Understanding the US Stock Market's Decline

The US stock market has been a beacon of economic health for decades, but recent years have seen its value fluctuate dramatically. Many investors are curious about how much the US stock market has dropped in recent times. This article delves into the details, analyzing the factors contributing to the decline and offering insights into the current market landscape.

Recent Stock Market Performance

In the past year, the US stock market has experienced a significant downturn. As of the latest data, the S&P 500 index, a widely followed benchmark for the US stock market, has dropped by approximately 20% from its all-time high in early 2022. This decline can be attributed to several factors, including rising inflation, supply chain disruptions, and concerns about the global economic outlook.

Inflation and Its Impact on the Stock Market

One of the primary reasons for the stock market's decline is the surge in inflation. The Consumer Price Index (CPI) has been on the rise, causing consumers to spend less and businesses to face higher costs. This has led to a decrease in corporate profits, which in turn has impacted stock prices.

Supply Chain Disruptions and the Stock Market

The COVID-19 pandemic has caused widespread supply chain disruptions, leading to shortages of key goods and services. This has not only impacted the economy but also the stock market. Companies that rely on a robust supply chain have seen their profits suffer, resulting in lower stock prices.

Global Economic Concerns

The US stock market is not immune to global economic concerns. Factors such as political instability, trade disputes, and currency fluctuations can all impact the market. As the global economy continues to face uncertainty, investors are likely to remain cautious, which can lead to further declines in stock prices.

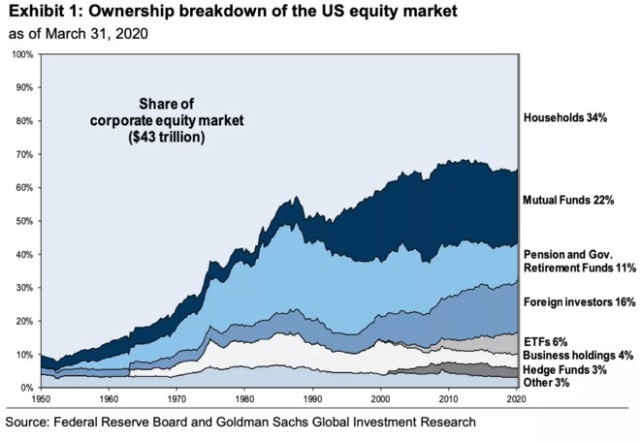

Sector-Specific Impacts

The decline in the US stock market has not affected all sectors equally. Some sectors, such as technology and healthcare, have held up relatively well, while others, such as energy and financials, have seen more significant declines. This is due to the varying degrees of exposure to inflation, supply chain disruptions, and global economic concerns.

Case Studies: Major Stock Market Declines

To understand the impact of a stock market decline, it's helpful to look at past events. One notable example is the 2008 financial crisis, when the S&P 500 index dropped by nearly 57%. This massive decline was driven by factors such as the collapse of major financial institutions, soaring unemployment rates, and a sharp increase in default rates on mortgages.

Another example is the dot-com bubble of the late 1990s, when the NASDAQ index dropped by 78%. This decline was caused by a speculative bubble in the technology sector, which eventually burst as investors realized that many of these companies were not profitable.

Conclusion

The US stock market has dropped significantly in recent times, driven by factors such as inflation, supply chain disruptions, and global economic concerns. While this decline is concerning for many investors, it's important to remember that the stock market has historically recovered from previous downturns. By understanding the factors contributing to the decline and staying informed about market trends, investors can make more informed decisions and navigate the current market landscape with confidence.