In today's globalized economy, understanding the relationship between Krma and the international stock ratio is crucial for investors and financial analysts alike. This article delves into the intricacies of these two financial metrics, providing a clear and concise analysis to help you make informed decisions in the stock market.

What is Krma?

Firstly, let's define Krma. Krma is a financial indicator that measures the performance of a particular stock or a group of stocks relative to the overall market. It is calculated by dividing the price of a stock by a specific benchmark, such as the S&P 500 or the NASDAQ Composite. This ratio helps investors assess the relative value and performance of a stock compared to the broader market.

Understanding the International Stock Ratio

The international stock ratio, on the other hand, is a measure of the performance of a stock or a group of stocks relative to the global market. It is calculated in a similar manner to Krma, but with a global benchmark, such as the MSCI World Index or the FTSE Global All Cap Index. This ratio allows investors to compare the performance of their investments against a broader international context.

Comparing Krma and the International Stock Ratio

When comparing Krma and the international stock ratio, it's important to consider several factors:

Market Context: The Krma ratio is more relevant for investors focused on the domestic market, while the international stock ratio is better suited for those looking at the global market.

Performance: The Krma ratio may provide a more accurate reflection of a stock's performance within the domestic market, while the international stock ratio can offer insights into a stock's performance relative to the global market.

Risk: The Krma ratio may be more volatile, as it is influenced by domestic market dynamics, while the international stock ratio may provide a more stable comparison due to its focus on the global market.

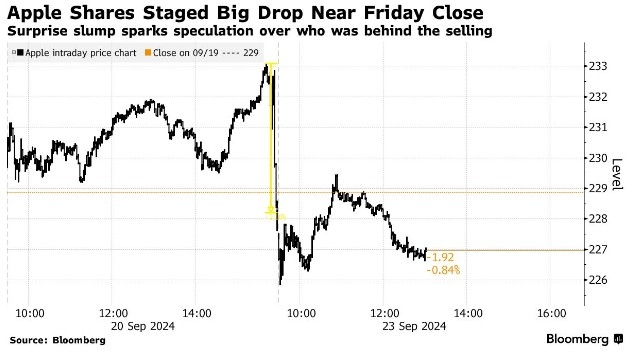

Case Study: Apple Inc.

To illustrate the differences between Krma and the international stock ratio, let's consider Apple Inc. (AAPL). As of this writing, the Krma ratio for Apple Inc. is 0.85, indicating that the stock is trading at 85% of its benchmark. In contrast, the international stock ratio for Apple Inc. is 1.10, suggesting that the stock is trading at 110% of its global benchmark.

This case study shows that the Krma ratio and the international stock ratio can provide different perspectives on the performance of a stock. While the Krma ratio indicates that Apple Inc. is slightly undervalued relative to the domestic market, the international stock ratio suggests that the stock is overvalued relative to the global market.

Conclusion

Understanding the relationship between Krma and the international stock ratio is essential for investors and financial analysts. By considering market context, performance, and risk, investors can make more informed decisions in the stock market. Remember, the key to successful investing is to analyze various financial metrics and gain a comprehensive understanding of the market dynamics.