Introduction: Stock trading is a crucial aspect of the financial world, and it is vital for investors to understand the rules and laws governing the practice in the United States. This article delves into the key regulations that investors need to be aware of, ensuring they navigate the stock market with confidence and compliance.

The Securities Act of 1933: The Securities Act of 1933, also known as the "truth in securities" law, requires companies to disclose accurate and comprehensive information to potential investors. This act ensures that investors have access to all necessary information before making investment decisions. Failure to comply with this act can result in severe penalties, including fines and imprisonment.

The Securities Exchange Act of 1934: The Securities Exchange Act of 1934 established the Securities and Exchange Commission (SEC) and regulates the buying and selling of securities on exchanges. This act ensures fair and transparent trading practices, including the reporting of corporate information, insider trading regulations, and the prevention of fraudulent activities. Companies listed on exchanges must adhere to specific reporting requirements and disclose material information to the public.

Insider Trading: Insider trading involves the illegal buying or selling of stocks based on non-public, material information. It is a significant concern in the stock market, and the SEC enforces strict laws to prevent insider trading. Individuals found guilty of insider trading face severe penalties, including fines, imprisonment, and the loss of their trading privileges.

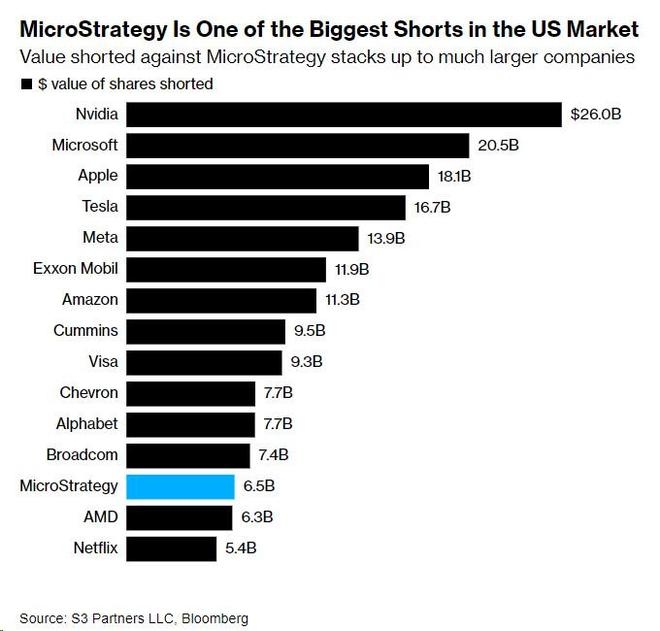

Short Selling Restrictions: Short selling is the practice of selling borrowed shares with the intention of buying them back at a lower price. While short selling can provide liquidity and price discovery in the market, it can also lead to volatility and market manipulation. The SEC has implemented various rules and restrictions to regulate short selling, ensuring it is conducted fairly and in compliance with the law.

Market Manipulation: Market manipulation involves fraudulent or deceptive practices that distort the price of securities. This can include practices such as wash trading, matched orders, and false rumors. The SEC has established strict laws to prevent market manipulation, ensuring a fair and orderly market for all participants.

The Sarbanes-Oxley Act of 2002: The Sarbanes-Oxley Act of 2002 was enacted in response to corporate scandals and aims to improve financial disclosures from corporations. This act imposes strict reporting requirements on publicly traded companies, including the requirement for CEOs and CFOs to personally certify the accuracy of financial reports. Failure to comply with the Sarbanes-Oxley Act can result in significant penalties and legal consequences.

Case Study: Enron Scandal One of the most notable cases of market manipulation and accounting fraud involved the Enron scandal in the early 2000s. Enron executives engaged in fraudulent accounting practices, hiding massive debt and using special purpose entities to manipulate financial statements. This resulted in the collapse of Enron and the loss of billions of dollars for investors. The scandal led to significant changes in corporate governance and financial reporting regulations.

Conclusion: Understanding the stock trading rules and laws in the United States is essential for investors to navigate the stock market effectively and legally. By adhering to these regulations, investors can protect themselves from fraudulent activities and ensure fair and transparent trading practices. Staying informed and compliant with these laws is crucial for long-term success in the stock market.