In recent months, there has been a significant increase in hedge funds shorting US stocks. This trend has sparked widespread concern among investors and market analysts. But what does it all mean? In this article, we will delve into the reasons behind this phenomenon, its potential implications, and analyze some notable examples.

Why Are Hedge Funds Shorting US Stocks?

Several factors have contributed to the rise in hedge funds shorting US stocks. Here are some of the key reasons:

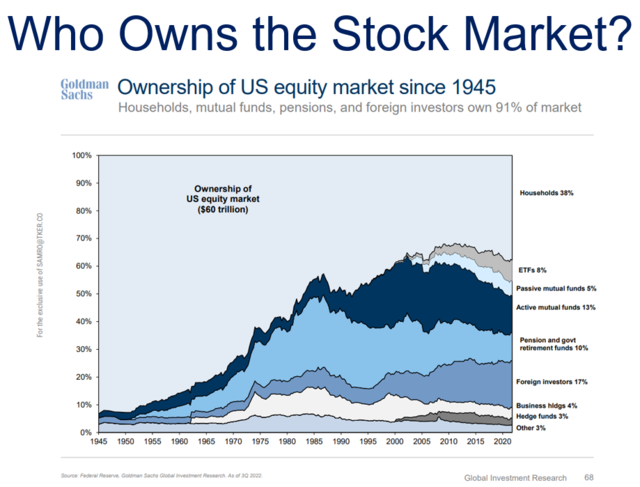

- Economic Concerns: As the global economy slows down, investors are becoming increasingly cautious. This has led to a heightened focus on risk-off strategies, with many hedge funds opting to short US stocks.

- High Valuations: Over the past few years, the US stock market has experienced significant growth. However, some investors believe that the market is currently overvalued, making it an attractive target for shorting.

- Political Uncertainty: The current political climate in the US has created a sense of uncertainty. This uncertainty has led to a decrease in investor confidence, prompting hedge funds to short US stocks.

Implications of Shorting US Stocks

The rise in hedge funds shorting US stocks has several potential implications:

- Market Volatility: Shorting can lead to increased market volatility, as investors react to the actions of hedge funds.

- Economic Impact: If a significant number of hedge funds continue to short US stocks, it could have a negative impact on the economy, as the value of stocks decreases.

- Regulatory Changes: The increase in shorting could prompt regulators to take action, potentially leading to changes in the way hedge funds operate.

Notable Examples

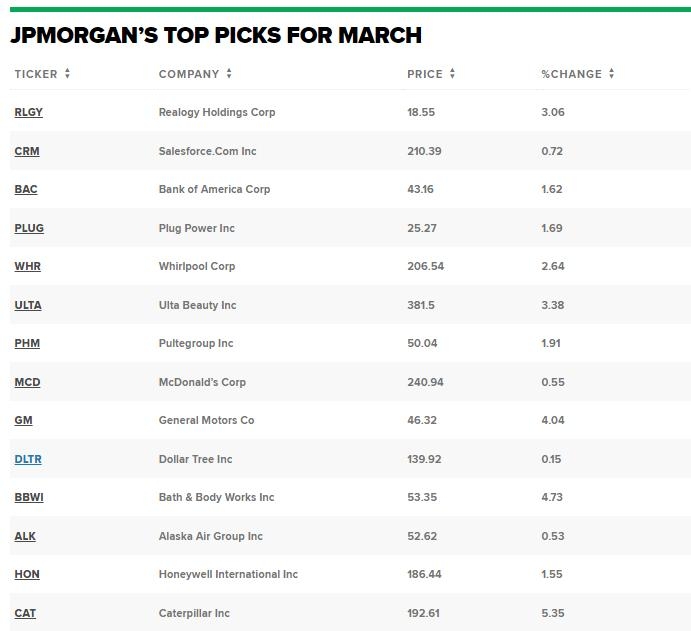

Several notable hedge funds have been involved in shorting US stocks. Here are a few examples:

- Bill Ackman: Bill Ackman, the founder of Pershing Square Capital Management, has been vocal about his bearish outlook on the US stock market. He has shorted several high-profile companies, including Herbalife and Target.

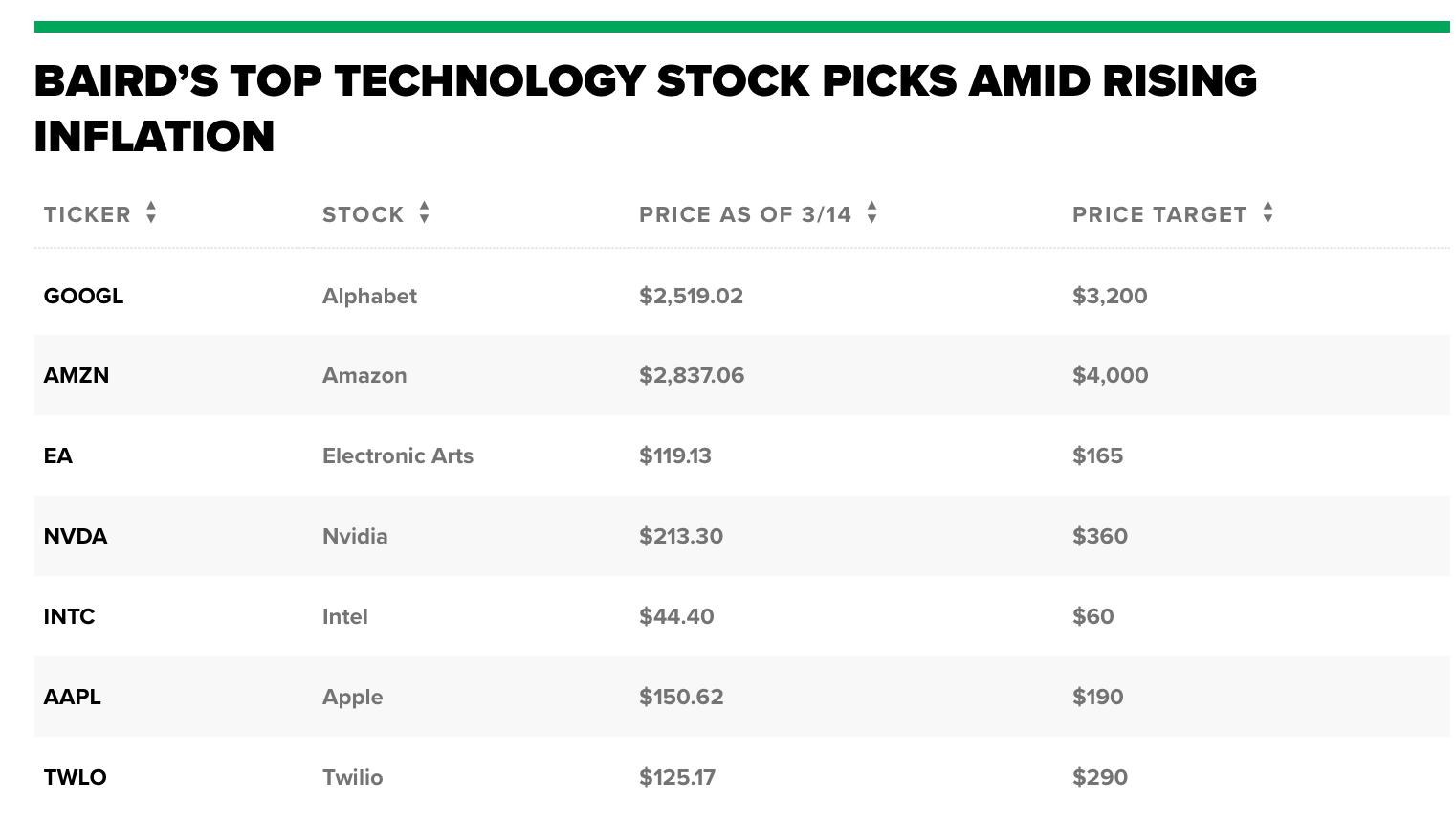

- John Paulson: John Paulson, the founder of Paulson & Co., is known for his successful short positions during the financial crisis. He has recently been shorting several US stocks, including Netflix and Amazon.

- David Tepper: David Tepper, the founder of Appaloosa Management, has been shorting US stocks for several years. He has recently been shorting companies in the technology and consumer discretionary sectors.

Conclusion

The rise in hedge funds shorting US stocks is a complex issue with significant implications. While some investors may view this trend as a sign of caution, others may be concerned about the potential negative effects on the market and the economy. As always, it is crucial for investors to stay informed and make informed decisions based on their own research and analysis.