In the ongoing debate about the current state of the US stock market, two prominent figures, Benjamin Graham and Robert Shiller, offer contrasting viewpoints. While both are renowned for their contributions to the field of finance, their perspectives on market valuation differ significantly. This article delves into their theories and analyzes whether the US stock market is indeed overvalued.

Benjamin Graham: The Father of Value Investing

Benjamin Graham, often referred to as the "father of value investing," believed that the intrinsic value of a stock is determined by its fundamental factors. He emphasized the importance of analyzing a company's financial statements, such as its earnings, cash flow, and debt levels. Graham's approach involves identifying stocks that are trading below their intrinsic value, which he believed would lead to long-term outperformance.

Robert Shiller: The Advocate of Cyclically Adjusted P/E Ratio

Robert Shiller, a Nobel laureate and economist, introduced the cyclically adjusted price-to-earnings (CAPE) ratio to assess market valuations. The CAPE ratio, also known as the Shiller P/E, takes into account the average inflation-adjusted earnings of a stock over the past 10 years. Shiller argues that this metric provides a more accurate picture of market valuations, as it accounts for the cyclical nature of the economy and earnings.

The Current State of the US Stock Market

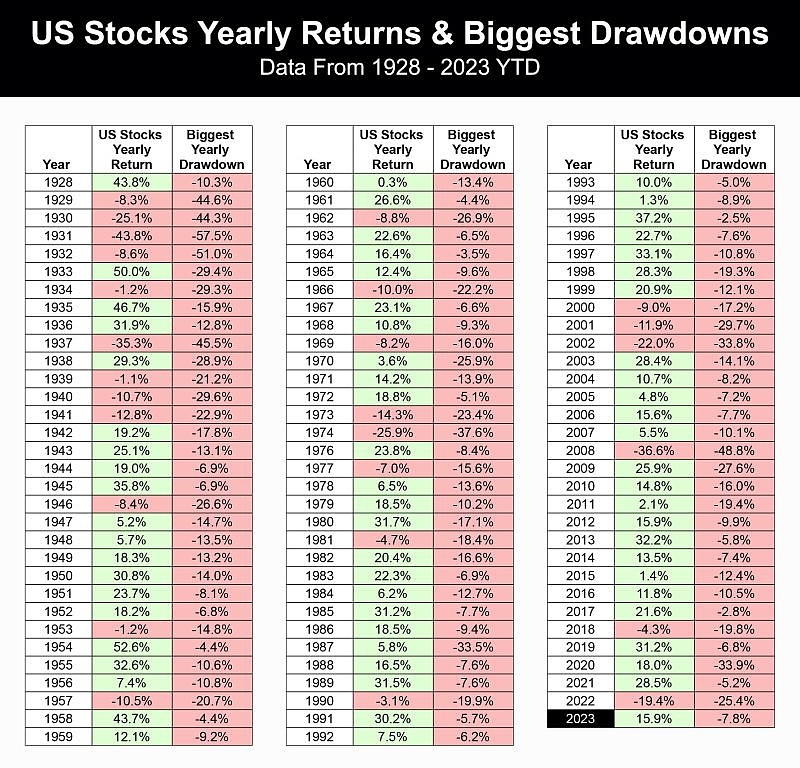

So, where do these theories stand in today's market environment? Many investors are questioning whether the US stock market is overvalued. To understand this, let's look at some key indicators:

1. Shiller P/E Ratio

As of this writing, the Shiller P/E ratio stands at around 32, which is significantly higher than its long-term average of approximately 16. This suggests that the stock market is overvalued according to Shiller's perspective.

2. Graham's Intrinsic Value Approach

Applying Graham's intrinsic value approach, it is essential to identify stocks that are trading below their intrinsic value. However, it's important to note that this analysis can be challenging, as it requires a thorough understanding of a company's financials and future prospects.

3. Market Capitalization

Another indicator to consider is market capitalization. As of now, the US stock market is characterized by a high concentration of tech stocks, which have driven market capitalization to record levels.

Case Study: Apple Inc.

To illustrate the differences between Graham and Shiller's approaches, let's consider the case of Apple Inc. (AAPL).

Shiller's Perspective: Apple's CAPE ratio is currently around 31, which is higher than its historical average. This suggests that the stock may be overvalued according to Shiller's methodology.

Graham's Perspective: On the other hand, Graham's intrinsic value analysis requires a more detailed assessment of Apple's financials. While Apple's price-to-earnings ratio is high, its strong balance sheet, consistent cash flow, and potential for growth may justify its valuation.

Conclusion

In conclusion, the debate between Graham and Shiller regarding the current state of the US stock market is ongoing. While the Shiller P/E ratio suggests that the market is overvalued, Graham's intrinsic value approach emphasizes the importance of individual stock analysis. Ultimately, investors must weigh these perspectives and consider their own investment strategies when determining whether the US stock market is overvalued.