] with a slight decline in the Dow Jones Industrial Average and the S&P 500. This decline can be attributed to several factors, including rising interest rates and concerns about inflation.

Economic Indicators

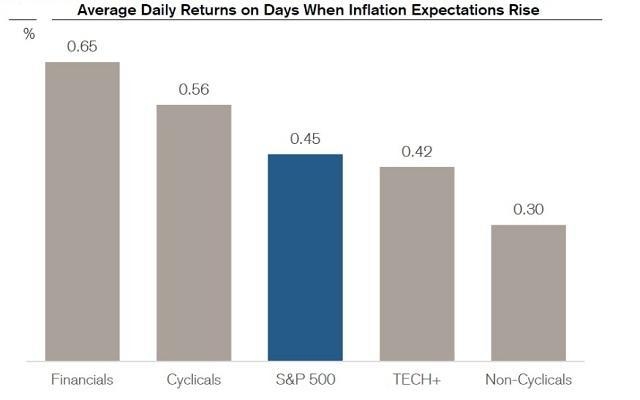

The latest unemployment rate and inflation data have been released, and they have had a significant impact on the stock market. Investors should pay close attention to these indicators and their potential impact on the market.

Company Earnings Reports

Several major companies have released their earnings reports, and the results have been mixed. Some companies have reported strong earnings, while others have reported weaker-than-expected results. Investors should analyze these reports and their implications for the market.

Sector Performance

The technology sector has been performing well, while the energy sector has been struggling. Investors should consider reallocating their portfolios based on sector performance.

Volatility

The stock market has been volatile recently, and this volatility is expected to continue. Investors should be prepared for potential market fluctuations and consider diversifying their portfolios.

Case Study

Let's take a look at a recent example of how the US stock market closed can impact investors. Company X, a technology company, released its earnings report after the US stock market closed. The report showed strong earnings, and the stock price surged in pre-market trading. However, when the market opened the next day, the stock price fell sharply due to broader market concerns. This example highlights the importance of understanding market trends and economic indicators when analyzing the US stock market closure.

Conclusion

The US stock market closure is a critical time for investors to assess their investments and make informed decisions. By analyzing market trends, economic indicators, company earnings reports, sector performance, and volatility, investors can better navigate the stock market and achieve their financial goals.