Are you considering investing in US stocks, but unsure whether it's the right time? The stock market can be unpredictable, but with the right knowledge and strategy, you can make informed decisions. In this article, we will explore the current state of the US stock market and help you determine if it's a good time to invest.

Understanding the US Stock Market

The US stock market is one of the largest and most influential in the world. It's home to numerous companies across various industries, including technology, healthcare, finance, and more. The stock market can be volatile, with prices fluctuating based on economic conditions, company performance, and investor sentiment.

Economic Indicators

Before deciding to invest, it's crucial to consider the current economic indicators. These include:

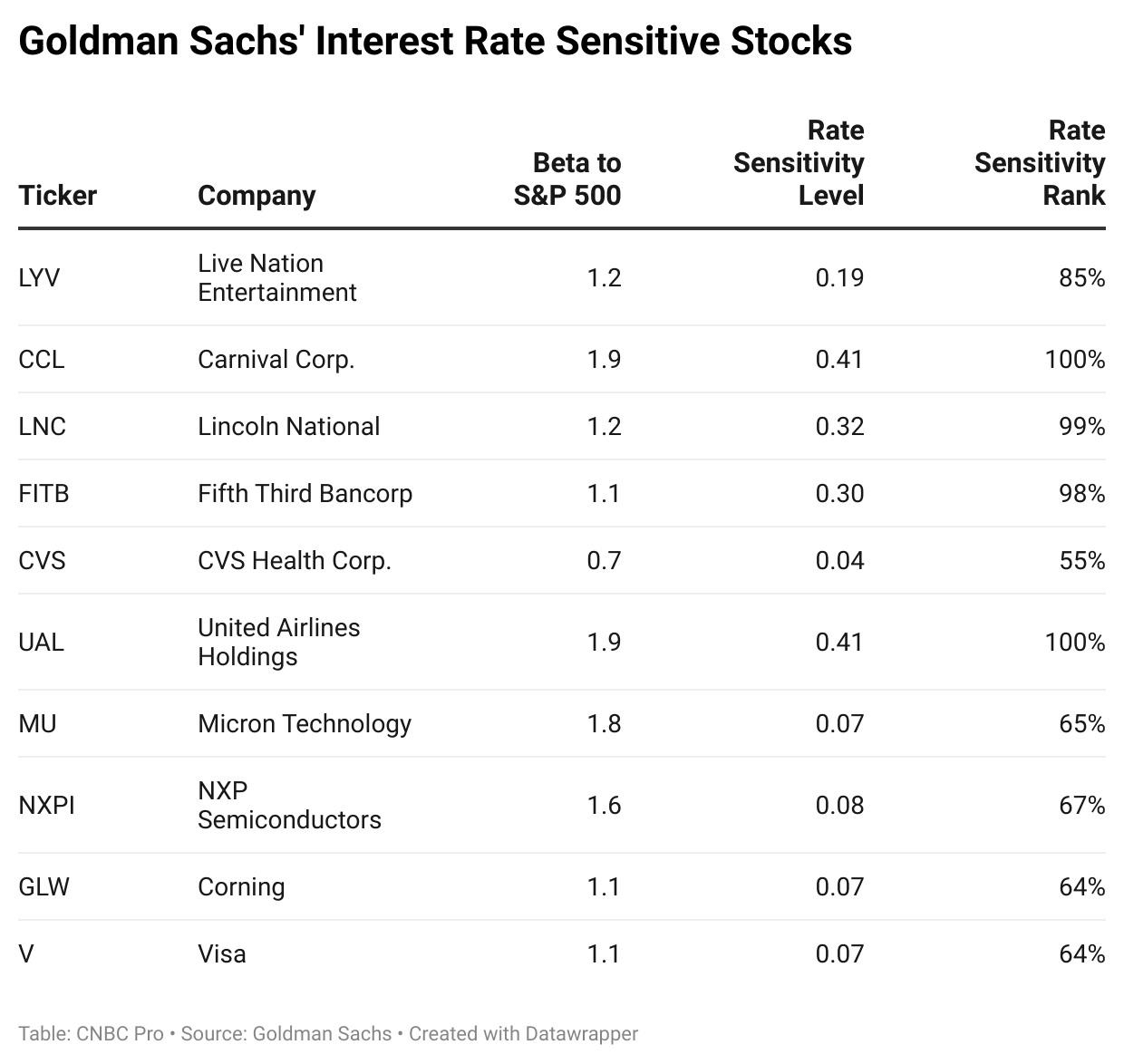

- Interest Rates: Lower interest rates can make stocks more attractive, as they provide higher returns compared to fixed-income investments.

- GDP Growth: A growing GDP suggests a strong economy, which can positively impact stocks.

- Unemployment Rates: Lower unemployment rates can indicate a healthy economy, boosting investor confidence.

- Inflation: Moderate inflation is typically considered good for the stock market, as it indicates economic growth.

As of early 2023, the US economy has shown signs of strength, with low unemployment rates and moderate inflation. This has created a favorable environment for stock investors.

Market Trends

Analyzing market trends can help you determine the right time to invest. Some key trends to consider include:

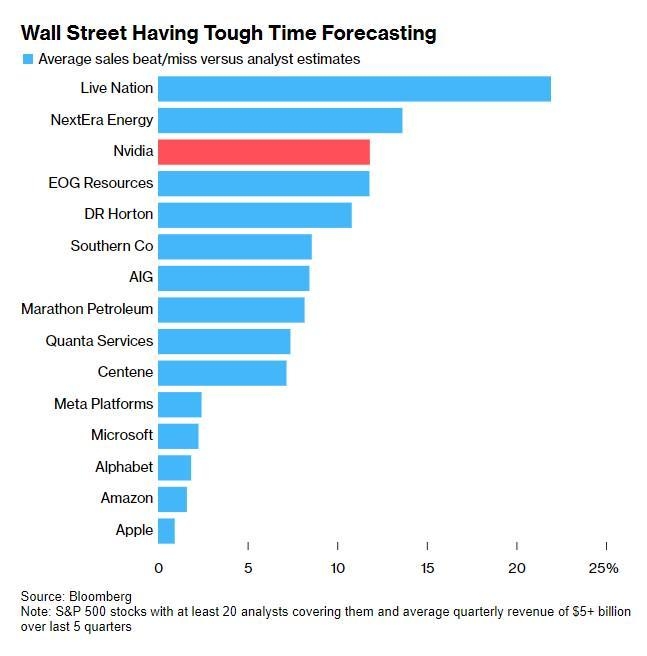

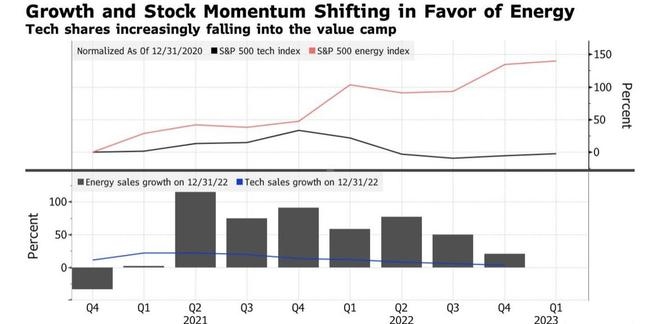

- Sector Performance: Different sectors perform differently based on economic conditions. For example, technology stocks may outperform during a tech boom, while healthcare stocks may be stronger during a health crisis.

- Market Cap: The size of a company's market cap can also influence its performance. Large-cap stocks are often considered less risky, while small-cap stocks may offer higher growth potential.

- Dividend Yields: Dividend yields can be an indicator of a stock's stability and potential returns.

Currently, the technology and healthcare sectors are performing well, making them attractive options for investors. Additionally, many companies are offering attractive dividend yields, providing a steady income stream.

Case Studies

To further illustrate the potential of investing in US stocks, let's look at a few case studies:

- Apple Inc. (AAPL): Over the past decade, Apple has delivered significant returns to investors. With a market cap of over $2 trillion, it's one of the largest companies in the world. Investing in Apple has proven to be a wise decision for those who got in early.

- Tesla, Inc. (TSLA): Tesla has become a major player in the electric vehicle industry, with its stock price skyrocketing over the past few years. Investors who invested in Tesla during its early stages have seen substantial gains.

- Amazon.com, Inc. (AMZN): Amazon has become a dominant force in e-commerce, with its stock price reflecting its market dominance. Those who invested in Amazon early have seen substantial returns.

Conclusion

Investing in US stocks can be a wise decision, especially when the economy is performing well and market trends are favorable. By considering economic indicators, market trends, and case studies, you can make informed decisions about when to invest. Remember, it's crucial to do your research and consult with a financial advisor before making any investment decisions.