In the world of finance, the battle between the US dollar and emerging markets stocks has been a fierce one. As investors, it's crucial to understand the dynamics at play and the potential impact on your portfolio. This article delves into the key factors influencing this showdown and provides insights for making informed decisions.

Understanding the US Dollar

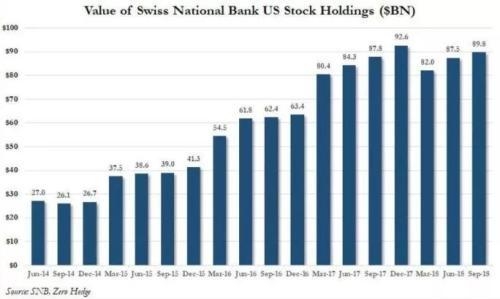

The US dollar, often referred to as the "greenback," is the world's primary reserve currency. Its stability and strength are vital for global economic stability. The US dollar is influenced by various factors, including interest rates, economic growth, and geopolitical events.

Emerging Markets Stocks: A Boon or a Bane?

Emerging markets stocks, on the other hand, represent shares of companies in developing countries. These markets often offer higher growth potential but come with higher risks. Factors such as political instability, economic reforms, and currency fluctuations play a significant role in the performance of emerging markets stocks.

The Showdown Begins

The battle between the US dollar and emerging markets stocks has been a complex one. Here's a closer look at the key factors:

1. US Dollar Strength

When the US dollar strengthens, it makes emerging market currencies weaker. This leads to a decrease in the value of emerging market stocks denominated in local currencies. Additionally, the higher value of the US dollar makes emerging market goods and services more expensive, leading to a decrease in exports.

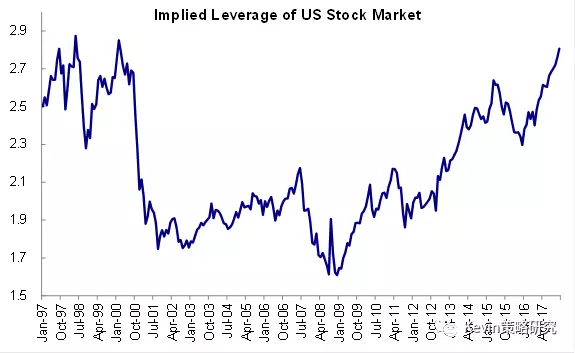

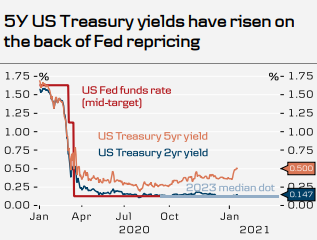

2. Interest Rate Differentials

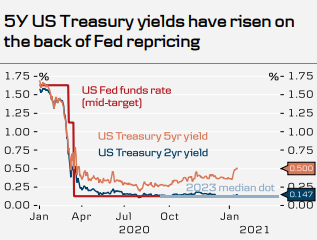

The US Federal Reserve (Fed) has been raising interest rates, making the US dollar more attractive to investors seeking higher returns. This can lead to a decrease in emerging market stocks as investors shift their focus to the US market.

3. Geopolitical Events

Geopolitical events, such as trade wars and political instability, can significantly impact both the US dollar and emerging market stocks. For example, the US-China trade war has had a detrimental effect on emerging market economies and stocks.

4. Economic Reforms

Emerging market economies that implement economic reforms and improve governance tend to see stronger performance in their stocks. Conversely, economies facing political and economic challenges often see a decline in stock prices.

Case Study: Brazil

Consider Brazil, an emerging market country with a strong economy. When the Brazilian real weakened against the US dollar, Brazilian stocks saw a decline. However, when the government implemented economic reforms, the Brazilian real stabilized, and stocks began to recover.

Conclusion

The battle between the US dollar and emerging markets stocks is a complex one. Understanding the key factors influencing both can help investors make informed decisions. While the US dollar may seem like the stronger contender, emerging markets stocks can offer significant growth potential for those willing to take on the risks.

Key Takeaways

- The US dollar's strength can impact emerging market currencies and stocks.

- Interest rate differentials between the US and emerging markets can affect stock performance.

- Geopolitical events and economic reforms play a crucial role in emerging market stocks.

- Diversifying your portfolio can help mitigate risks associated with both the US dollar and emerging markets stocks.