Introduction: In the world of defense and security, the US Department of Defense (DoD) plays a crucial role in safeguarding the nation's interests. As a result, investing in companies that supply the DoD can be a lucrative opportunity for investors. This article delves into the US Department of Defense stock market, exploring the potential benefits and key considerations for investors.

Understanding the US Department of Defense Stock: The US Department of Defense stock refers to shares of companies that provide goods and services to the DoD. These companies range from defense contractors to technology providers, logistics firms, and more. Investing in these stocks allows investors to gain exposure to the defense sector, which is often seen as a stable and profitable industry.

Benefits of Investing in US Department of Defense Stock:

Stable Revenue Streams: The DoD operates on a continuous budget, ensuring that defense contractors have a steady stream of revenue. This stability can be attractive to investors seeking reliable income.

Long-Term Growth Potential: As threats to national security evolve, the DoD's budget is likely to increase, providing long-term growth potential for defense-related companies.

Dividend Yields: Many defense contractors offer attractive dividend yields, making them appealing to income-focused investors.

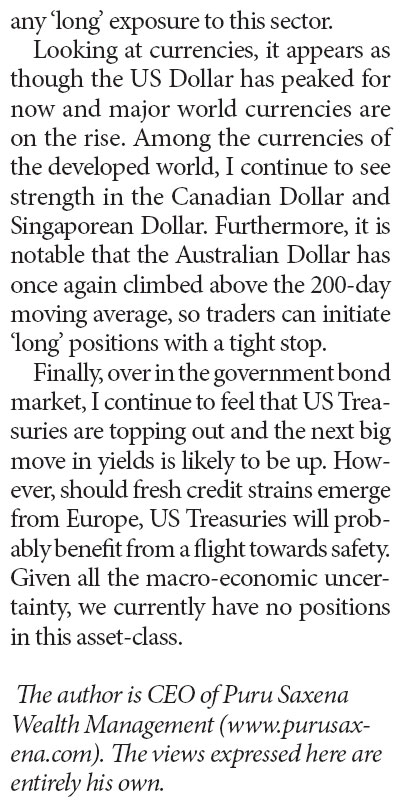

Political and Economic Stability: Investing in the defense sector can be a hedge against political and economic uncertainties, as defense spending often remains stable during turbulent times.

Key Considerations for Investing in US Department of Defense Stock:

Market Volatility: The defense sector can be subject to market volatility, influenced by political events, budget cuts, and regulatory changes. Investors should be prepared for potential fluctuations in stock prices.

Government Contracts: The success of defense companies largely depends on securing government contracts. Investors should carefully evaluate the company's contract portfolio and its ability to win new contracts.

Technological Advancements: The defense industry is constantly evolving, with new technologies and innovations. Investors should consider companies that are at the forefront of technological advancements.

Regulatory Environment: The defense sector is heavily regulated, and changes in regulations can impact company performance. Investors should stay informed about regulatory developments.

Case Studies:

Lockheed Martin: As one of the largest defense contractors in the world, Lockheed Martin has a strong presence in various defense programs. Its diverse product portfolio and ability to secure contracts make it an attractive investment.

Raytheon Technologies: Raytheon Technologies is a leading provider of defense and aerospace products and services. Its focus on innovation and technological advancements positions it well for long-term growth.

Northrop Grumman: Northrop Grumman is a global defense contractor with a strong focus on technology and innovation. Its presence in various defense programs and contracts makes it a compelling investment opportunity.

Conclusion: Investing in US Department of Defense stock can be a lucrative opportunity for investors seeking stability and long-term growth. However, it is crucial to conduct thorough research and consider key factors such as market volatility, government contracts, and technological advancements. By staying informed and making informed decisions, investors can capitalize on the potential benefits of investing in the defense sector.