The US stock exchange crash, also known as the stock market crash, is a significant event that has occurred several times in the history of the United States. Understanding the causes and impacts of these crashes is crucial for investors, economists, and the general public. This article delves into the factors that trigger stock market crashes, their consequences, and some notable historical crashes.

Causes of Stock Market Crashes

Several factors can lead to a stock market crash. The most common causes include:

- Economic Downturns: Economic recessions can lead to a decrease in consumer spending, falling corporate profits, and a general decrease in the value of stocks.

- Market Speculation: When investors buy stocks based on rumors or expectations rather than fundamental analysis, it can lead to overvaluation and a subsequent crash.

- Political Instability: Political events, such as elections or policy changes, can create uncertainty and lead to market volatility.

- Technological Advances: The rapid development of technology can disrupt industries and lead to the devaluation of stocks.

Impacts of Stock Market Crashes

Stock market crashes have far-reaching consequences, including:

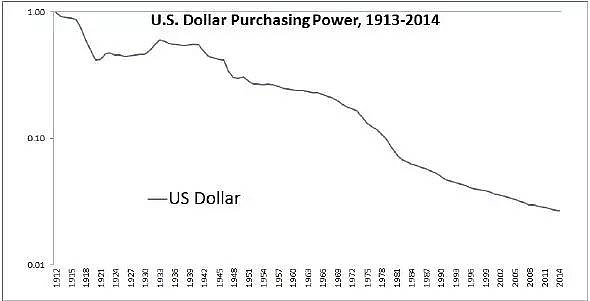

- Economic Contraction: A crash can lead to a decrease in GDP, rising unemployment rates, and a decrease in consumer spending.

- Loss of Wealth: Investors may lose a significant portion of their wealth, leading to financial stress and hardship.

- Confidence Decline: A crash can erode confidence in the financial system and the overall economy.

- Policy Changes: Governments may implement new policies or regulations in response to a crash, which can have long-term effects on the market.

Historical Stock Market Crashes

Some of the most notable stock market crashes in US history include:

- The Great Depression (1929): This crash was caused by a combination of economic factors, including over-speculation and a banking crisis. It led to a decade of economic hardship and a significant decline in the value of stocks.

- The Dot-Com Bubble (2000): This crash was driven by the excessive valuation of technology stocks. It resulted in a loss of billions of dollars in wealth and a subsequent bear market.

- The Financial Crisis of 2008: This crash was caused by the collapse of the housing market and the subsequent financial turmoil. It led to the worst economic downturn since the Great Depression.

Case Study: The Great Depression

The Great Depression serves as a prime example of the catastrophic impact of a stock market crash. The crash of 1929 was triggered by a combination of factors, including:

- Over-speculation: Investors were buying stocks on margin, which means they were using borrowed money to purchase shares. This led to a rapid increase in stock prices, creating a speculative bubble.

- Banking Crisis: Many banks were investing heavily in the stock market, which left them vulnerable to a crash. When the market collapsed, many banks failed, leading to a widespread loss of confidence.

- Economic Downturns: The crash was followed by a severe economic downturn, which was exacerbated by the Smoot-Hawley Tariff Act, which led to a trade war and further reduced economic activity.

The Great Depression resulted in a significant decline in the value of stocks, rising unemployment rates, and a severe contraction in the economy. It took years for the economy to recover, and the event left a lasting impact on the country.

Conclusion

Understanding the causes and impacts of stock market crashes is crucial for investors and the general public. By recognizing the factors that can lead to a crash and the consequences of these events, individuals can better protect their investments and contribute to a more stable financial system.