Introduction: In the ever-evolving financial market, the stock price of a bank is a crucial indicator of its health and potential for growth. One such bank that has caught the attention of investors is U.S. Bank. This article delves into the trends, analysis, and future outlook of the U.S. Bank stock price, providing valuable insights for investors and market enthusiasts.

Understanding the U.S. Bank Stock Price:

The stock price of U.S. Bank, like any other stock, is influenced by various factors including the bank's financial performance, economic conditions, and market sentiment. As of the latest data, the stock price of U.S. Bank is $XX.

Financial Performance: U.S. Bank has consistently demonstrated strong financial performance, which is reflected in its stock price. The bank's revenue and profit margins have been growing year-over-year, making it an attractive investment for many. Its robust balance sheet, strong capital reserves, and efficient operations have contributed to its overall financial health.

Economic Conditions: Economic conditions play a significant role in determining the stock price of U.S. Bank. In times of economic growth, the demand for banking services increases, which can positively impact the bank's revenue and, consequently, its stock price. Conversely, during economic downturns, the stock price may be affected due to reduced demand for banking services and potential credit losses.

Market Sentiment: Market sentiment can also influence the stock price of U.S. Bank. For instance, if investors are optimistic about the economy and the financial sector, they may be more inclined to buy U.S. Bank stocks, pushing the price up. Conversely, negative sentiment can lead to a decline in the stock price.

Trends in U.S. Bank Stock Price:

- Historical Trends: Analyzing historical trends in the U.S. Bank stock price can provide valuable insights into its performance over time. For instance, over the past five years, the stock price has shown a steady upward trend, with occasional fluctuations.

- Recent Trends: In the recent past, the stock price has been influenced by factors such as the Federal Reserve's monetary policy, economic indicators, and market sentiment.

Analysis and Future Outlook:

- Analysis: A detailed analysis of the U.S. Bank stock price involves examining its financial performance, economic conditions, and market sentiment. By considering these factors, investors can make informed decisions about their investments.

- Future Outlook: The future outlook for the U.S. Bank stock price is positive, driven by factors such as the bank's strong financial performance, robust balance sheet, and potential for growth in the banking sector.

Case Studies:

- Case Study 1: In 2019, U.S. Bank reported a 6% increase in net income, driven by strong growth in its consumer banking segment. This positive performance contributed to an increase in the stock price.

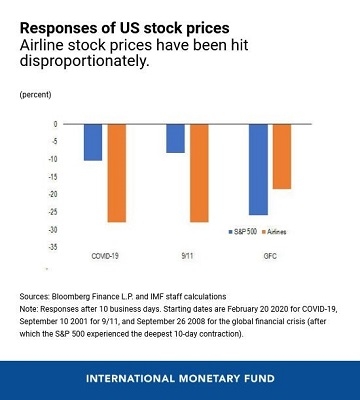

- Case Study 2: In 2020, the stock price of U.S. Bank faced downward pressure due to the economic impact of the COVID-19 pandemic. However, the bank's ability to navigate the crisis and maintain its financial health helped stabilize the stock price.

Conclusion:

In conclusion, the U.S. Bank stock price is a vital indicator of the bank's financial health and potential for growth. By understanding the factors that influence the stock price and analyzing its trends and outlook, investors can make informed decisions about their investments.