Introduction:

Understanding Volatility: Volatility refers to the degree of variation in the price of a stock over a specific period. It is measured by the standard deviation of the stock's returns. High volatility means that the stock's price can fluctuate widely, both up and down, in a short period of time. This can create both opportunities and challenges for investors.

Factors Contributing to Stock Volatility: Several factors can contribute to stock volatility, including:

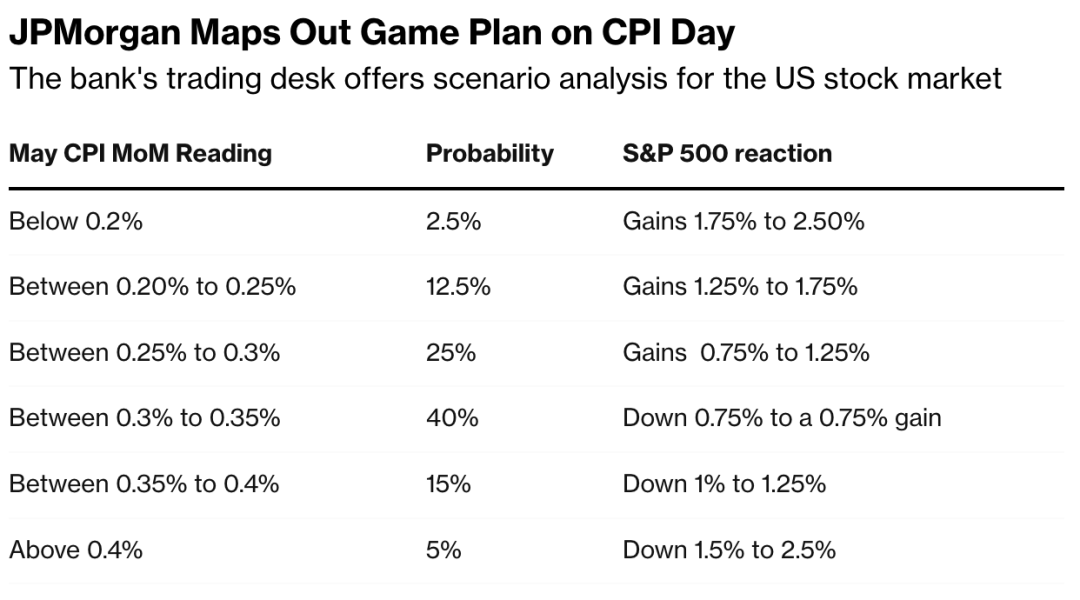

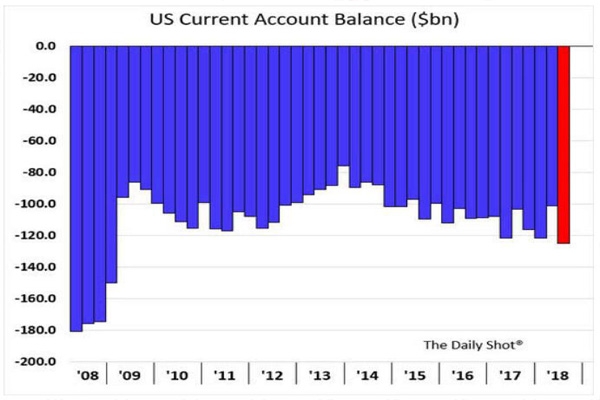

Economic Indicators: Economic data such as GDP growth, unemployment rates, and inflation can significantly impact stock prices. Changes in these indicators can lead to increased volatility.

Company Performance: A company's financial performance, such as earnings reports, revenue growth, and profit margins, can cause stock prices to fluctuate. Positive news can drive prices up, while negative news can cause them to plummet.

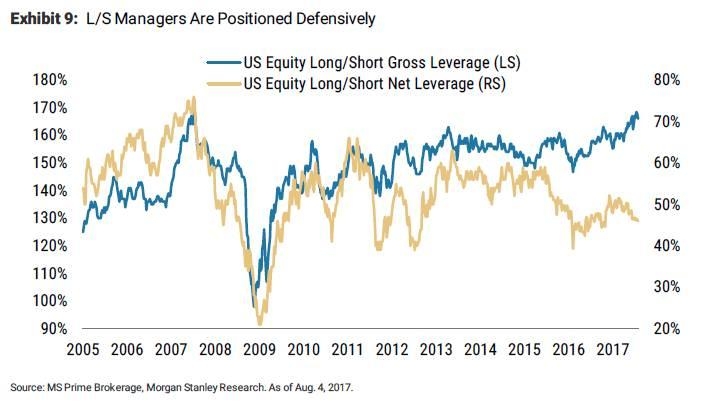

Market Sentiment: The overall sentiment of the market can also influence stock volatility. Factors such as political events, regulatory changes, and market trends can create uncertainty and lead to volatile stock prices.

Sector and Industry Dynamics: Certain sectors and industries may be more prone to volatility due to their sensitivity to economic changes or regulatory risks.

Most Volatile US Stocks July 2025:

Tesla, Inc. (TSLA): As a leader in the electric vehicle (EV) industry, Tesla is known for its high volatility. The company's innovative products and strong market position make it a key player to watch in July 2025.

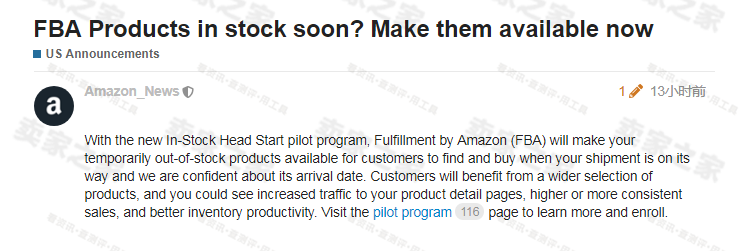

Amazon.com, Inc. (AMZN): As the world's largest online retailer, Amazon's stock is often affected by changes in the e-commerce industry and consumer spending patterns.

NVIDIA Corporation (NVDA): A leading player in the semiconductor industry, NVIDIA's stock can be highly volatile due to its reliance on the demand for graphics processing units (GPUs).

Facebook, Inc. (META): With the ongoing regulatory scrutiny and privacy concerns, Facebook's stock can experience significant volatility.

Berkshire Hathaway Inc. (BRK.B): The stock of Warren Buffett's investment company can be highly volatile due to its diverse portfolio of companies and Buffett's investment decisions.

Conclusion: The most volatile US stocks in July 2025 are likely to be influenced by a combination of economic factors, company performance, market sentiment, and sector dynamics. Investors should carefully consider these factors before investing in volatile stocks, as they can offer significant opportunities but also come with substantial risks. By staying informed and staying alert, investors can navigate the volatile stock market and potentially capitalize on the most volatile US stocks in July 2025.