In today's fast-paced financial world, the US stock market is a hub of activity, especially within the financial sector. This article delves into the intricacies of the financial sector US stock, highlighting key trends, market dynamics, and opportunities for investors.

Understanding the Financial Sector US Stock

The financial sector encompasses a wide array of companies, including banks, insurance companies, investment firms, and real estate investment trusts (REITs). These companies play a crucial role in the economy by providing essential financial services and products.

Market Dynamics

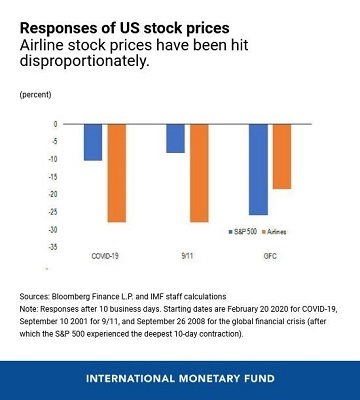

The financial sector US stock has seen significant growth over the years. Factors such as low-interest rates, strong economic growth, and technological advancements have contributed to this growth. However, it's essential to understand the market dynamics to make informed investment decisions.

Key Trends

Digital Transformation: The financial sector is rapidly adopting digital technologies to enhance customer experience and streamline operations. Companies like JPMorgan Chase and Bank of America are investing heavily in digital solutions, including mobile banking and AI-driven customer service.

Regulatory Changes: Regulatory reforms, such as the Dodd-Frank Act, have impacted the financial sector. While these reforms have increased transparency and stability, they have also created challenges for financial institutions.

Globalization: The financial sector is becoming increasingly globalized. This trend has opened up new markets and opportunities for financial companies, but it also exposes them to higher risks.

Opportunities for Investors

Investing in the financial sector US stock offers several opportunities:

Dividend Yields: Many financial companies offer attractive dividend yields, making them a good option for income-seeking investors. For instance, JPMorgan Chase has a dividend yield of around 2.5%.

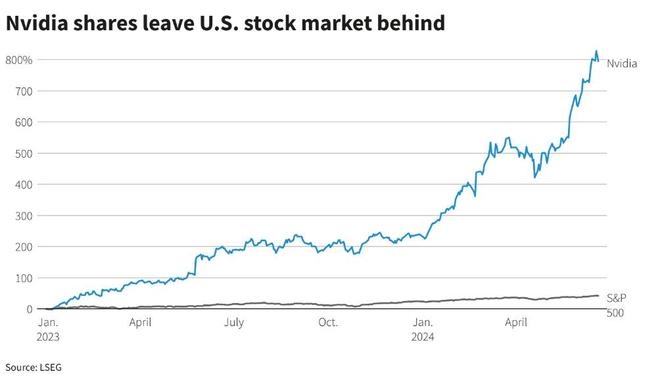

Growth Potential: Some financial companies, particularly those focusing on digital solutions, have significant growth potential. For example, PayPal has seen rapid growth due to its expansion into new markets and partnerships.

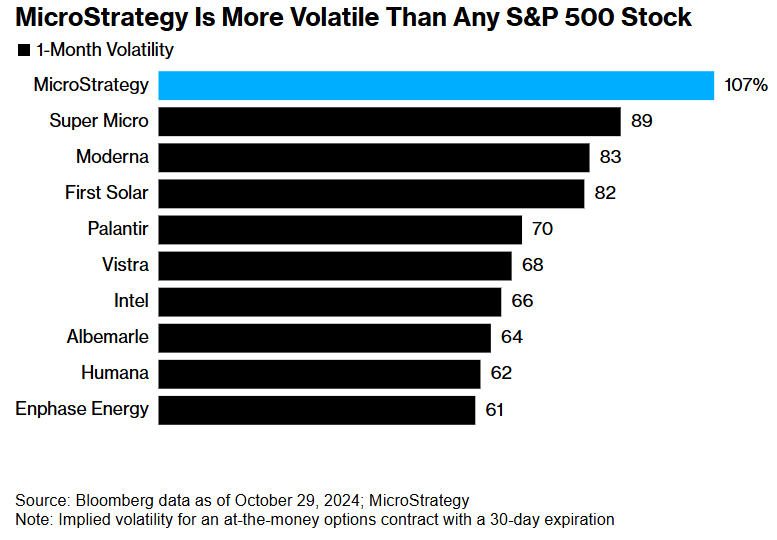

Market Volatility: The financial sector is known for its volatility. This volatility can create opportunities for savvy investors to buy undervalued stocks and sell them at a higher price.

Case Studies

Wells Fargo: Wells Fargo has faced numerous challenges, including a scandal involving unauthorized accounts. Despite these issues, the company has shown resilience and is now focusing on rebuilding its reputation and customer trust.

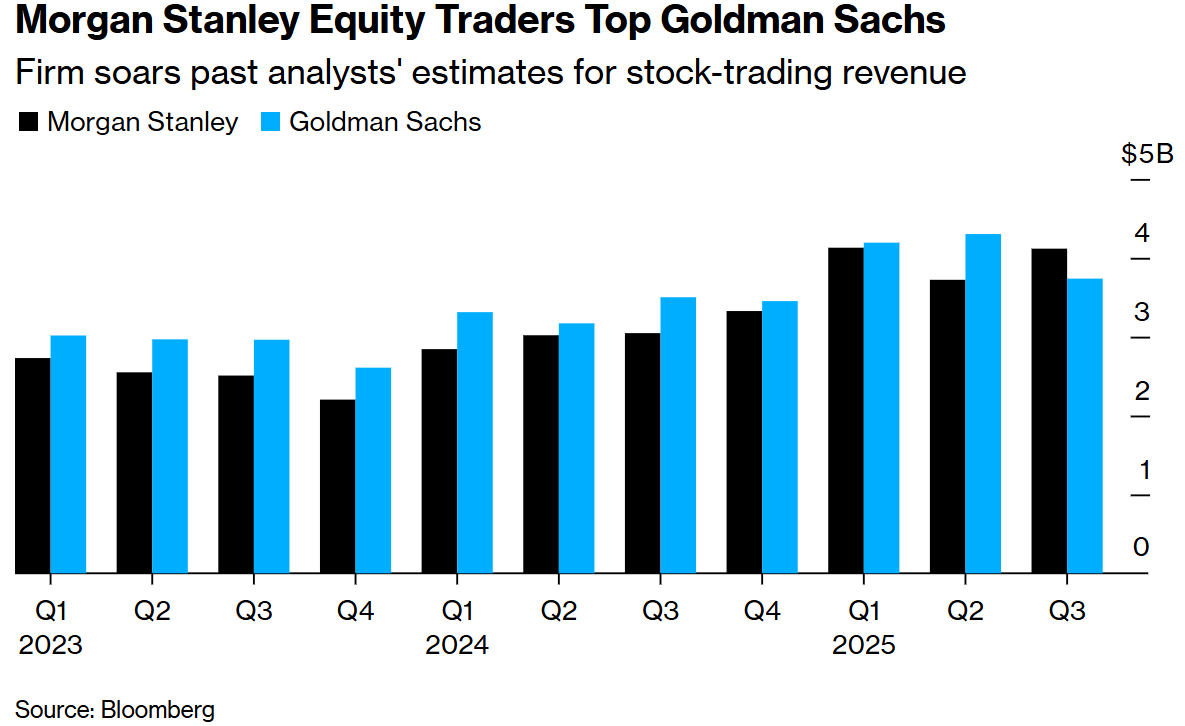

Goldman Sachs: Goldman Sachs has been a leader in the financial sector, consistently generating strong returns for its investors. The company's focus on innovation and diversification has contributed to its success.

Conclusion

The financial sector US stock is a complex and dynamic market. Understanding the key trends, market dynamics, and opportunities is crucial for investors looking to make informed decisions. By staying informed and adopting a long-term investment strategy, investors can benefit from the potential growth and stability offered by the financial sector US stock.