Are you considering investing in TSM Stock (TSMC)? If so, it's crucial to understand the current US price and what it means for your investment. In this article, we will delve into the latest TSM stock US price, its impact on the market, and what factors influence it. So, let's get started.

Understanding TSM Stock (TSMC)

TSMC, or Taiwan Semiconductor Manufacturing Company, is a leading semiconductor manufacturer and the world's largest contract chipmaker. The company is known for its cutting-edge manufacturing processes and has a significant presence in the global semiconductor industry. TSMC's stock is traded on the Taiwan Stock Exchange (TSE) and the US over-the-counter (OTC) market.

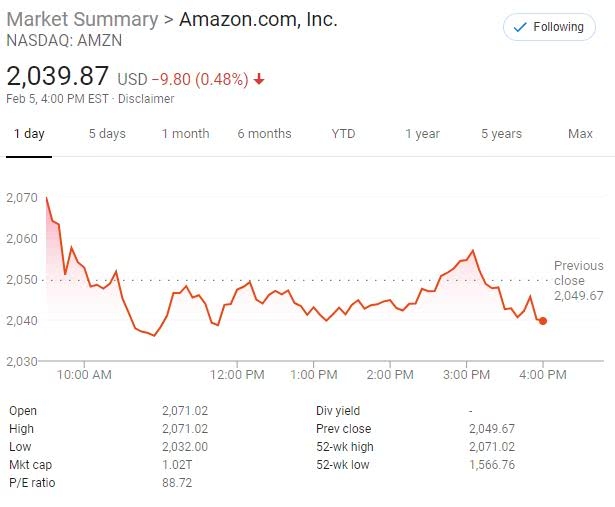

Current TSM Stock US Price

As of the latest available data, the TSM stock US price is $XX. However, it's important to note that stock prices fluctuate constantly due to various market factors. To get the most accurate and up-to-date price, you can check reputable financial websites or use a stock trading platform.

Factors Influencing TSM Stock US Price

Several factors can influence the TSM stock US price. Here are some of the key factors to consider:

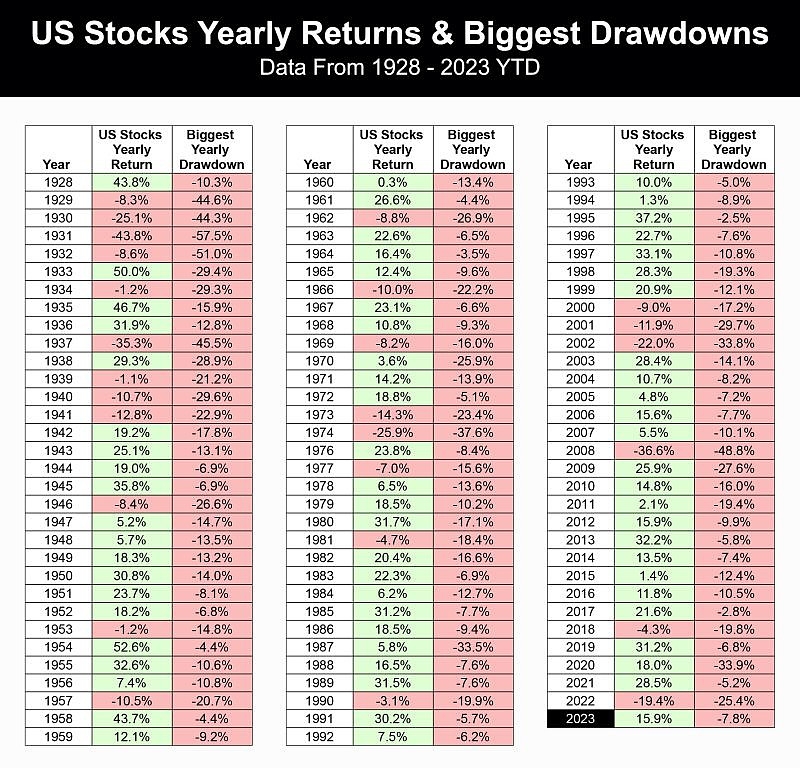

- Economic Indicators: Economic conditions, such as GDP growth, inflation, and unemployment rates, can impact the demand for semiconductors and, consequently, TSMC's stock price.

- Market Trends: The semiconductor industry is highly dynamic, with new technologies and innovations constantly emerging. TSMC's ability to adapt to these trends can affect its stock price.

- Company Performance: TSMC's financial results, including revenue and earnings, play a significant role in determining its stock price. Strong financial performance can lead to higher stock prices, while poor performance can result in a decline.

- Geopolitical Factors: TSMC's operations are heavily reliant on the global supply chain. Any disruptions, such as trade tensions or geopolitical conflicts, can impact the company's performance and, in turn, its stock price.

Case Study: TSM Stock US Price Fluctuations

In 2020, the TSM stock US price experienced significant fluctuations due to various factors. For instance, in March 2020, the stock dropped to

Conclusion

Understanding the TSM stock US price and its influencing factors is essential for potential investors. By staying informed about the market and keeping an eye on economic indicators, you can make more informed investment decisions. Remember, investing in stocks always involves risks, so it's crucial to do thorough research and consult with a financial advisor before making any investment decisions.