Understanding the Market Dynamics

Investing in foreign stocks can be a complex decision, especially for Canadians considering US stocks. The allure of the American market, with its diverse sectors and robust economy, often tempts investors across the border. But is it a wise move for a Canadian to invest in US stocks? Let's delve into the factors to consider.

The US Stock Market: A Global Leader

The US stock market is the largest and most liquid in the world. It's home to some of the most influential and successful companies, including tech giants like Apple, Microsoft, and Google. Investing in US stocks can offer exposure to a wide range of sectors and industries, which can be beneficial for diversification.

Currency Fluctuations: A Double-Edged Sword

One of the primary concerns for Canadian investors is the fluctuation of the Canadian dollar against the US dollar. While a strong USD can lead to significant gains, a weak USD can erode profits. However, this risk can be mitigated through currency hedging strategies.

Tax Implications

Another crucial factor to consider is the tax implications. Canadian investors are subject to Canadian income tax on their US stock dividends, which can be a significant consideration. However, the tax rate may be lower than the US corporate tax rate, making it a favorable investment for some.

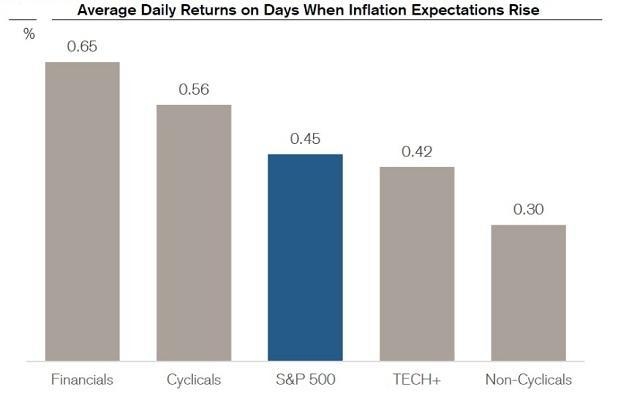

Market Volatility: A Risk to Consider

The US stock market, like any other, is subject to volatility. Market fluctuations can lead to significant gains or losses, and it's essential for investors to be prepared for both scenarios. Diversifying your portfolio can help mitigate the risk associated with market volatility.

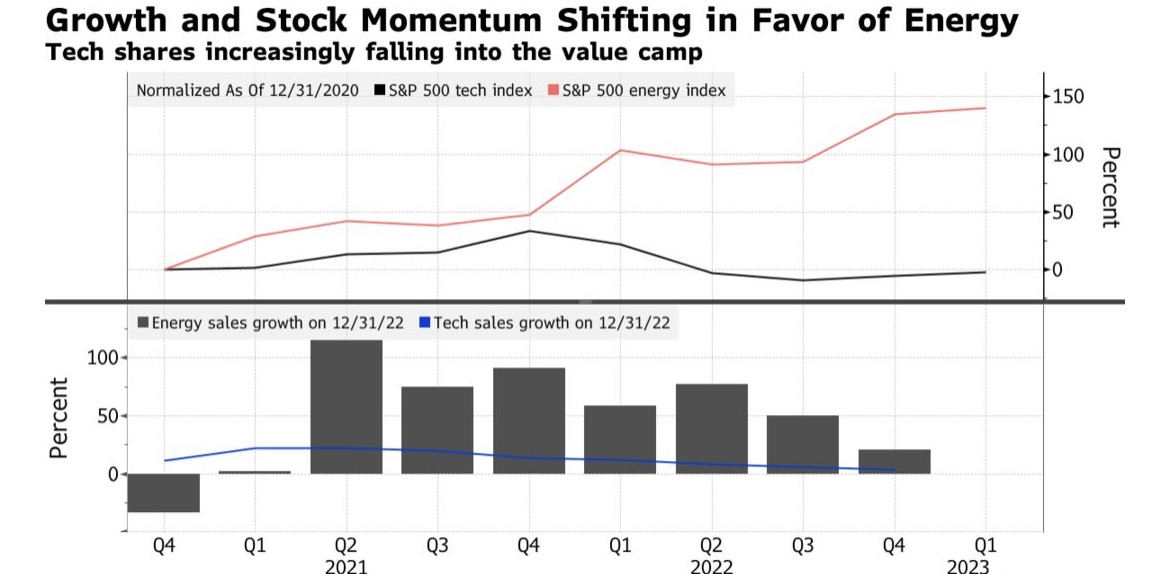

Case Study: The Tech Sector

Let's consider a case study involving the tech sector. A Canadian investor who invested

Conclusion: Weighing the Pros and Cons

Investing in US stocks can offer numerous benefits, including exposure to a diverse range of sectors and potential for significant returns. However, it's crucial to consider the risks, including currency fluctuations and market volatility. A well-diversified portfolio and a sound investment strategy can help mitigate these risks and maximize returns.

In conclusion, whether or not a Canadian should invest in US stocks depends on their individual financial situation, risk tolerance, and investment goals. Thorough research and consultation with a financial advisor are essential before making any investment decisions.