In the fast-paced world of electric vehicles (EVs), Tesla has emerged as a global leader. However, its rise has not gone unnoticed by Chinese companies, which are now stepping up their game to compete on the US stock market. This article delves into the growing rivalry between Tesla and its Chinese counterparts, exploring their strategies and the potential impact on the market.

Tesla's Dominance in the US Stock Market

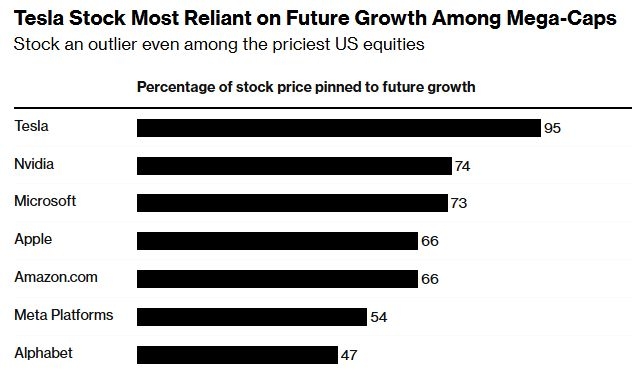

Tesla, founded by Elon Musk, has been a game-changer in the EV industry. Its innovative products, such as the Model S, Model X, and Model 3, have captured the attention of consumers and investors alike. The company's stock has seen significant growth, making it one of the most valuable companies in the world.

Chinese Rivals Emerge

As Tesla continues to dominate the US stock market, Chinese companies are not sitting idle. Several Chinese EV manufacturers have been making waves, aiming to challenge Tesla's dominance. Companies like NIO, XPeng Motors, and Li Auto have been gaining traction, with their own line of electric vehicles.

NIO's Expansion

NIO, founded in 2014, has quickly become a major player in the Chinese EV market. The company has expanded its presence in the US, with plans to open more stores and service centers. NIO's ES8, ES6, and EC6 models have been well-received by consumers, and the company's stock has seen a surge in recent months.

XPeng Motors: A Fast-Rising Star

XPeng Motors, another Chinese EV manufacturer, has been making headlines with its innovative approach. The company's P7 model has been praised for its design and performance, and XPeng has been aggressively expanding its sales network in the US. Its stock has also seen considerable growth, reflecting the company's potential.

Li Auto: Embracing New Technologies

Li Auto, founded in 2015, has focused on developing a range of electric pick-up trucks and SUVs. The company's ET7 model has been particularly popular, and Li Auto has been working on expanding its production capacity to meet the growing demand. Its stock has also been on the rise, signaling the company's potential to become a major player in the EV market.

The Impact on the US Stock Market

The rise of Chinese EV manufacturers in the US stock market is likely to have a significant impact. As these companies continue to innovate and expand, they may attract more investors, leading to increased competition for Tesla. This competition could drive down prices, improve quality, and accelerate the adoption of electric vehicles in the US.

Conclusion

The competition between Tesla and Chinese EV manufacturers is a testament to the growing importance of the EV industry. As these companies continue to innovate and expand, the US stock market is likely to see significant changes. Whether Tesla can maintain its dominance or Chinese companies can dethrone it remains to be seen, but one thing is certain: the EV market is here to stay, and it's going to be an exciting ride.