Introduction: In the world of stock trading, having the right tools at your disposal can make all the difference. One such tool is a technical screener for US stocks. This powerful resource allows investors to filter through a vast array of stocks and identify those that meet specific criteria. In this article, we will explore the importance of a technical screener, how to choose the right one, and provide a comprehensive guide to using it effectively.

Understanding Technical Screening

Technical screening involves analyzing historical price and volume data to identify patterns and trends that may indicate potential investment opportunities. By using a technical screener, investors can save time and effort by automatically filtering out stocks that do not meet their criteria.

Why Use a Technical Screener for US Stocks?

- Efficiency: A technical screener can process vast amounts of data in seconds, allowing investors to quickly identify promising stocks.

- Customization: Users can tailor their screening criteria to match their investment strategy, whether it's looking for growth stocks, value stocks, or something else.

- Data-Driven Decisions: By relying on historical data, investors can make more informed decisions based on proven patterns and trends.

How to Choose the Right Technical Screener

When selecting a technical screener, consider the following factors:

- Features: Look for a screener that offers a wide range of technical indicators and filters.

- Ease of Use: Choose a platform that is user-friendly and easy to navigate.

- Cost: Consider the price and whether it fits within your budget.

Some popular technical screeners for US stocks include:

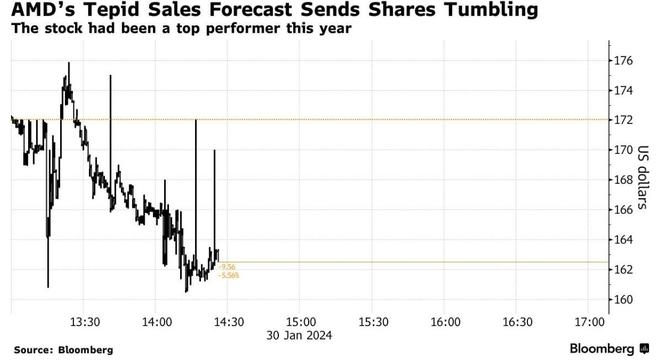

- Bloomberg Terminal: A comprehensive platform offering a wide range of tools and data.

- Thinkorswim: A popular platform among retail traders, offering advanced technical analysis tools.

- TradeStation: A powerful platform with a variety of technical indicators and strategies.

Using a Technical Screener Effectively

Once you have chosen a technical screener, follow these steps to use it effectively:

- Define Your Criteria: Determine the specific criteria you want to use for screening, such as price, volume, moving averages, and technical indicators.

- Apply Filters: Use the screener's filters to narrow down your search based on your criteria.

- Review Results: Analyze the results and identify stocks that meet your investment criteria.

- Further Research: Conduct additional research on the selected stocks to validate your findings and ensure they align with your investment strategy.

Case Study: Finding Growth Stocks

Suppose you are looking for growth stocks with a price-to-earnings ratio (P/E) below 20 and a 50-day moving average above

Conclusion: A technical screener for US stocks is a valuable tool for investors looking to streamline their stock selection process. By understanding how to choose the right screener and use it effectively, you can save time, make informed decisions, and potentially increase your chances of success in the stock market.