The recent Brexit vote has caused a stir in global financial markets, with investors around the world closely monitoring the effects. One of the most significant impacts has been on US Brexit stock, as investors grapple with the uncertainty surrounding the UK's departure from the European Union. In this article, we will delve into the implications of Brexit on US stocks and provide insights into how American investors can navigate this challenging landscape.

The Brexit Vote and Its Immediate Impact

The Brexit vote, which took place on June 23, 2016, resulted in a 52% majority in favor of leaving the EU. This decision sent shockwaves through global markets, causing stock prices to plummet and volatility to surge. The US stock market, which includes a significant number of companies with exposure to the UK and Europe, was not immune to the turmoil.

Understanding US Brexit Stock

US Brexit stock refers to American companies that have a substantial presence in the UK and Europe, or those that have significant business ties to these regions. These companies are particularly vulnerable to the economic and political uncertainties caused by Brexit. Some of the most affected sectors include financial services, pharmaceuticals, and consumer goods.

Impact on Financial Services

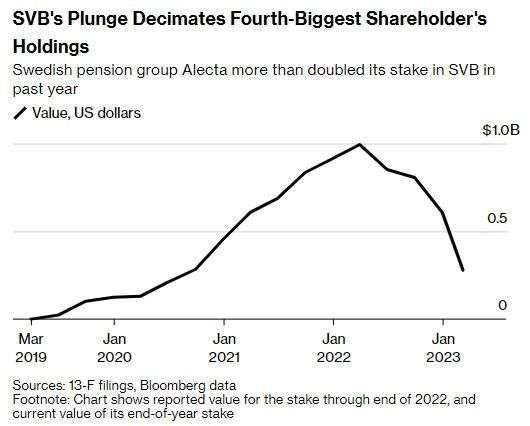

The financial services sector has been one of the hardest hit by Brexit. Many UK-based financial institutions, such as banks and insurance companies, have operations across the EU. The uncertainty surrounding the UK's exit from the EU has raised concerns about the future of these businesses, leading to a decline in their share prices. American financial services companies with significant exposure to the UK and Europe have also been impacted, with their stock prices suffering as a result.

Pharmaceuticals and Consumer Goods

The pharmaceutical and consumer goods sectors have also been affected by Brexit. Many pharmaceutical companies conduct research and development in the UK and Europe, and the uncertainty surrounding the future of these operations has raised concerns. Similarly, consumer goods companies that rely on the UK and European markets for sales have seen their stock prices decline.

Navigating the Landscape

For American investors looking to navigate the US Brexit stock landscape, there are several key strategies to consider:

Diversification: Diversifying your portfolio can help mitigate the risks associated with US Brexit stock. By investing in a variety of sectors and regions, you can reduce your exposure to any single market or industry.

Research: Conduct thorough research on the companies you are considering investing in. Look for companies with strong fundamentals and a diversified business model that can weather the uncertainties caused by Brexit.

Long-term perspective: While the short-term volatility caused by Brexit can be unsettling, it's important to maintain a long-term perspective. Many companies with exposure to the UK and Europe have the potential to recover and thrive in the long run.

Case Studies

Several American companies have been impacted by Brexit. One notable example is AstraZeneca, a pharmaceutical company with significant operations in the UK. The uncertainty surrounding the future of its operations in Europe has caused its stock price to decline. However, the company's strong fundamentals and diversified business model may allow it to recover in the long term.

Another example is Procter & Gamble, a consumer goods company with significant exposure to the UK and European markets. The company's stock price has also been affected by Brexit, but its strong brand and diverse product portfolio may help it navigate the challenges posed by the UK's departure from the EU.

In conclusion, the impact of Brexit on US Brexit stock has been significant, with uncertainty causing volatility in global markets. However, by understanding the risks and employing sound investment strategies, American investors can navigate this challenging landscape and potentially benefit from the opportunities that arise.