In the dynamic world of finance, the US market stock index serves as a crucial tool for investors, traders, and analysts to gauge the overall health and performance of the stock market. This article delves into the key aspects of the US market stock index, exploring its significance, components, and how it impacts investors' decisions.

Understanding the US Market Stock Index

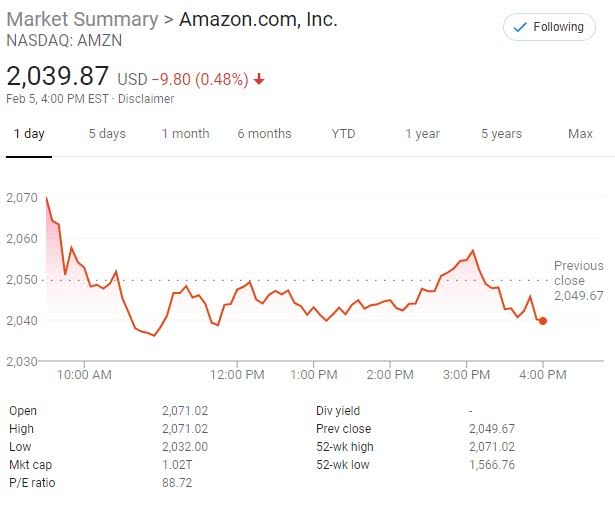

The US market stock index is a statistical measure that reflects the performance of a selected group of stocks, typically representing the broader market. It provides investors with a snapshot of the market's trends and potential opportunities. The most well-known US market stock index is the S&P 500, which tracks the performance of 500 large companies listed on stock exchanges in the United States.

Components of the US Market Stock Index

The US market stock index is composed of a diverse range of companies across various sectors. The S&P 500, for instance, includes companies from industries such as technology, healthcare, finance, and consumer goods. This diversification ensures that the index reflects the overall market performance rather than the performance of a single sector.

Significance of the US Market Stock Index

The US market stock index holds immense importance for several reasons:

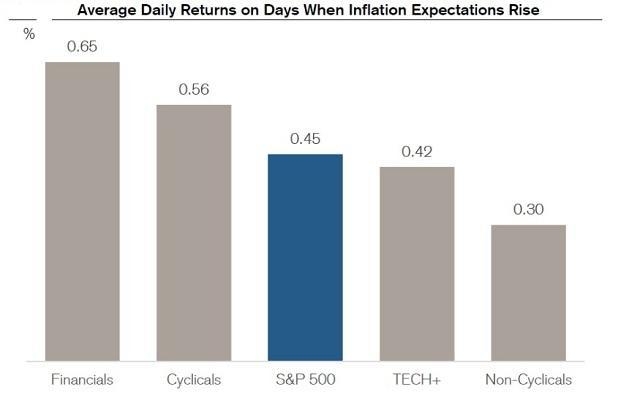

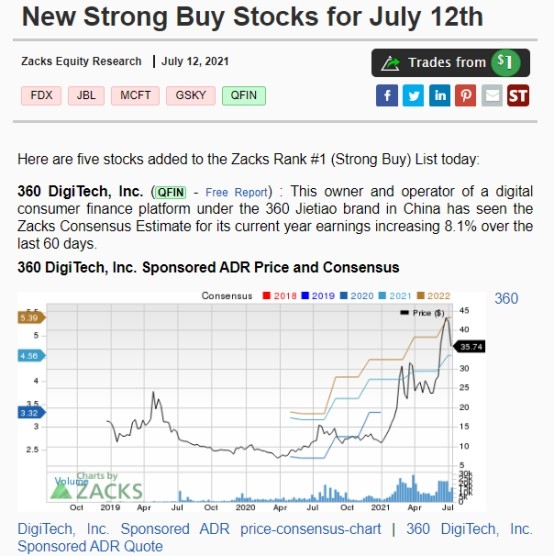

- Market Trend Analysis: The index provides valuable insights into market trends, helping investors make informed decisions. By analyzing the index, investors can identify potential opportunities or risks in the market.

- Benchmarking: The index serves as a benchmark for comparing the performance of individual stocks or portfolios. This allows investors to assess their investments against the broader market.

- Investor Confidence: The performance of the US market stock index can significantly impact investor confidence. A rising index indicates a strong market, while a falling index may indicate market concerns.

Impact of the US Market Stock Index on Investors

The US market stock index plays a vital role in shaping investors' decisions:

- Investment Allocation: Investors often allocate their investments based on the performance of the index. A rising index may prompt investors to increase their exposure to stocks, while a falling index may lead to conservative investment strategies.

- Portfolio Management: The index helps investors manage their portfolios by providing a clear picture of market conditions. This enables them to adjust their investments accordingly.

- Market Timing: The US market stock index can be used as a tool for market timing, helping investors identify the right time to enter or exit the market.

Case Study: The S&P 500 during the COVID-19 Pandemic

One notable example of the impact of the US market stock index on investors is during the COVID-19 pandemic. In early 2020, the index experienced a significant decline as the pandemic spread globally. However, as the economy gradually recovered, the index began to rebound, providing investors with opportunities to capitalize on the market's recovery.

In conclusion, the US market stock index is a vital tool for investors, traders, and analysts to understand the broader market's performance. By monitoring the index, investors can make informed decisions, manage their portfolios effectively, and identify potential opportunities or risks.