In the ever-evolving world of finance, the stock market in the United States remains a pivotal cornerstone of global economic activity. As the world's largest and most liquid stock market, it offers a fascinating array of investment opportunities and challenges. In this article, we'll delve into the intricacies of the stock market US, providing insights into its key components, performance trends, and essential factors to consider when making investment decisions.

The US Stock Market: A Brief Overview

The stock market in the US is primarily composed of two major exchanges: the New York Stock Exchange (NYSE) and the Nasdaq. These platforms facilitate the buying and selling of shares in publicly-traded companies, allowing investors to capitalize on market trends and individual company performances.

Key Factors Influencing the US Stock Market

Economic Indicators: The US stock market is significantly influenced by economic indicators, such as unemployment rates, inflation, and GDP growth. A strong economic environment tends to drive investor confidence and, consequently, stock prices.

Political Events: Political events, including elections, policy changes, and international relations, can have a profound impact on the US stock market. Investors closely monitor political developments to gauge potential risks and opportunities.

Market Sentiment: Market sentiment refers to the overall perception and attitude of investors towards the market. It can be driven by various factors, including economic data, company earnings, and investor expectations. This sentiment can cause stock prices to fluctuate significantly.

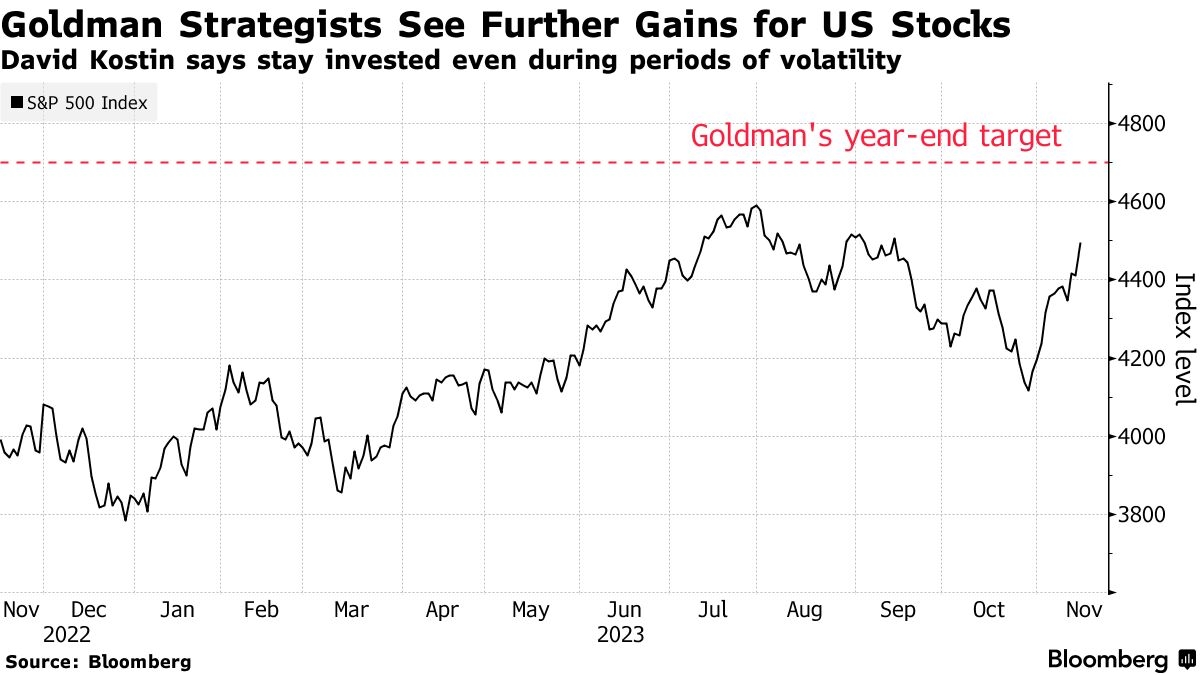

Market Cycles: The stock market often follows a cyclical pattern, characterized by phases of growth and contraction. Understanding these cycles can help investors identify optimal entry and exit points for their investments.

Performance Trends in the US Stock Market

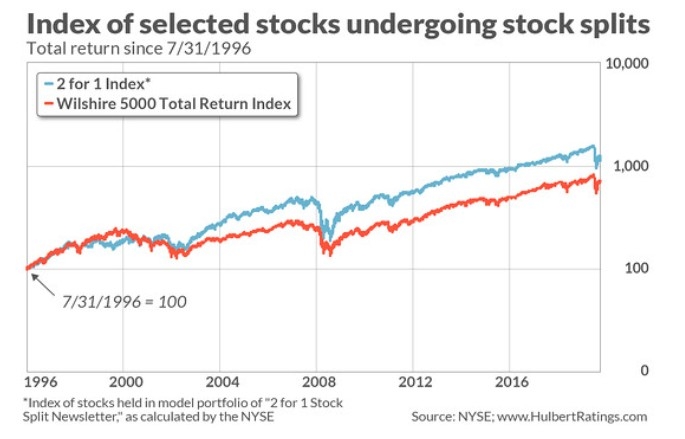

Long-term Growth: The US stock market has historically demonstrated robust long-term growth. Since the 1920s, the stock market has provided investors with a reliable source of capital appreciation, often outpacing inflation.

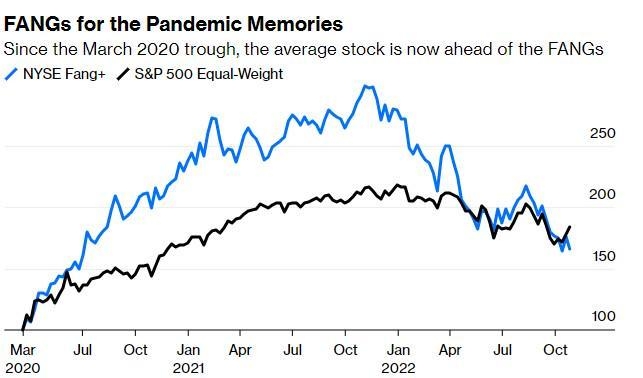

Sector Performance: Different sectors within the stock market US have varying performance trends. Technology, healthcare, and consumer discretionary sectors have often outperformed the broader market in recent years, while sectors like energy and financials have experienced more volatility.

Case Studies: To illustrate the dynamic nature of the stock market US, consider the following case studies:

- Facebook (now Meta Platforms, Inc.): In 2012, Facebook's initial public offering (IPO) sparked a frenzy of excitement and skepticism. Since then, the company has faced numerous challenges, including privacy concerns and shifting market trends. Despite these challenges, Facebook's stock has experienced significant growth over the long term.

- Tesla, Inc.: Tesla's meteoric rise in the stock market has captured the attention of investors worldwide. Since going public in 2010, Tesla's stock has seen dramatic fluctuations, reflecting both its innovative approach to the automotive industry and its struggles with production and profitability.

Conclusion

The stock market US is a complex and dynamic environment, offering a wide array of opportunities and challenges. By understanding key factors influencing the market and staying informed about market trends, investors can make more informed decisions and potentially achieve substantial returns. As the stock market continues to evolve, it will remain a crucial element in the global economic landscape.