The world of penny stocks is often shrouded in mystery, with investors looking for that next big opportunity. However, recent news has sparked considerable interest in the US penny stock market. In this article, we delve into the recent catalysts that have propelled penny stocks to the forefront of investors' minds.

1. Technological Breakthroughs

One of the primary drivers behind the surge in US penny stocks is technological breakthroughs. Start-ups and established companies alike are making significant strides in various sectors, such as artificial intelligence, biotechnology, and renewable energy. As these innovations continue to gain traction, investors are flocking to penny stocks of companies that are at the forefront of these developments.

Case Study: A small biotech company recently received approval for a new drug that has shown promising results in clinical trials. The news sent the company's stock soaring, showcasing the potential of penny stocks in the healthcare sector.

2. Mergers and Acquisitions

Mergers and acquisitions (M&A) have become a significant catalyst for the US penny stock market. As larger companies seek to expand their market share, they often look towards smaller, undervalued stocks. This has created a favorable environment for penny stock investors, who can benefit from the potential upside of these transactions.

Case Study: A major tech company recently expressed interest in acquiring a small software developer that has developed a cutting-edge AI platform. The rumors of a potential acquisition sent the company's stock skyrocketing, providing a clear example of how M&A can drive penny stock prices.

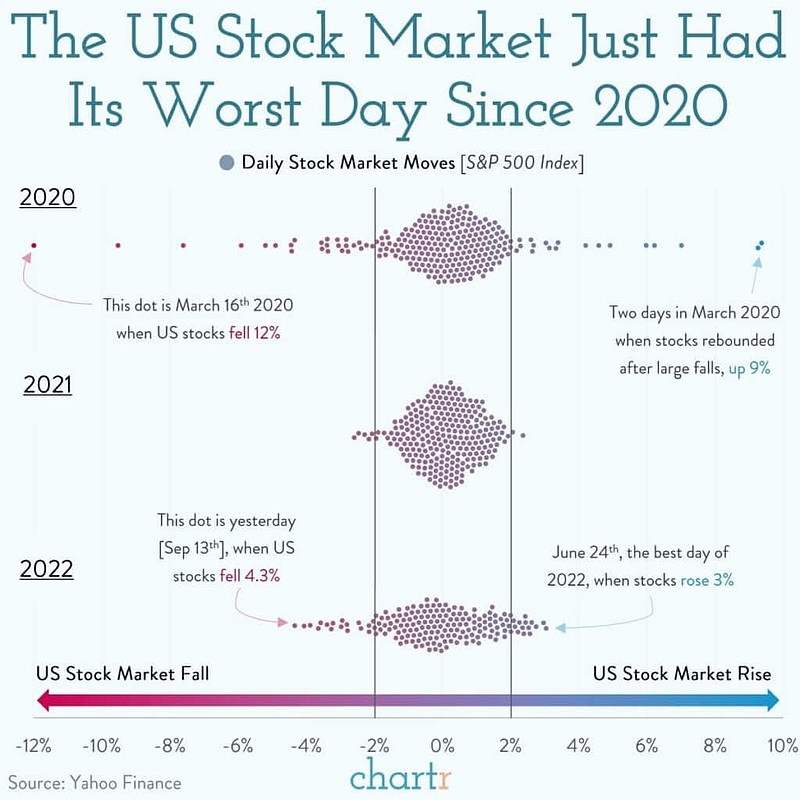

3. Market Volatility

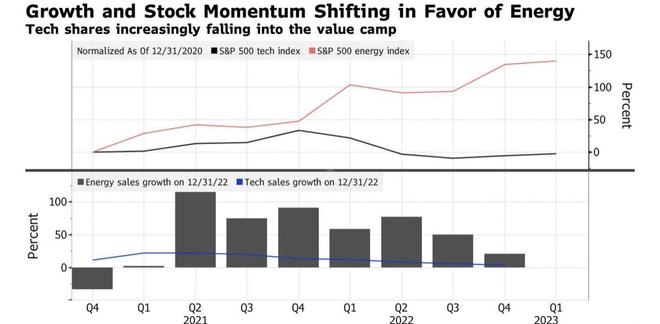

Market volatility has been another key factor behind the recent surge in US penny stocks. With traditional stocks fluctuating wildly, investors are turning to penny stocks in search of higher returns. While this strategy comes with increased risk, it has proven to be fruitful for those who understand the market dynamics.

Case Study: A recent market downturn led to a significant drop in the prices of major tech stocks. In contrast, a small tech company's stock soared, attracting the attention of investors seeking alternative investment opportunities.

4. ESG and Sustainability

Environmental, Social, and Governance (ESG) factors have become increasingly important in the investment world. Many investors are looking for companies that prioritize sustainability and social responsibility. As a result, penny stocks of companies with strong ESG practices are gaining popularity.

Case Study: A small renewable energy company that focuses on sustainable practices recently received a significant investment from a major private equity firm. The news sent the company's stock surging, highlighting the potential of penny stocks in the ESG sector.

5. Blockchain and Cryptocurrency

The rise of blockchain and cryptocurrency has also played a significant role in the growth of the US penny stock market. Many companies are exploring the use of blockchain technology, while others are entering the cryptocurrency space. This has led to increased interest in penny stocks of companies involved in these sectors.

Case Study: A small fintech company that specializes in blockchain solutions recently partnered with a major bank. The partnership led to a surge in the company's stock, demonstrating the potential of penny stocks in the blockchain industry.

In conclusion, the US penny stock market has been propelled by a variety of recent catalysts. From technological breakthroughs to market volatility and ESG factors, investors are increasingly interested in these undervalued stocks. However, it is important to conduct thorough research and exercise caution when investing in penny stocks, as they come with higher risks compared to traditional stocks.