Are you a Moroccan investor looking to diversify your portfolio by investing in US stocks? With the global financial market becoming increasingly interconnected, accessing US stocks from Morocco is now more feasible than ever. In this article, we'll guide you through the process of investing in US stocks from Morocco, highlighting the necessary steps and considerations.

Understanding the Basics

Before diving into the investment process, it's crucial to understand the basics. US stocks represent ownership in a company listed on one of the major American stock exchanges, such as the New York Stock Exchange (NYSE) or the Nasdaq. Investing in US stocks can provide exposure to a diverse range of industries, including technology, healthcare, and finance.

Choosing a Brokerage Firm

The first step in investing in US stocks from Morocco is to choose a reliable brokerage firm. Many international brokerage firms offer services to Moroccan investors, allowing them to trade US stocks seamlessly. Here are some factors to consider when selecting a brokerage firm:

- Regulatory Compliance: Ensure that the brokerage firm is regulated and licensed by a recognized financial authority, such as the Securities and Exchange Commission (SEC).

- Fees and Commissions: Compare the fees and commissions charged by different brokerage firms to find the most cost-effective option.

- Customer Support: Look for a brokerage firm that offers excellent customer support, including multilingual support if needed.

Some popular brokerage firms for Moroccan investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Opening an Account

Once you've chosen a brokerage firm, the next step is to open an account. The process typically involves the following steps:

- Fill out an Application: Complete the online application form provided by the brokerage firm, providing your personal and financial information.

- Verification Process: The brokerage firm will verify your identity and financial information through documents such as a passport, driver's license, and bank statements.

- Fund Your Account: Transfer funds from your Moroccan bank account to your brokerage account using wire transfer or another available method.

Investing in US Stocks

Now that your brokerage account is set up, it's time to start investing in US stocks. Here are some tips to help you get started:

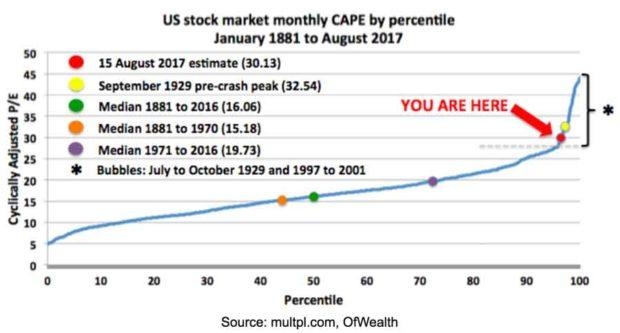

- Research: Conduct thorough research on potential investments, including the company's financial health, industry trends, and competitive position.

- Diversify: Diversify your portfolio to reduce risk by investing in a mix of stocks across various industries and sectors.

- Set Realistic Goals: Establish clear investment goals and timelines, and stick to your plan.

Case Study: Investing in Apple Stock

Let's say you're interested in investing in Apple (AAPL) stock. After conducting your research, you determine that Apple is a strong investment due to its dominant position in the technology industry and consistent revenue growth. You decide to invest $10,000 in Apple stock.

Over the next year, Apple's stock price increases by 20%. As a result, your investment is now worth

Conclusion

Investing in US stocks from Morocco is a viable option for Moroccan investors looking to diversify their portfolios. By following these steps and conducting thorough research, you can successfully invest in US stocks and potentially achieve impressive returns. Remember to choose a reliable brokerage firm, open an account, and stay focused on your investment goals.