In a move that has sent ripples through the financial markets, President Donald Trump announced a pause on tariffs that were set to impact a range of goods from China. This decision has been met with optimism in the stock market, with many investors seeing it as a positive sign for economic stability and growth.

Understanding the Tariff Pause

The tariff pause refers to a temporary halt on the imposition of additional tariffs on Chinese goods. These tariffs were originally set to take effect on December 15, 2019, and were intended to put further pressure on China in ongoing trade negotiations. However, President Trump's decision to pause these tariffs came after discussions with Chinese leaders, indicating a potential shift in the trade war dynamics.

Impact on US Stocks

The news of the tariff pause has been a significant boost for US stocks. The S&P 500, a widely followed index of large-cap stocks, saw a significant increase following the announcement. This uptrend was driven by a combination of factors:

- Improved Trade Relations: The pause in tariffs is seen as a positive sign for improved trade relations between the US and China. This optimism has led to a surge in investor confidence, driving up stock prices.

- Economic Stability: The halt on tariffs is expected to reduce the cost of goods for American consumers and businesses. This, in turn, is expected to boost economic growth and consumer spending, further supporting stock prices.

- Sector-Specific Impact: Certain sectors, such as technology and manufacturing, are particularly sensitive to trade tensions. The tariff pause is expected to benefit these sectors, as it reduces the risk of higher costs and supply chain disruptions.

Case Studies

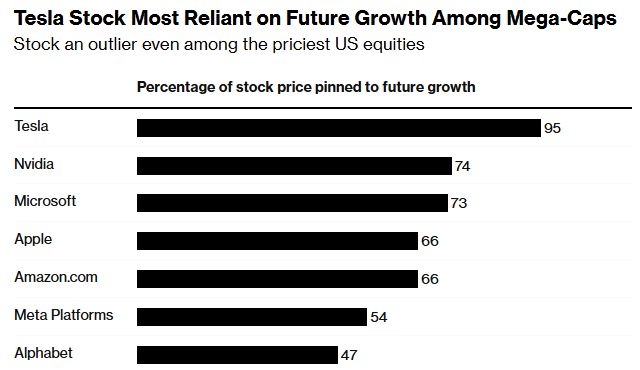

One notable example of the impact of the tariff pause on stocks is the technology sector. Companies like Apple and Microsoft, which rely heavily on Chinese manufacturing, have seen their stock prices surge following the announcement. Similarly, companies in the manufacturing sector, such as 3M and Caterpillar, have also experienced positive stock movements.

Conclusion

The tariff pause announced by President Trump has injected a dose of optimism into the stock market. While it remains to be seen how the ongoing trade negotiations will unfold, the positive initial reaction from investors suggests that the pause could be a significant step towards economic stability and growth. As the situation evolves, it will be interesting to observe how the stock market continues to respond to these developments.