The US stock market has been a significant indicator of economic health and growth for decades. However, like any financial market, it is subject to fluctuations and losses. This article delves into the question: "How much has the US stock market lost?" We will explore the factors contributing to these losses and analyze the impact on investors.

Understanding Market Losses

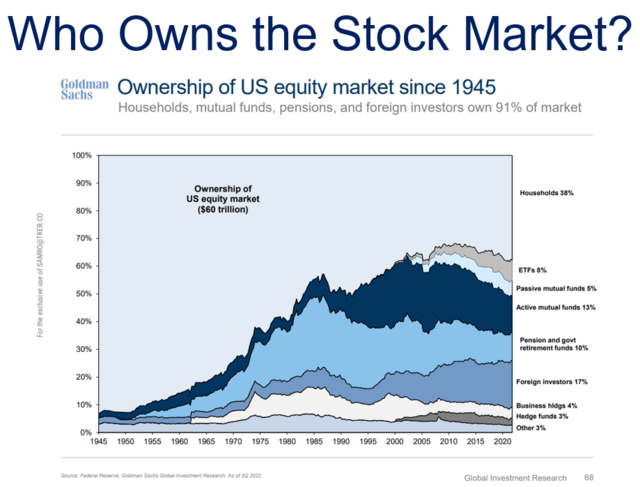

Market losses can occur due to various factors, including economic downturns, political instability, or global events. To understand the extent of these losses, we need to look at historical data and recent trends.

Historical Perspective

In the past few decades, the US stock market has experienced several significant downturns. One of the most notable was the 2008 financial crisis, which led to a significant loss of approximately 50% in the S&P 500 index. This loss was primarily attributed to the collapse of the housing market and the subsequent credit crunch.

Another major downturn occurred in 2020, triggered by the COVID-19 pandemic. The S&P 500 experienced a sharp decline of around 34% from its peak in February to its trough in March. However, it recovered relatively quickly, posting a strong rally by the end of the year.

Recent Trends

In recent years, the US stock market has been characterized by volatility. The COVID-19 pandemic has led to a shift in investor sentiment, with a greater focus on technology and healthcare stocks. This shift has resulted in significant gains for these sectors, while others have suffered losses.

The NASDAQ Composite index, which is heavily weighted towards technology stocks, has seen significant growth in recent years. However, other indices, such as the S&P 500 and the Dow Jones Industrial Average, have experienced mixed results.

Impact on Investors

The extent of market losses can have a significant impact on investors. For those who invested heavily in the stock market during periods of downturn, they may have experienced substantial losses. However, it is important to note that the stock market is a long-term investment vehicle, and short-term losses can often be recovered over time.

Investors who took a more conservative approach and diversified their portfolios may have weathered the downturns more effectively. By spreading their investments across various asset classes, they were able to mitigate the impact of market losses.

Case Study: Tech Stocks in the Pandemic

One notable case study during the COVID-19 pandemic was the performance of tech stocks. Companies like Apple, Amazon, and Microsoft saw significant gains despite the overall market downturn. This was primarily due to the increased demand for technology products and services during the pandemic.

On the other hand, sectors like energy and financials experienced significant losses. This highlights the importance of diversification in a portfolio, as it allows investors to benefit from different market conditions.

Conclusion

The US stock market has experienced various levels of losses throughout its history. Understanding the factors contributing to these losses and their impact on investors is crucial for making informed investment decisions. While the stock market can be volatile, long-term investors who stay diversified and maintain a disciplined approach can navigate through market downturns and ultimately achieve their financial goals.