The Dow Jones Industrial Average (DJIA), a widely followed indicator of the stock market's health, reached a significant milestone on January 20, 2021. This article delves into the events surrounding this date, analyzing the factors that contributed to the market's performance and its implications for investors.

The Background

The Dow Jones Industrial Average is a price-weighted average of 30 large publicly traded companies in the United States. It includes some of the most influential and recognizable companies in the world, such as Apple, Microsoft, and Visa. As a result, the DJIA is often used as a proxy for the overall health of the stock market.

On January 20, 2021, the DJIA closed at 30,914.40, marking a new record high. This was a significant achievement, considering the market's volatility over the past few years, particularly during the COVID-19 pandemic.

Factors Contributing to the Record High

Several factors contributed to the record-high close on January 20, 2021.

- Economic Recovery: The US economy began to recover from the COVID-19 pandemic, with vaccination rates increasing and businesses reopening. This recovery led to improved corporate earnings and increased investor confidence.

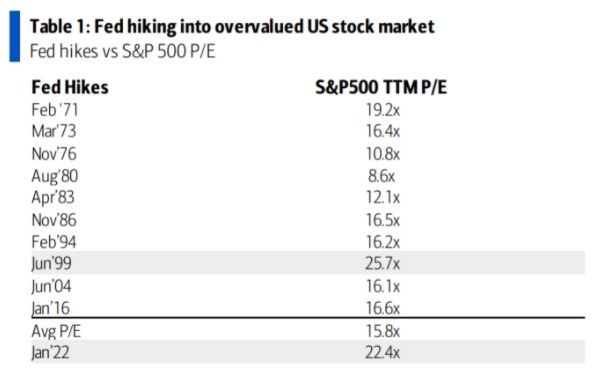

- Monetary Policy: The Federal Reserve continued to implement accommodative monetary policy, keeping interest rates low and supporting the stock market.

- Technology Stocks: The technology sector, which is heavily represented in the DJIA, continued to perform well. Companies like Apple and Microsoft reported strong earnings, driving the index higher.

Implications for Investors

The record-high close on January 20, 2021, had several implications for investors.

- Investor Confidence: The strong performance of the DJIA suggested that investors were optimistic about the future of the stock market.

- Stock Market Valuations: Despite the record-high close, some investors expressed concerns about the high valuations of certain stocks. This led to a debate about whether the stock market was overvalued or undervalued.

- Sector Rotation: Investors began to rotate out of sectors that had performed well during the pandemic, such as technology, and into sectors that had been negatively impacted, such as energy and financials.

Case Studies

To illustrate the impact of the DJIA's performance on specific companies, let's consider two case studies.

- Apple: Apple, a component of the DJIA, reported strong earnings on January 20, 2021. This contributed to the index's record-high close. The company's strong performance was driven by increased demand for its products, particularly during the holiday season.

- Visa: Visa, another DJIA component, also reported strong earnings on the same day. The company's revenue growth was driven by increased online spending and the expansion of its global network.

Conclusion

The Dow Jones Industrial Average's record-high close on January 20, 2021, was a significant event for the stock market. It was driven by a combination of economic recovery, accommodative monetary policy, and strong performance from key sectors. While the market's strong performance was encouraging, investors should remain cautious and consider the potential risks associated with high valuations.