Investing in US stocks can be a lucrative venture for both beginners and seasoned investors. With the right strategy and knowledge, you can tap into the vast potential of the American stock market. This article will provide you with a comprehensive guide to trading in US stocks, covering everything from understanding the market to selecting the right stocks for your portfolio.

Understanding the US Stock Market

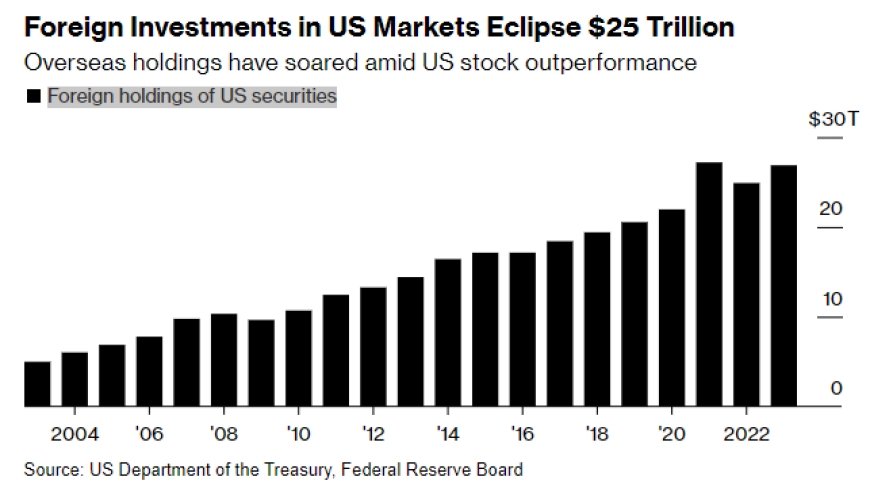

The US stock market is one of the largest and most diverse in the world. It consists of several exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list a wide range of companies, from small startups to large multinational corporations.

Before diving into the market, it's crucial to understand the different types of stocks available. Common stock represents ownership in a company and comes with voting rights. Preferred stock, on the other hand, pays a fixed dividend and has a higher claim on assets and earnings than common stock.

Choosing the Right Stocks

Selecting the right stocks is key to successful trading. Here are some factors to consider:

- Industry and Sector: Research industries and sectors that are performing well and have long-term growth potential.

- Company Financials: Analyze a company's financial statements, including its revenue, profit margins, and debt levels.

- Management: Look for companies with experienced and competent management teams.

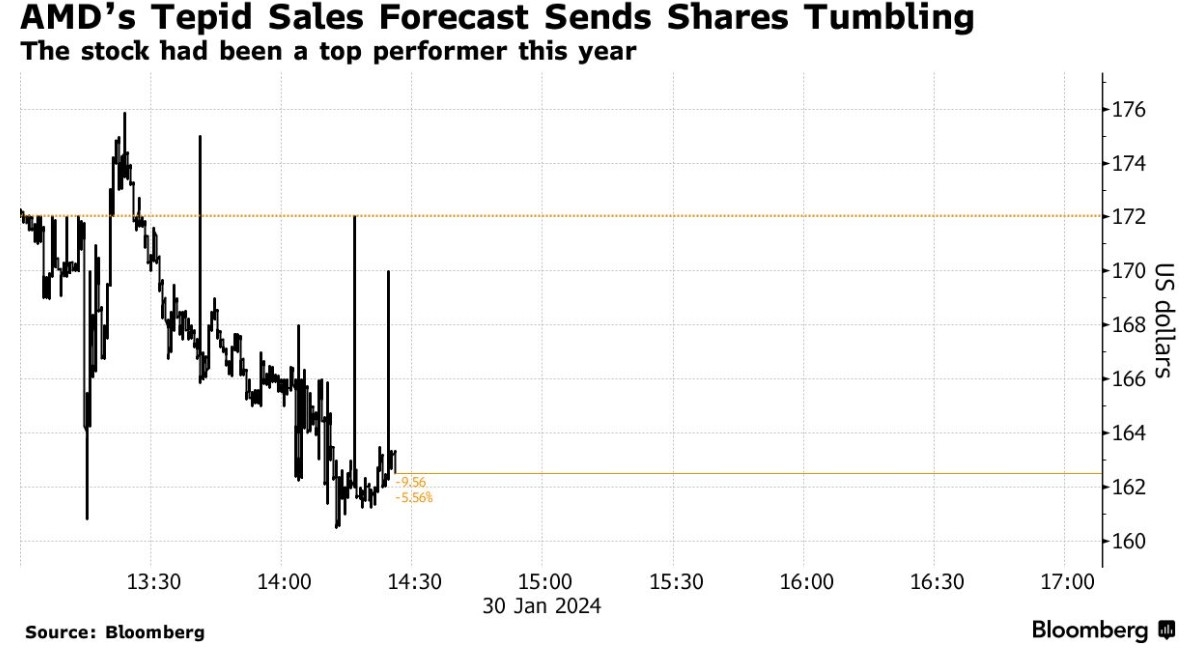

- Market Trends: Stay updated on market trends and economic indicators that may impact the stock market.

Using a Brokerage Account

To trade in US stocks, you'll need a brokerage account. There are many brokerage firms to choose from, each offering different services and fees. When selecting a brokerage, consider factors such as:

- Commissions: Look for a brokerage with competitive commission rates.

- Platform: Choose a platform that is user-friendly and offers the tools and resources you need to trade effectively.

- Customer Service: Ensure the brokerage provides reliable customer support.

Developing a Trading Strategy

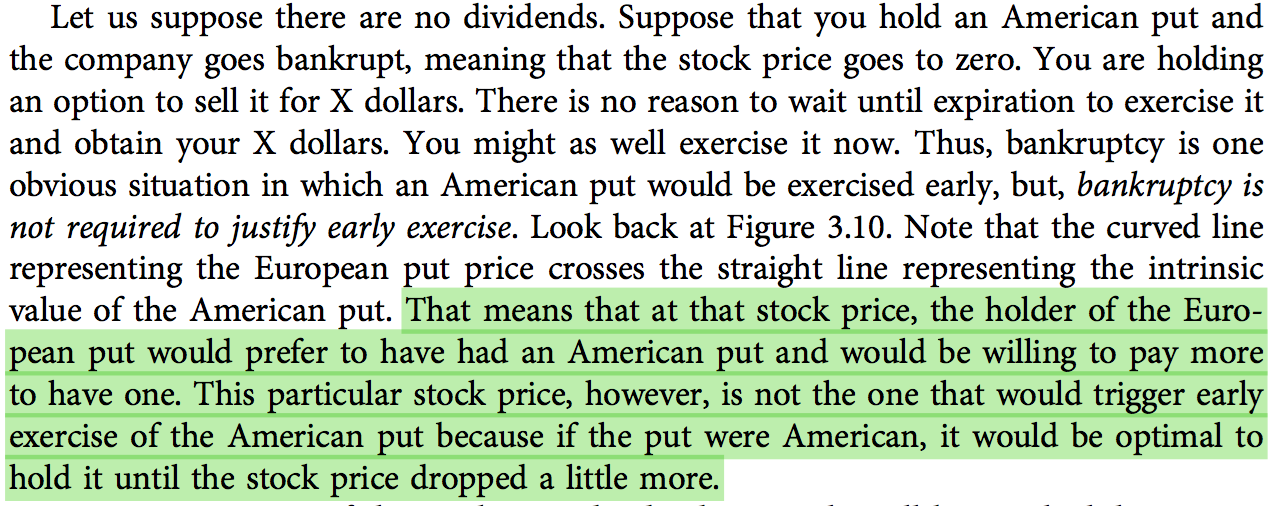

A well-defined trading strategy is essential for success in the stock market. Here are some popular trading strategies:

- Day Trading: Buying and selling stocks within the same day.

- Swing Trading: Holding stocks for a few days to a few weeks.

- Position Trading: Holding stocks for several months to several years.

Risk Management

Risk management is crucial to protect your investment portfolio. Here are some risk management techniques:

- Diversification: Invest in a variety of stocks across different industries and sectors.

- Stop-Loss Orders: Set a stop-loss order to limit your potential losses.

- Risk/Reward Ratio: Only invest in stocks with a favorable risk/reward ratio.

Case Studies

Let's take a look at a few case studies to illustrate the potential of investing in US stocks:

- Apple Inc. (AAPL): Since its initial public offering (IPO) in 1980, Apple has become one of the most valuable companies in the world. Investors who bought Apple stock in 1980 and held onto it would have seen their investment grow by over 100,000%.

- Tesla Inc. (TSLA): Tesla has seen significant growth in recent years, with its stock price increasing by over 1,000% since its IPO in 2010. Investors who bought Tesla stock in 2010 would have seen their investment grow by over 1,000%.

Conclusion

Trading in US stocks can be a rewarding experience for investors who are willing to put in the time and effort to understand the market and develop a solid trading strategy. By following the tips outlined in this article, you can increase your chances of success in the stock market. Remember to stay informed, manage your risks, and stay patient. Happy trading!