Are you an Australian investor looking to expand your portfolio beyond local markets? Trading US stocks from Australia can be a great way to diversify and potentially increase your returns. In this guide, we'll explore the steps and considerations for trading US stocks from Australia.

Understanding the Basics

Before diving into trading US stocks, it's essential to understand the basics. The US stock market is one of the largest and most liquid in the world, with numerous exchanges like the New York Stock Exchange (NYSE) and the NASDAQ. Here's what you need to know:

- Stock Market Hours: The US stock market operates from 9:30 AM to 4:00 PM Eastern Time (ET).

- Currency Conversion: Since the US stock market operates in US dollars, you'll need to consider currency conversion when trading.

- Regulations: Ensure you're aware of any regulatory requirements for trading US stocks from Australia.

Opening a Brokerage Account

To trade US stocks from Australia, you'll need a brokerage account with a reputable broker that offers access to the US stock market. Here are some key factors to consider when choosing a brokerage:

- Regulatory Compliance: Ensure the broker is regulated by a recognized financial authority, such as the Australian Securities and Investments Commission (ASIC) and the Financial Industry Regulatory Authority (FINRA) in the US.

- Fees and Commissions: Compare fees and commissions for stock trading, as well as any additional fees for currency conversion and international transactions.

- Platform and Tools: Look for a platform that offers easy-to-use tools, research, and analytics to help you make informed trading decisions.

Navigating the Trading Process

Once you have a brokerage account, here's how to navigate the trading process:

- Research and Analyze: Conduct thorough research on potential stocks using fundamental and technical analysis. Consider factors like financial health, market trends, and news events.

- Place an Order: Log in to your brokerage account, select the stock you want to trade, and place your order. You can choose from various order types, such as market orders, limit orders, and stop orders.

- Monitor Your Investments: Keep track of your investments by regularly reviewing your portfolio and staying informed about market trends and company news.

Currency Conversion Considerations

When trading US stocks from Australia, currency conversion is a crucial factor to consider. Here are some tips:

- Exchange Rates: Keep an eye on the exchange rate between the Australian dollar (AUD) and the US dollar (USD) as it can impact your returns.

- Currency Conversion Fees: Be aware of any fees associated with currency conversion, as they can eat into your profits.

- Hedging: Consider using hedging strategies to protect against currency fluctuations.

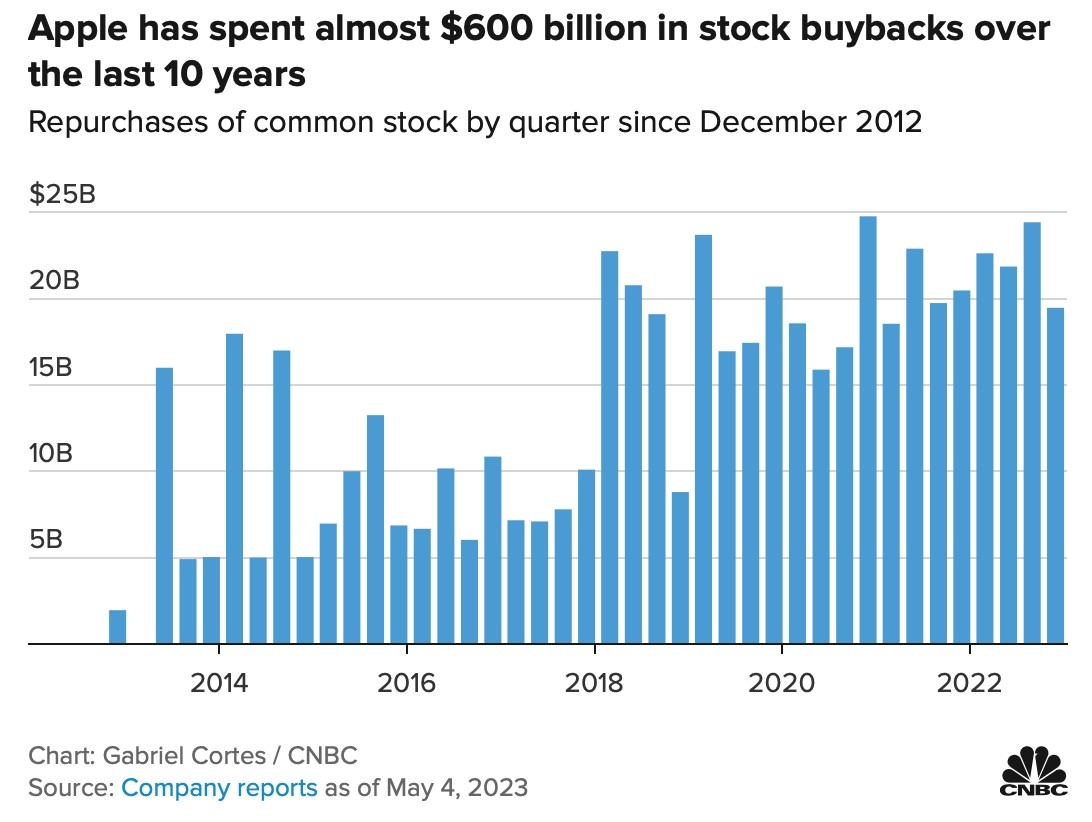

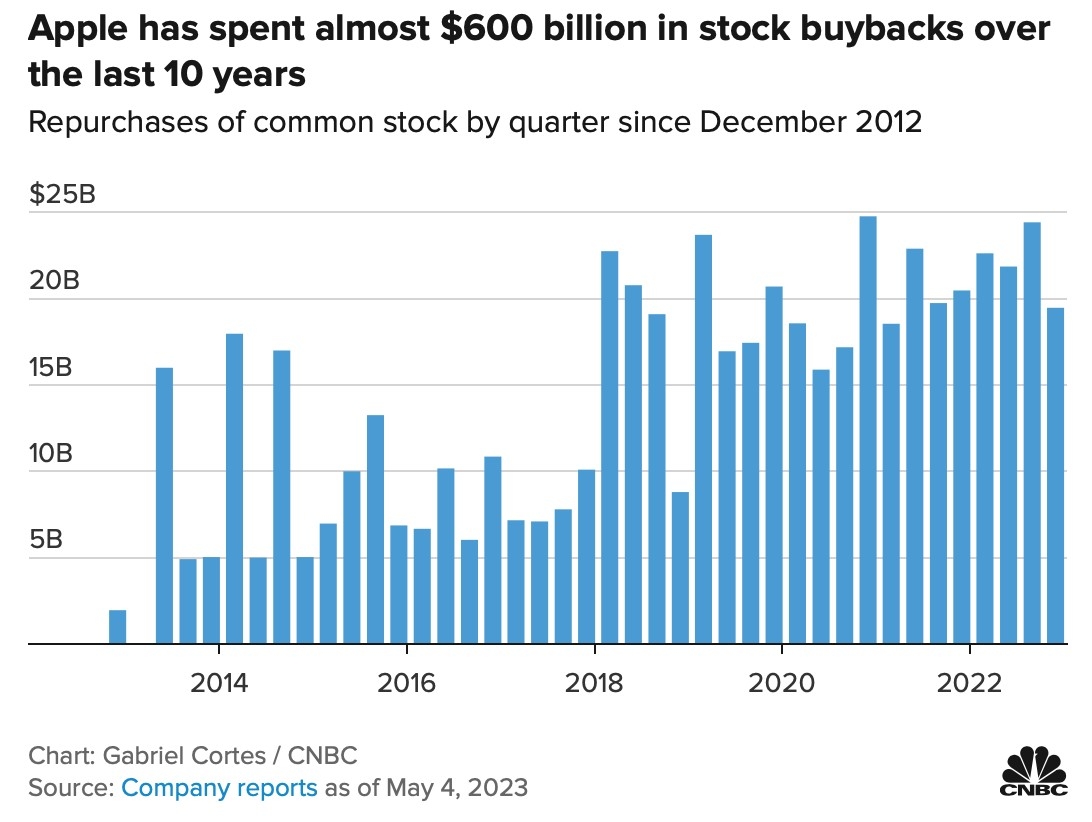

Case Study: Investing in Apple Inc. (AAPL)

Let's say you're interested in investing in Apple Inc. (AAPL), one of the most popular stocks in the US. Here's how you would go about it:

- Research: Conduct thorough research on Apple's financial health, market position, and growth prospects.

- Open a Brokerage Account: Choose a broker that offers access to US stocks and has a strong reputation.

- Place an Order: Log in to your brokerage account, select Apple Inc. (AAPL), and place a market order to buy shares.

- Monitor Your Investment: Keep track of Apple's performance and market trends, and adjust your investment strategy as needed.

Trading US stocks from Australia can be a rewarding way to diversify your portfolio and potentially increase your returns. By understanding the basics, choosing the right brokerage, and conducting thorough research, you can make informed trading decisions and achieve your investment goals.