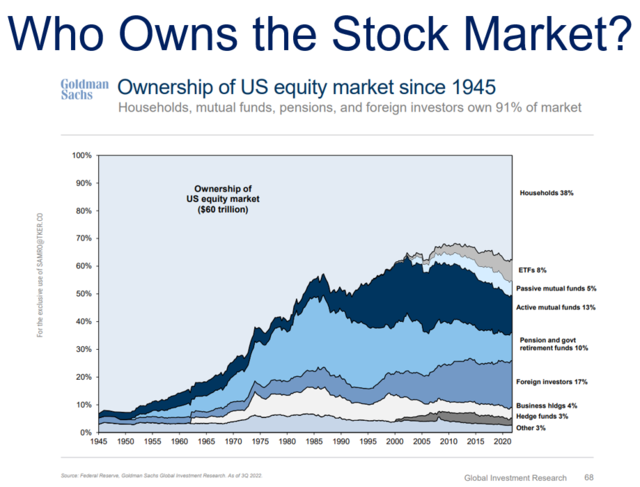

The U.S. government's ownership of stocks is a topic of great interest and importance. Understanding the extent of this ownership can provide insights into the government's economic policies and investment strategies. In this article, we will delve into the details of how much stock the U.S. government owns, its implications, and the potential impacts on the economy.

The Federal Reserve's Role

The Federal Reserve, often referred to as the "Fed," plays a crucial role in the U.S. government's stock ownership. The Fed has the authority to purchase stocks and other financial assets as part of its monetary policy. This is done to influence interest rates and stimulate economic growth.

As of the most recent data available, the Federal Reserve owns approximately $4.5 trillion in assets, including stocks. This makes it one of the largest shareholders in the United States. The majority of these assets are in the form of U.S. Treasury securities, but a significant portion is also in stocks.

The U.S. Treasury's Role

In addition to the Federal Reserve, the U.S. Treasury also owns a considerable amount of stock. The Treasury purchases stocks as part of its investment strategy, aiming to generate returns on its surplus funds.

The U.S. Treasury's stock ownership is managed by the Government Accountability Office (GAO) and the Treasury Department. As of the latest available data, the Treasury owns approximately $1.3 trillion in stocks. This includes stocks of various companies across different sectors, such as technology, healthcare, and finance.

Implications of Government Stock Ownership

The U.S. government's ownership of stocks has several implications for the economy and the financial markets.

Economic Stabilization: By owning stocks, the government can help stabilize the economy during times of crisis. For example, during the 2008 financial crisis, the government's stock purchases helped prevent a further collapse of the financial system.

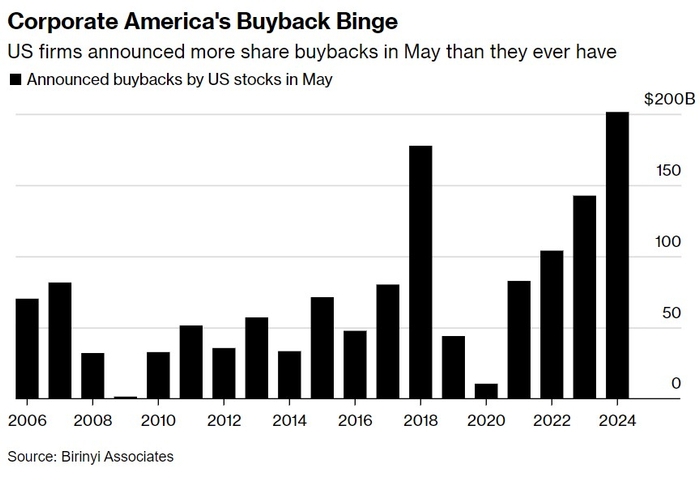

Influence on the Stock Market: The government's ownership of stocks can also influence the stock market. Large-scale purchases or sales of stocks by the government can affect stock prices and investor sentiment.

Investment Returns: The government's stock ownership also serves as an investment strategy. By generating returns on its stock investments, the government can potentially improve its financial position.

Case Study: The Federal Reserve's Stock Purchases during the 2008 Financial Crisis

One notable example of the government's stock ownership is the Federal Reserve's actions during the 2008 financial crisis. In response to the crisis, the Fed purchased billions of dollars in stocks and other financial assets to stabilize the financial system and stimulate economic growth.

The Fed's stock purchases helped lower interest rates, making it easier for businesses and consumers to borrow and spend. This, in turn, helped stimulate economic activity and prevent a deeper recession.

Conclusion

The U.S. government's ownership of stocks is a complex and multifaceted issue. Understanding the extent of this ownership, its implications, and the potential impacts on the economy is crucial for investors, policymakers, and the general public. As the government continues to manage its stock investments, its actions will undoubtedly shape the financial markets and the economy.